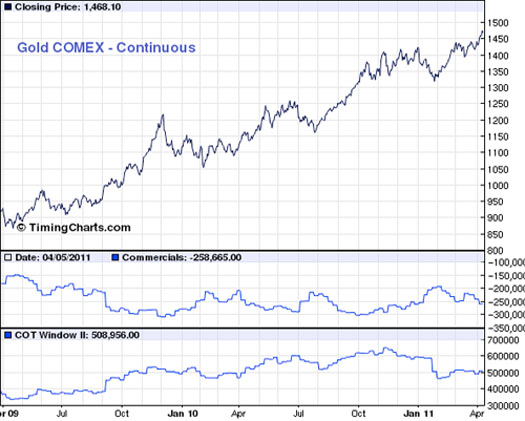

The chart below from timingcharts.com shows the price, commercial short position and open interest. A high commercial short position typically coincides with a top in the market. Note that the commercial short position totaled 302K contracts at the very end of September. At the January low, the commercials were short less than 200K contracts. As of last Tuesday, the figure stood at 258K contracts, which is well below the recent high of 302K contracts. Open interest has declined from 650K contracts in November to 509K contracts as of last Tuesday.

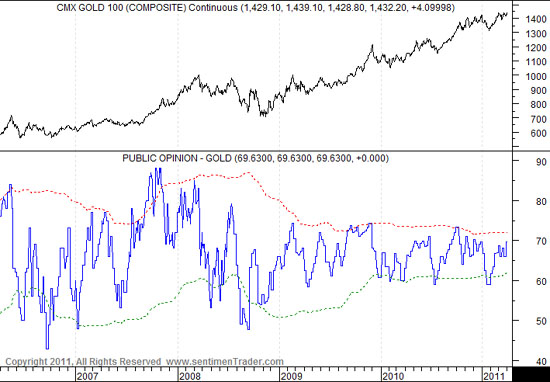

Sentimentrader's public opinion gauge shows 69% bulls. Interestingly, since late 2008, public opinion has remained in a range from 60% to 73% bulls. Note that major peaks in 2006 and 2008 came near 85% bulls. If and when public opinion exceeds 75% bulls, then we'll have an indication that some speculation is coming into the market.

Sentiment by itself is not a timing tool unless it shows major extremes in either direction. Looking at sentiment data helps us decipher the near-term potential of a market. This data for gold tells us that the market is in a healthy position. Speculation in the futures market and speculation by the public are at reasonable if not even lower levels. This tells us that the market is in a position to rise in the near term (with an increase in speculation) and that the potential downside is somewhat limited.

Looking for more analysis? Consider our professional guidance and analysis; take a free 14-day trial to our service.

Good Luck!

Jordan Roy-Byrne

[email protected]

Subscription service