TICKERS: AREVA, CCO; CCJ, CVV; CVVUF; DH7, DML; DNN, FIS, , KEP, PDN, RGT, UEX, URG; URE, , UUU, U

David Talbot: This Time, Uranium Demand Is for Real

Interview

Source: George Mack of The Energy Report (1/25/11)

Mining Analyst David Talbot of Toronto, Ontario-based Dundee Securities, sees demand for uranium rising far into the future. He points to the extraordinary buildout of infrastructure in India, Russia and especially China, where the number of reactors currently under construction could triple the number already in use, and where growth could increase 14- to 15-fold a decade from now. Dave shares his extensive knowledge and field experience with The Energy Report and leaves readers with a few interesting ideas that present tremendous potential for growth.

Mining Analyst David Talbot of Toronto, Ontario-based Dundee Securities, sees demand for uranium rising far into the future. He points to the extraordinary buildout of infrastructure in India, Russia and especially China, where the number of reactors currently under construction could triple the number already in use, and where growth could increase 14- to 15-fold a decade from now. Dave shares his extensive knowledge and field experience with The Energy Report and leaves readers with a few interesting ideas that present tremendous potential for growth.

The Energy Report: Your list of buy ratings wouldn't be this broad if you weren't still bullish on the spot price of uranium. Are you bullish? If so, what factors are causing you to be?

David Talbot: Yes, I am bullish on the spot price of uranium. I think it's all about demand this time. I believe that in the past, investors were essentially focused on supply disruptions as the driver for uranium prices. This time around, I think the demand fundamentals are strong and people are paying attention to that. If you take a look at the trendlines of the number of reactors that are in operation and that are being planned, built and proposed, this continues to rise month after month without exception. If you look at China, India and Russia alone, these three countries account for about 50% of the reactor build. China currently has 13 reactors in operation, which is about 2% of their electrical production capacity. But it has 27 reactors that are under construction, 50 in the planning stages, and it has plans to grow that number to about 188 reactors by 2020, which would represent about 7% of its electrical production capacity. This could essentially increase the country's uranium use from its current annual 8 million pounds (Mlb.) to about 45–50 Mlb., which is roughly equal to what the U.S. uses today.

But the story doesn't really stop there. Russia's goal appears to be nuclear power domination, and the country is essentially signing high-level trade agreements with foreign governments. Russia also went after Uranium One Inc. (TSX:UUU). Also, countries like Japan and Korea are building out their nuclear power efforts. So, we believe this access to supply is going to become a real concern for many and that uranium prices are likely to continue to rise. I'm assuming $65/lb. U308 price for 2011, $70/lb. next year, $75/lb. for 2013, $67/lb. in 2014 and $65/lb. thereafter.

TER: Uranium bounced along a $40/lb. baseline for a long time, and during this last six months we've seen an amazing increase in price. Have you seen such a spike before?

DT: I would have to say that the increase in 2006–2007 was probably a larger spike. At that time, the uranium price essentially jumped from $40 to $136 within a year's time. Then, everybody was looking at the spot price. Well, in 2007 spot trading was only about 20 Mlb., or only 8% of the total volume of uranium trades. This time around I think it's a little different. The spot market is much, much bigger—about 50 million pounds, which represents about one-third of the entire market.

TER: Do you believe this is a more sustainable rise than we've seen in the past?

DT: Absolutely. I think it's more sustainable. Last time around, a lot of that speculation also hinged on some of the supply side disruptions—namely Cigar Lake and Ranger. So, this time, not only is there a larger, more robust spot market, it's really the demand that's driving price increases—not supply disruptions.

TER: How does the economy affect the uranium industry? We're in recovery now, but what would happen if we had a double dip?

DT: First of all, the nuclear renaissance really didn't take a break during the credit crisis of 2008 or the economic weakness since. As mentioned before, the trendline showing the number of reactors in operation, and being built, planned and proposed continues to rise month after month without exception. Utilities are notorious for their long-term outlook and, ultimately, another recession probably wouldn't impede their outlook or their uranium requirements.

TER: Do you believe some companies in your coverage universe are more sensitive to economic conditions? And what would those be?

DT: Yes, with an expanding economy I think generalist demand for equities would likely pick up. They often look for new areas to invest their money. We saw this inflow of new money move into the sector quite significantly last November after 52 million pounds worth of the China-AREVA (PAR:CEI) long-term contracts were announced. Generalist investors often manage larger funds and have greater volumes of cash to place; out of necessity, they're drawn to the large-cap, more liquid names like Uranium Participation Corp. (TSX:U), Cameco Corp. (TSX:CCO; NYSE:CCJ), Paladin Energy Ltd. (TSX:PDN; ASX:PDN) or Uranium One. So, I would say the large-cap stories would be the first ones that would benefit. But typically we all see that trickle-down effect—the smaller stocks, the developers, the explorers also tend to benefit.

