Even so, you might as well call this a record price. In real terms, as Matt Turner at Mitsubishi told me this week, one ounce of silver briefly rose above 40 of today's U.S. dollars per ounce in 1864, when the American Civil War neared its climax. In nominal dollars, the Hunt brothers' multi-billion-dollar corner only saw it more highly priced on five trading days in January 1980. And while U.S. investors buying silver are waiting for a new intra-day high, it's already broken new ground against the British Pound and for most of the Eurozone, too.

The cause? Gold investors have long claimed the metal is "telling us" something. "First warning" of the looming financial crisis ahead, said Marc Faber in his Gloom, Boom & Doom Report of September '07, was when "the price of gold more than doubled in nominal terms and against the Dow Jones Industrial Average [because of] ultra-expansionary U.S. monetary policies with artificially low interest rates."

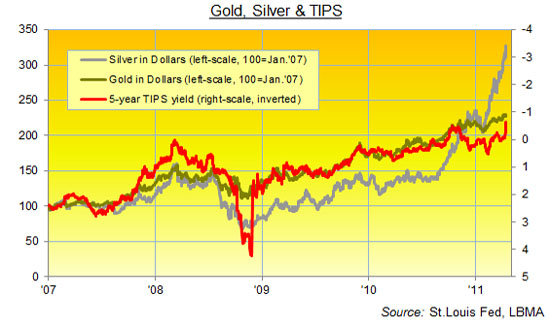

. . .in which case, and with global interest rates further below zero today after inflation than at any time since 1980, what in the hell is silver telling us now?

"TIPS pay a lower rate of interest than regular Treasuries," explained Bloomberg News when the yield offered by 5-year Treasury Inflation Protected Securities briefly dipped below zero (and $20 silver broke a 28-year high) back in March 2008.

"[That's] because their principal rises in tandem with a version of the consumer price index which includes food and energy prices. Rising demand for TIPS [which pushes up prices and so pushes down the nominal yield] indicates investors expect the inflation adjustment to make up the difference."

What great expectations TIPS buyers must have of Uncle Sam's "inflation adjustment" today. They're buying five-year index-linked bonds with a nominal yield of minus 0.6%, anticipating a full 2.8% per year fillip from Washington when compared with the annual yield now offered by conventional five-year bonds. And what greater hopes still must the new rush of investors buying silver hold. . .rejecting TIPS in favor of metal, and breaking silver's tight connection with both gold prices and TIPS yields as our chart above shows.

Note the point at which silver breaks higher—right when Fed chairman Bernanke vowed to begin QEII in summer last year. That a fast-growing nugget of the world's private wealth is fearful of the result is clear. That silver looks a turbo-charged play is clearer still. Because as an industrial as well as monetary metal, silver is exposed to strong economic growth—as well as loose central-bank policy—in a way that its cousin, gold bullion, isn't. You could point to 2010's record levels of Indian and Chinese gold demand coming off their continued economic booms, but Asia's silver investment demand is surging faster still. And the aim of all this easy money, remember, is to keep GDP stoked, whether in Beijing, Washington, Frankfurt or London.

Little wonder then that Chinese, U.S., Eurozone and UK inflation is rising sharply. And so no wonder either then that. . .

- By value, London's wholesale bullion market last month saw silver volumes jump to one-sixth the daily turnover of gold plus silver, according to the LBMA's new stats, released to members today. That's a 13-year high. In raw dollars, silver turnover set new all-time records for the second month running.

- By number, Aberdeen International Inc. (TSX:AAB) New York's Comex saw the volume of silver futures contracts overtake the volume of gold futures on Monday and Tuesday this week. By value, silver trading rose to one-seventh of total gold and silver volumes, up from a seventeenth just a month ago.

- ETF Securities say their silver exchange-traded products saw "more flows than any other individual commodity ETP" in the first quarter

- Here at BullionVault—the world's largest gold ownership service online—our customers have pushed silver trading up from 22% of daily volumes by value in January to 27% in both March and so far in April.

Silver's bull run—unlike gold's—is all about inflation, which is worth bearing in mind whether you're quitting, holding, ignoring or looking to start buying silver today.

Adrian Ash

BullionVault

Gold value calculator | Buy gold online at live prices

Formerly City correspondent for The Daily Reckoning in London and head of editorial at the UK's leading financial advisory for private investors, Adrian Ash is the editor of Gold News and head of research at BullionVault—winner of the Queen's Award for Enterprise Innovation, 2009 and now backed by the World Gold Council market-development and research body—where you can buy gold today vaulted in Zurich on $3 spreads and 0.8% dealing fees.

(c) BullionVault 2011

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events—and must be verified elsewhere—should you choose to act on it.