The breakout to new highs last week was undoubtedly a very bullish development and it makes an advance toward $50 a reasonable objective for later this year. However, there are signs, principally in the behavior of gold and precious metals stocks—including the volume patterns in individual silver stocks—that silver is first going to react back before it continues much higher.

On its 8-month, chart we can see the bullish engulfing candlestick pattern that was a factor enabling us to predict the rally and, as we had also expected, the large number of traders who had bids in near the $25 support level were left standing at the station as the train pulled out without them.

Despite the longer-term bullish implications of the breakout to new highs, silver is thought to be very close to topping out now on a short- to medium-term basis, which has more to do with what we can see developing on the gold charts and the charts of PM stock indices and individual silver stocks, than it has to do with the silver chart. Although we can see that on Friday silver hit a trendline target, which could mark the top of a broadening pattern that silver could now react back across.

If silver is now destined to react back with gold and PM stocks, how far might it drop? A reasonable objective for a reaction would be the January low from which this advance started, while bearing in mind the obvious strength displayed in recent weeks, it may not drop back further than the support level in the $28 area.

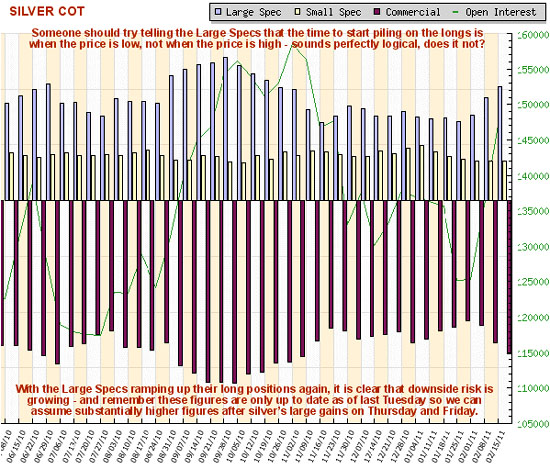

The latest silver COT chart shows that the large specs have ramped-up their long positions again over the past couple of weeks—and remember that this chart is only up to date as far as last Tuesday's close, so we can expect their positions to be considerably higher than shown here after silver's sharp rise on Thursday and again on Friday, which means that downside risk has reappeared. The COT chart was a factor that assisted us in determining that silver was set to rally in the last update, as at that time the Commercial short and large spec long positions were at a very low level.