TER: What if we were in an economic decline? What companies might suffer from that?

DT: In a declining market, I think the smaller, illiquid names would tend to decline a little more. A lot of those companies are dependent on equity financings to sustain their exploration programs or development programs.

TER: Please compare investment opportunities within the developers versus the explorers.

DT: Developers typically have a certain level of drilling, probably a resource and perhaps at least a scoping-study level report on the project. There may be some visibility as far as the ultimate size of the project the company might be working with, and quite often management teams are bolstered with experience and depth. This provides a certain level of comfort for investors, and they may be willing to give up some stock performance for a lower level of risk or assurance of future cash flow, you know, the necessity that a mine will be built. But with the exploration stocks, some of these variables aren't so clear.

TER: Why don't you put target prices on exploration stocks?

DT: I think what it comes down to is that you don't actually have a resource estimate. You definitely don't have a scoping-study level report on the project and, ultimately, you don't know how big that project is going to be. So, for instance, if you were to value one of those early stage projects by throwing an arbitrary target price on it, it may not do justice to the company. I think you really need to wait until you get a bit more information and data before you can start actually running a proper discounted cash flow (DCF) model or even a simple pounds-in-the-ground model.

TER: China has announced that it has the capability to reprocess spent fuel. How does this bode for uranium demand and price?

DT: We believe this news should have no effect on the current supply/demand situation. I don't necessarily subscribe to this recent hype in the media but if this technology is real, its implementation is unlikely for another 10–15 years or more. Fast breeder reactors have been on the drawing board for years, but they're probably not going to be implemented on a commercial scale until perhaps the 2020s or 2030s. Furthermore, fuel reprocessing is not really a new technology. It's currently being used, mainly in Japan, the UK, France and Russia. The resulting mixed oxide (MOX) fuels, which essentially are blends of natural and reprocessed uranium that contain more than one type of oxide of fissile material, account for about 3% of world nuclear supply right now. So, China's announcements that it has the potential to stretch this uranium by 60-fold are not necessarily believable.

TER: You had some companies that you wanted to talk about?

DT: There are three stocks at the top of the list—Rockgate Capital Corp. (TSX:RGT), Hathor Exploration Ltd. (TSX.V:HAT) and UEX Corp. (TSX:UEX). First of all, Rockgate Capital is one of the darlings of the sector, but we are restricted on the stock at this time. Its main project is the Falea project in (Republic of) Mali in western Africa. It now hosts 27.8 Mlb. of U308 and 40.6 million ounces (Moz.) silver following its recent resource estimate update. The uranium-silver combination isn't that common today, but it has the potential to improve economics of the potential operation here. We saw a large improvement in the average grades of both uranium and silver, and we're looking forward to seeing a scoping study later this quarter.

TER: By the way, congratulations on that. It was $0.72 when you initiated; that's more than a 200% return.

DT: Thank you.

TER: Is there another that you want to mention?

