In the midst of roller-coaster oil prices and a global reassessment of nuclear power, in early April a key development in the natural gas arena slipped by mostly unnoticed: a report from the U.S. Energy Information Administration (EIA) about global shale gas potential.

We all know that shale gas discoveries in America have altered the country's gas picture dramatically—a twelvefold increase in production over the last decade has transformed the U.S. from an importer to a self-sufficient, natural-gas-loving nation, while also pushing natural gas prices way down. U.S. shale gas production increased by an average of 48% per year from 2006–2010 and output is expected to rise almost threefold between 2009 and 2035, according to the EIA's latest Annual Energy Outlook.

In the face of such impressive shale success in America, many began to wonder about shale gas potential in other parts of the world. In response, the EIA commissioned a report estimating the global volume of shale gas outside of the United States and the results are, well, a bit mind-boggling.

The report marks the first attempt to estimate the volume of technically recoverable shale gas on a global scale—and did so by assessing 48 shale basins in 32 countries outside of the U.S. (where the resources were already known). While U.S. resources stand at an impressive 862 trillion cubic feet (Tcf), those 48 global basins contain an estimated 5,760 Tcf of technically recoverable shale gas. That gives a global shale gas total of 6,622 Tcf.

To put that into perspective, most current estimates of the world's technically recoverable natural gas resources (not including shale gas) come in at 16,000 Tcf, which means shale resources add more than 40% to the world's gas volume.

And that's not all. The study excluded several major types of potential shale resources, based primarily on data limitations. Importantly, the study only covered 32 nations and excluded several gas-rich countries, including Russia and nations in the Middle East. Large, conventional gas resources in these places mean there has been little reason to look for shale gas, so we still have little clue as to how much is there, though most expect sizable amounts. The study also excluded offshore basins. As such, the world's shale gas resources are certainly larger than this initial count.

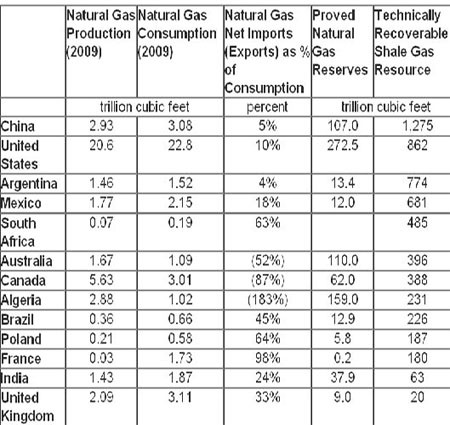

Above is a shortened table, summarizing some of the study's findings

We can pull two groups of countries that might find shale gas development pretty attractive out of this table. The first is those countries that currently depend heavily on natural gas imports but also have significant shale resources: France, Poland, Turkey, Ukraine, South Africa, Morocco and Chile. The second group is those countries that already produce substantial amounts of natural gas and also have large shale resources. In addition to the United States, this group includes Canada, Mexico, China, Australia, Libya, Algeria, Argentina and Brazil.

There are major differences within these groups, however, on whether to utilize shale resources. France, for example, is thought to have comparable shale resources to Poland. Poland has traditionally relied heavily on Russian natural gas imports, so the country has been keenly issuing shale exploration licenses. Polish Prime Minister Donald Tusk recently said that, while shale gas development has to be environmentally sound, "Our determination is clear: Every cubic meter of gas in Poland must be used if possible." By contrast, the French government has placed a moratorium on shale gas exploration in response to widespread concerns about the environmental impacts of horizontal drilling and fracturing.

Perhaps the biggest surprise from the above list is China. The shale gas estimate for China came in so high that the country's National Energy Administration commissioned a shale gas-development plan. The China National Petroleum Company completed its first horizontal shale gas test well in late March and is moving quickly to explore China's shale reserves in partnership with experienced gas producers like Royal Dutch Shell Plc (NYSE:RDS.A; NYSE:RDS.B) and Chevron.

Energy-hungry China is unlikely to let environmental concerns impede development of what seems to be a truly staggering domestic, unconventional gas resource. In other parts of the world, such as Europe and increasingly North America, residents are becoming more vocal in their concerns about shale gas.

Environmental backlash could in fact pose the biggest obstacle to shale gas production. There are widespread concerns around the use and disposal of fracking fluids, which are proprietary mixtures of water, sand and chemical lubricants. Many believe that fracking fluids can—and in places already have—contaminate groundwater aquifers; there is also a major debate about how to dispose of the huge volumes of fracking fluids created in drilling a single well. In addition, a set of recent studies countered the common claim that natural gas is a "green" fuel, which is based on gas producing less carbon dioxide per unit of energy than "dirtier" fuels like coal. While that may be true, the studies investigated the total carbon emissions created in drilling and fracking a well and collecting, processing and burning the gas. They found that natural gas is actually worse for the environment than coal.

The debate over fracking will undoubtedly continue for years. The EIA report has added fuel to that fire, as it will be hard for the world to ignore a fuel resource of this size. However, finding shale gas is just one small step toward actually producing it. The report suggests that any shale gas development outside of the United States is likely five to ten years away, primarily because many of the countries that could benefit from shale production do not have the specialized equipment needed to drill and frack horizontal wells.

In fact, one nonprofit think tank—the Post Carbon Institute—is challenging the idea that shale gas production can continue apace even in the U.S. The Institute investigated what would be required to maintain the production increases and determined that the infrastructure requirements are unrealistic.

Study author David Hughes estimates there is actually only a 12-year supply of easily accessible, domestic natural gas, in part because well productivity is declining. To maintain the current rate of production would require the drilling of 30,000 wells annually—a slight increase from the current rate of 25,000 and a level that Hughes believes will incite a major environmental backlash.

While not everyone will agree with Hughes' conclusions, it is true that "technically recoverable resources" often stay in the ground for a very long time because they are not realistically or economically recoverable.

And here's yet another reason why it may take a long time for the shale gas phenomenon to grow outside of the United States: As long as natural gas prices remain depressed, it will be cheaper for countries to buy gas rather than to develop their own resources. Mexico, for example, is building six new natural gas power plants this year but is planning to increase imports to fuel those plants, even though state-owned Petroleos Mexicanos (Pemex) recently discovered as much as one trillion cubic feet of gas reserves. Instead of developing those fields in the northern state of Coahuila, Pemex will instead focus on oil output and the Mexican-state power utility will import more gas.

We all like to imagine renewable resources powering our future, but the truth is that coal, oil and natural gas currently provide more than 80% of the world's primary energy needs. Nuclear power adds only 6% and renewables contribute just 2% of global energy—a figure that will at best rise to 7% by 2035. So it seems very likely that shale gas will play an increasingly important role in the years to come. How much of this massive resource will actually see development remains to be seen. But now we have a start on understanding just how much shale gas the world has to offer and from here economic and environmental concerns will have to fight it out.

Marin Katusa and his team are on the cutting edge of the energy sector—combining a network of industry connections with meticulous due diligence to find the best energy plays for subscribers. For only 7 days, you can now get the Casey Energy Report for 40% off the regular price. Try it for 3 months—if you're not completely satisfied, cancel for a full refund. More here.