"Frequently, something out of the blue like this, an extraordinary event, really creates a buying opportunity. I have seen that happen in the U.S., I have seen that happen around the world. I don't think Japan will be an exception" -Warren Buffett, March 21, 2011Natural and manmade disasters spur innovation in new technologies. While the events are fresh, and people are in crisis, media coverage becomes hyper-focused on every bit of bad news. As a result, there's an overall lack of proportion regarding the disaster and prospects for recovery. In "Nuclear Overreactions," The Wall Street Journal provided these clear-minded observations:

"Our larger point is less about nuclear power than how we react as a society to inevitable disasters, both natural and manmade. Because a plane crashes, we don't stop flying. . .Because the Challenger space shuttle blew up, we didn't stop shuttle flights. We should learn from the Japanese nuclear crisis—not let it feed a political panic over nuclear power in general."

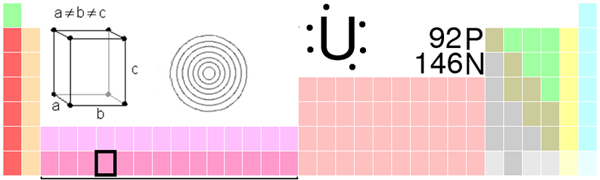

We've had only five precedent nuclear accidents since 1950. In each case, the S&P 500's median decline has averaged 5% over a period of 25 days. Even Chernobyl saw a 5% market decline. The greatest long-term fallout would be a drop in the value of financial markets, which can create an economic drag.

Here Comes M&A in a Big Way for Uranium Stocks

There is mounting evidence that the nuclear industry is heading into consolidation.

About 30% of Japan's energy came from its 54 nuclear power plants. With 11 shut down, there's an energy shortage. Until it rebuilds, which may be several years, Japan needs non-nuclear fuels like oil, coal and natural gas—and prices are rising in anticipation.