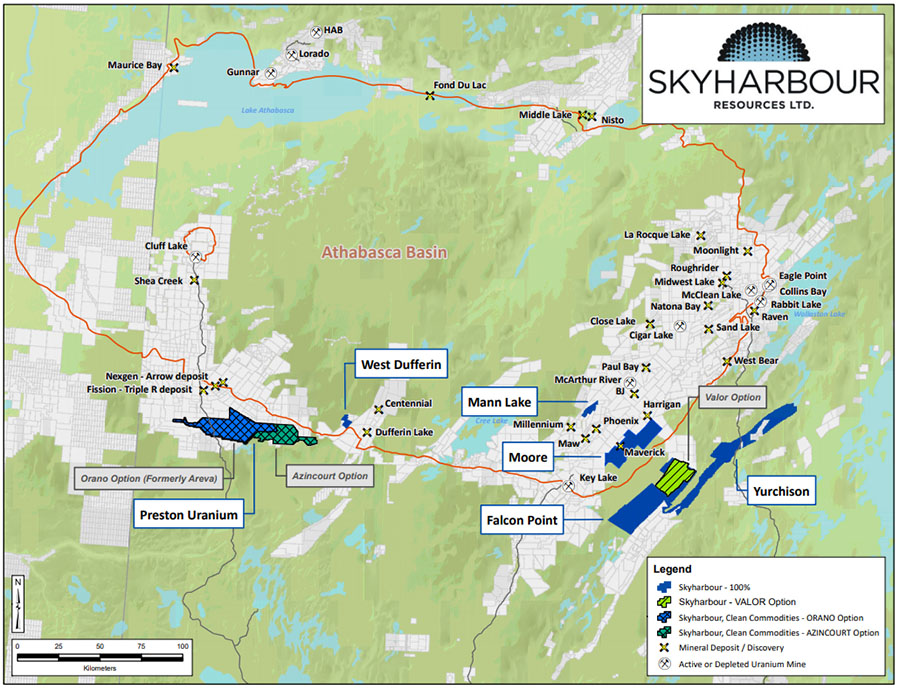

DT: We've got a buy on Hathor Exploration with a $4.50 target price. Its project lies about 4 km. from AREVA's and Denison Mines Corp.'s (TSX:DML; NYSE.A:DNN) 50 Mlb. Midwest Project in the Athabasca Basin of Saskatchewan. We're really impressed with what this team accomplished last year. Exploration is showing a very robust mineralized system, and the company's been able to increase the Roughrider resource to about 28 Mlb. with a U308 grade of 2.88%. But it's also expanded the high-grade zone by almost 24 Mlb., grading 11.7% in the core of the deposit. Now, as good as this sounds, we think the best might be yet to come. To the east, the company's discovered another deposit it's calling Roughrider East.

TER: Has winter drilling begun?

DT: It has just begun. I know Hathor has also started drilling the Henday Project about 10 km. to the north. One issue with the Roughrider project is that it is under water, so the company has to build up the ice sufficiently in order to start putting the rigs out on the ice. That ice-building process was just completed and it's something that would've started in December or late November.

TER: You've got a very healthy implied return of more than 90% on this stock. When Hathor gets the first read on this property between Roughrider and Roughrider East, will that be the catalyst?

DT: Absolutely. I think Roughrider East is going to be the real driving force here. If you do a back-of-the-envelope calculation on Roughrider East and add it to the Roughrider project, you can almost envision 50 Mlb. or more from that project alone.

TER: Another company?

DT: Yes: UEX Corporation. This is a stock that's been resurrected over the last six months. We've got a buy and a $2.80 target price on it. The company has two main projects in, again, the prolific Athabasca Basin. It's got a 49% interest in the world-class Shea Creek Deposit to the west. It also has 100% interest in the Hidden Bay Project to the east. Shea Creek is a joint venture (JV) with AREVA and already hosts 88 Mlb. With subsequent drilling, we wouldn't be surprised if it's already surpassed the century mark. There are pockets of mineralization that host about 20% U308, particularly at the unconformity.

TER: Is Shea Creek the catalyst for UEX now?

DT: You know, as much as that is a world-class project, it is deep and it's going to be relatively expensive to explore and develop. I think it's going to take quite a long time; so, the catalyst in the near term will be Shea Creek drill results because this stock tends to trade or perform on exploration results. But from the corporate standpoint, the catalyst is going to be what happens in the east end. Is Hidden Bay going to be acquired, or will the company be acquired for its Hidden Bay asset, which lies on Cameco's doorstep?

TER: You've got a 50% upside potential from here if it meets your target price. That would be a very nice pop. It's up 71-1/2% over the past 52 weeks. Were there any other companies that you wanted to discuss?

DT: Sure. There are a few stories out there that I'm talking with my clients about quite a bit. Ur-Energy Inc. (NYSE.A:URG; TSX:URE) is one of those. We've got a buy on the stock and a $3.25 target price. This company has two fairly large in-situ recovery (ISR)-amenable projects in Lost Creek and Lost Soldier in Wyoming. What it's proposing is an ISR plant capable of processing about 2 Mlb. of uranium production per year. Capital and operating costs are expected to be low. The management and technical teams are quite experienced and company staff has extensive depth in ISR operating experience.

TER: So, do you think Ur-Energy might have all of its permits before midyear?

DT: We can only hope. I don't like forecasting when governments are going to act. The company still needs its final Wyoming Department of Environmental Quality (WDEQ) license from the state, but it currently has a draft license from WDEQ.

TER: What has driven Ur-Energy stock up 228% over the past 52 weeks and 150% in the past three months?

DT: First of all, strong performance in the sector. I think there's near-term production potential and the receipt of the draft NRC license was important, as well. I really think this being a U.S.-listed stock and a U.S.-based stock also has helped with strong U.S. retail interest. But it's not the only company benefiting from some of those issues. Uranerz Energy Corporation (TSX:URZ; NYSE.A:URZ) has done exactly the same thing, and we've got a buy and a $4.25 target price on it. Hopefully, this company's permitting process is coming to a close as well. It plans to build an ISR plant in Wyoming and ramp up to about 1.6 Mlb. uranium starting in early 2012. Again, capital and operating costs are expected to be low. Uranerz is very successful at exploration.

