It's best to limit total annual exposure to CNBC to about 30 minutes. For about two to five minutes per month I hold my breath and pinch my nose and avail myself of the utter sewage these people spew into the airwaves.

But yesterday, when a friend forwarded me this article by "Fast Money" Executive Producer John Melloy, my mouth fell agape. I knew they were almost sinisterly stupid but this article takes the cake.

Even the headline itself: Gold's Record Surge—a Rejection of Capitalism? is enough to make investors shake their heads. He may as well have entitled it: Hot Dog & Beer Popularity Surge—a Rejection of Baseball Food?—it'd make as much sense.

He starts off his magnum opus of ignorance straight away by stating a painfully flawed premise:

The gold trade has been pretty clear cut for the last 30—even 1,000—years. The yellow metal with a nice weight to it has been a store of value against inflation. But something changed two-and-a-half years ago in the middle of the financial crisis. From 1976 to November 2008, when the Consumer Price Index (CPI) went up, so did gold, according to analysis by Crosscurrents Newsletter Editor Alan Newman. Since then, gold has gone up when the CPI has contracted (deflation) or expanded (inflation).

Nothing changed, John. Try to keep up with the rest of us.

I think we can clear things up in three simple sentences:So, to clarify, gold continues to go up because the money supply continues to increase (the Austrian Money Supply tracks the money supply much better than M1, M2 or M3). The government's CPI figure is a fairy tale.

- Inflation is an increase in the money supply.

- Prices rise BECAUSE of inflation.

- The CPI bears no resemblance to reality, in terms of the price rises CAUSED by inflation.

Sadly, however, John continues:It keeps going up because more and more people don't want to play in a capitalist system where banks are still too big to fail, the Federal Reserve buys Treasuries in the open market and countries openly, and in a coordinated fashion, try to devalue paper assets right before our eyes.John, you don't live in a capitalist system. If it was a capitalist system the Federal Reserve would not exist. Central banks are one of the 10 tenets of communism. In fact, the U.S. almost meets all of the requirements for communism now (with my comments in italics):He finishes his article with the coup de grace of absurdity:

- Central banking system—The Federal Reserve

- Government controlled education—Public Schools & Government Regulated Private Schools

- Government controlled labor—Government regulated labor and legalization of unions

- Government ownership of transportation and communication vehicles—General Motors, Amtrak

- Government ownership of agricultural means and factories—Farm subsidies

- Total abolition of private property—Perhaps next?

- Property rights confiscation—Eminent Domain Evocations

- Heavy income tax on everyone—Check

- Elimination of rights of inheritance—Inheritance tax, in process

- Regional planning—Obama was a community organizer, wasn't he?

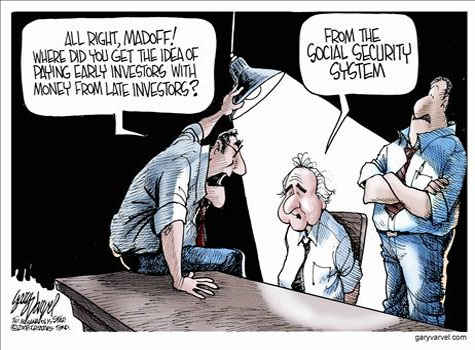

"Gold has no valuation, no metrics, no commercial use," said veteran commodities trader Dan Dicker. "It's the world's most respected ponzi scheme."

Social Security is a ponzi scheme. The U.S. dollar and U.S. Treasuries are a Ponzi scheme. Gold? That's free-market money. . .you don't even recognize it anymore do you, John?

CNBC Clueless About Gold