Keep in mind that gold is the type of asset class that performs best when it's strongly outperforming the other asset classes. This seems like an obvious statement but it is an important one. If stocks and/or bonds are performing very well, money (usually mainstream) flows into those asset classes—not gold. If conventional asset classes perform well, there is little reason for the masses to go into gold.

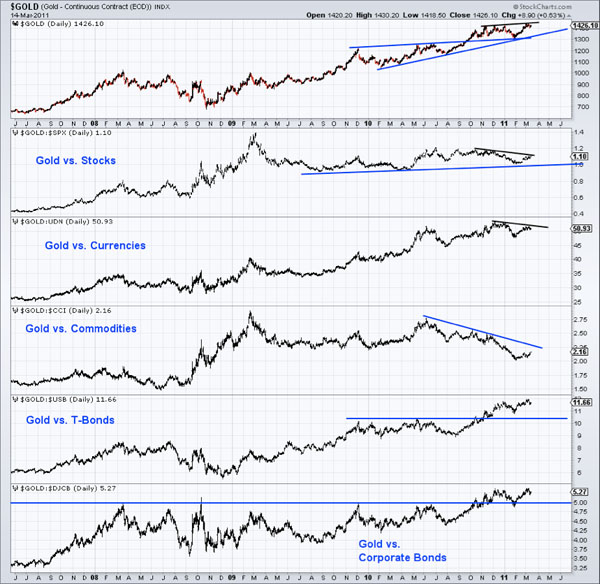

In the chart below we show gold against various asset classes. gold has made a new high in nominal terms but hasn’t held it. One reason could be the weak performance of gold against stocks, currencies and commodities. In recent months, money has flowed into those markets and not gold. Gold made marginal highs against both bonds, but with risk aversion increasing and a possible US Dollar rally, how long will that last?

Gold's real performance is mixed, which suggests a sustained breakout in nominal terms is unlikely at present. Gold has started to outperform stocks and commodities and we expect that to continue. However, there is a clear divergence with gold priced in other currencies, which suggests that recent U.S. dollar weakness has buoyed gold. While struggling, the USD has yet to break support. Sentimentrader's public opinion is only 31% bulls for the U.S. dollar.

When many markets are in flux, as is the current situation, intermarket analysis becomes all the more important. Comparing markets against each other helps us decipher the leaders, the winners and the laggards. The current picture for gold is mixed but could become clearer if/when the greenback confirms its bottom. We would welcome that, as it would clear out the last of the weak hands and position gold ready to move higher.

These are difficult times. When trends are shifting or changing, we need to analyze various markets and asset classes to get a better handle on what is going on. This analysis allowed us to foresee the lack of a true breakout in gold and gold shares while the gold permabulls continued to cheerlead onward. If you are looking for more professional guidance to help you ride this bull market, then consider a free 14-day trial to our premium service.

Good Luck!

Jordan Roy-Byrne, CMT

[email protected]

Subscription Service