TER: Uranerz has $36 million in cash now. It's just completed financing. Is it set?

DT: I think it's set for now. With that said, this is a company that continues to explore. Ur-Energy has two big 43-101-complaint resource deposits, but Uranerz is a little more hand-to-mouth when it comes to its resource build.

TER: Uranerz has performed nearly as well as Ur-Energy. What will be the next catalyst to move Uranerz?

DT: Again, we are waiting for the final NRC license to permit here. So, that's going to be the big one. Once the company gets that, they should be off to the races.

TER: Do you have another company you'd like to mention?

DT: I just want to make sure I put my two cents in on Fission Energy Corp. (TSX.V:FIS). We've got a buy rating with a venture risk on it, and no target price.

TER: Fission is up an amazing 343% over the past year, and you still have a buy rating on it?

DT: About a year ago, Fission discovered a deposit just west of Hathor's Roughrider deposit on its Waterbury Lake JV with Korea Electric Power Corporation (KEPCO) (NYSE:KEP), which is a Korean nuclear utility that's in bed with the junior exploration company. Drilling is in the early stages, but the second-best hole to date is 15-1/2% U308 over 5.5 meters. So far, the zone measures roughly 120 meters long by 50 meters wide and we think it's likely to grow further.

TER: Do you have another company?

DT: Maybe one final one. CanAlaska Uranium Ltd. (TSX.V:CVV; Fkft:DH7; OTCBB:CVVUF) is a watch list stock at Dundee. This is another one of those small grassroots explorations plays in the Athabasca Basin, perhaps looking to become the next Fission. What we're really looking for here is the next discovery.

TER: The company has a market cap of $26 million. I'm wondering if that may have scared some investors away.

DT: Certainly. It's one of those risk/reward issues. Big funds typically cannot play in some of these smaller stocks because when they try to buy, the stock price takes off, or they're just not liquid enough to get out. Liquidity has been a chief concern since the credit crunch of 2008. But there are people out there who like this early stage project.

TER: I've enjoyed talking with you today, Dave. Thank you very much for your time.

DT: Those were great questions. Thank you very much.

Dundee Securities Senior Mining Analyst David Talbot worked for nine years as a geologist in the gold exploration industry in Northern Ontario. His field experience included three years with Placer Dome and six years managing projects for Franco-Nevada Corp. and its successor, Newmont Capital. David joined Dundee's research department in May 2003 and in the summer of 2007, he took over the role of analyzing the fast-growing uranium sector. David is a member of the Prospectors and Developers Association of Canada, the Society of Economic Geologists and graduated with distinction from the University of Western Ontario, with an Honours B.Sc. degree in geology.

Want to read more exclusive Energy Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Expert Insights page.

DISCLOSURE:

1) George Mack of The Energy Report conducted this interview. He personally and/or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Energy Report: Ur-Energy, Uranerz, Fission and CanAlaska.

3) David Talbot: I personally and/or my family own shares of the following companies mentioned in this interview: CanAlaska Uranium Ltd. I personally and/or my family am paid by the following companies mentioned in this interview: None.

4) David Talbot beneficially owns, has a financial interest in, or exercises investment discretion or control over the following companies mentioned in this interview: CanAlaska Uranium Ltd. David Talbot has visited certain material operations of the following issuer(s): Uranium One Inc., Rockgate Capital Corp., Paladin Energy Ltd., Hathor Exploration Ltd., UEX Corp., Ur-Energy Inc., Uranerz Energy Corp. and Fission Energy Corp. David Talbot and/or Dundee Securities Corporation has been partially reimbursed for expenses by the following issuer(s) for travel to material operations of the issuer(s): Uranium One Inc., Rockgate Capital Corp., Paladin Energy Ltd., Hathor Exploration Ltd., UEX Corp., Ur-Energy Inc., Uranerz Energy Corp. and Fission Energy Corp. Dundee Securities Corporation has provided investment banking services to Rockgate Capital Corp., Hathor Exploration Ltd., UEX Corp. and Fission Energy Corp. in the past 12 months. Dundee Securities Corporation and/or its affiliates, in the aggregate, own and/or exercise control and direction over greater than 10% of a class of equity securities issued by Rockgate Capital Corp. Dundee Securities Corporation and its affiliates, in the aggregate, beneficially own 1% or more of a class of equity securities issued by CanAlaska Uranium Ltd. Garth MacRae, a director of DundeeWealth Inc. and Dundee Corp. and member of the Board of Governors of Goodman & Company, Investment Counsel Ltd., is a director of Uranium Participation Corp.