It is not the debt capacity of the U.S. government that is of primary importance, nor how much will be cut from proposed federal spending over the next ten years. There is something fundamental at stake here and much more important to the future of the U.S. It will be made clear by the outcome of budget cuts, if any are finally made. It is, namely, the adversative relationship between the country's public and private sectors; or to put it bluntly, the tax-eaters versus taxpayers.

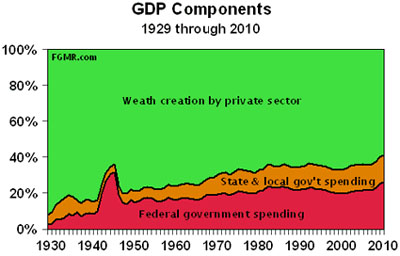

I've pondered how to best make this point and decided to illustrate it with a chart, which requires some explanation. The chart below presents GDP, but does so in a unique way.

The chart is built upon the indisputable fact that the private sector creates wealth. Governments do not create wealth; they consume it. This observation makes it clear that the private sector supports government spending, which is an important fact not captured in most discussions about the economy and the one-sided view of it given the way GDP is normally presented. A growing GDP is deemed to be a good thing but, in reality, one must look under the hood to see the engine that is really driving the U.S. economy—and it is not government spending because governments do not create the goods and services that enable the American people to fulfill their needs and wants to maintain and hopefully increase their standard of living.

Don't misinterpret my point here. I am not saying that some government spending is not worthwhile, or perhaps, needed. All I intend to show is how burdensome government has become to the wealth-creating private sector. I do this by using GDP, but some further explanation is necessary.

GDP is a measurement of spending in the economy. In many respects, it is a flawed measurement. For example, when a tornado levels a town, wealth is destroyed. Rebuilding the town boosts GDP, but this positive GDP enhancement does not arise from the creation of new wealth. After all, the wealth (i.e., the destroyed houses already stood); rebuilding what already existed is not creating new wealth. There are other problems with GDP, too.

These limitations, however, can be overcome for the point I'm making by looking at the components of GDP differently. I look at the spending measured by GDP but focus on the other side of the coin because it shows that the private sector is creating the nation's wealth, which is non-government spending plus the trade balance. This approach recognizes that the government sector is spending the wealth created by the private sector. So, by illustrating the public- and private-sector components of GDP as a percent of total GDP, the following chart shows the relationship between tax-eaters and taxpayers. The resulting picture of the nation's economy isn't pretty.

The feathers are being plucked from the goose at a record rate. Government spending has become an even bigger force in the economy than when the U.S. was on a war footing during World War II. Never before has government consumed so much of the private sector's wealth creation.

The important conclusion to be made from the above chart is that Americans who produce wealth are getting squeezed. This picture of economic activity clearly illustrates that tax-eaters have never been more burdensome to wealth-producing taxpayers.

The above chart illustrates the great extent to which the U.S. has become reliant upon socialist dogma. State and local government spending consumes nearly 3x more wealth than it did in 1929, while the federal government's consumption over this period has risen more than tenfold.

Thus, what policymakers in Washington, D.C. and, indeed, throughout the country should be focusing on is shrinking the size of government. The country needs to turn its back on socialism. It wasn't big government that made America what it was. Big government and the accompanying central planning are not going to make today's economic problems any better.

The U.S. needs to face the fact that big government is the problem that ails its economy, which needs wealth creation and not more government spending. The vast majority of tax-eaters need to become private-sector wealth producers. Other remedies that will put the U.S. economy back on the right track are reduced taxes, less regulation and an end government intervention in all aspects of the market process.

As it has embraced socialism and all the trappings of the 'nanny-state,' the U.S. has lost its way. It is this point that unhappily is absent from discussions about the debt limit.

James Turk

Free Gold Money Report