The run-up in gold prices attracted investors to the gold and silver mining sector and for those looking for significant exposure, producers that do not forward sell their production provide the vehicle to take advantage of the improvement in gold prices. However, during the recent pullback in both silver and gold prices, these stocks naturally experienced some profit taking—particularly by speculators who have recently taken an interest in this small sector of the market.

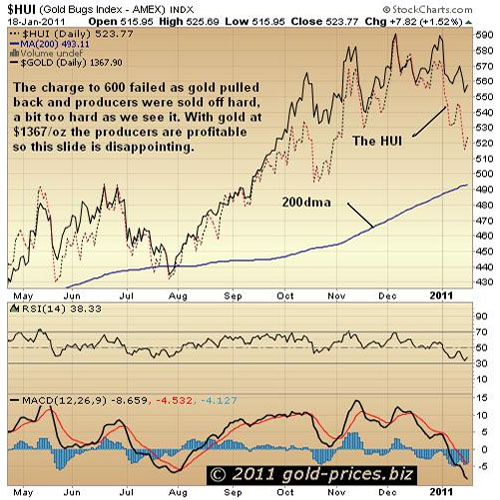

Taking a quick look at the above chart, which compares the progress of the HUI with that of gold prices, we can see the HUI has been tracking gold closely until this recent downturn when the HUI has moved considerably lower. This is a disappointment to us as the stocks appear to head lower faster than the metals, but they also appear to move higher slower than the metals.

The HUI is the AMEX Gold BUGS Basket of Unhedged Gold Stocks Index and represents a portfolio of 14 major gold mining companies. The Index is designed to give investors significant exposure to near-term movements in gold prices by including companies that do not hedge their gold production beyond one and a half years.

Investing in stocks is attractive, as the stocks should offer leverage by as much as 3:1, 4:1 or 5:1 to the metals; if the returns are mediocre, investors couldn't see the point in taking the many and varied risks inherent to the mining industry. The phase we are in right now shows the stocks struggling to manage a 1:1 ratio with the metals.

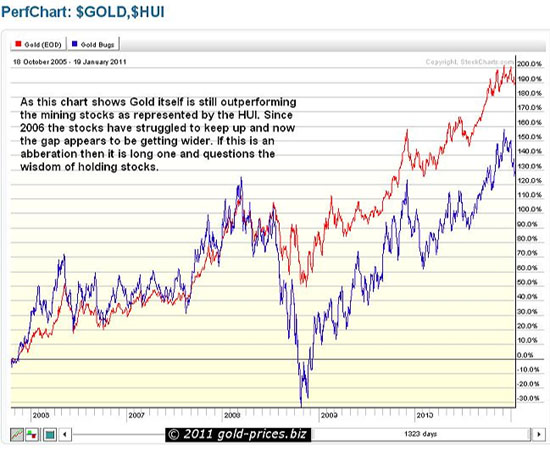

The following chart compares gold to the HUI; since 2006, the stocks have struggled to keep pace with gold and the divergence appears to getting wider. So, is this a buying opportunity or have things indeed changed suggesting the stocks may not be the best way to play this golden bull? After all, this is not 1980 and other vehicles are available that are consuming a fair amount of investors' cash. There are a variety of exchange traded funds (ETFs) that specialize in gold itself; and everyday now we see the launch of a new vehicle offering a slightly different slant on the way to play this market. These vehicles offer exposure to gold, ease of access and liquidity along with a price that moves almost in lock step with gold.

There is no doubt in our minds that gold producers are in for a good time but this is not a monopolistic environment, so they now need to become more creative to attract and maintain customers. A half decent dividend would be a starting point, offering existing shareholders the opportunity to participate in the next stock offering, offer the product they mine for purchase by their own the investors, etc. Some companies are in the process of doing some of these things but not all. The businesses that can't keep up with gold prices need to find an olive branch and come up with something revolutionary that secures their market share, otherwise funds will move to a safer and more profitable place. Miners—you have been warned so get your skates on.

As our readers know we have been, and are still firmly, ensconced in the inflationary camp and, apart from the massive price increases that have hit the overall commodities market, there are signs that inflation is pushing through—like the UK just announced. Oil prices took the blame as the annual CPI growth moved up in December to an eight-month high of 3.7%—well above the 2.0% target—giving the Bank of England a new headache. Also note that these figures do not include the latest rise in value added tax (VAT) in the UK, which will no doubt boost this figure even higher next time around.

For what it's worth, our strategy remains unchanged with the purchase and holding of physical gold first, followed by a small number of stocks, and then a few options trades in an attempt to get the leverage the stocks are not delivering currently. In fact, we are so confident gold prices will rise that we have offered to refund the fee paid to our premium options trading service should gold prices not hit $1500/oz. this year.

Whilst being dragged mercilessly around the shops the other day, I spotted a jeweler shop with the usual signs outside saying 'We buy and sell gold and silver,' etc. It looked like a good place for some respite and an opportunity to find out just what is happening at the High Street end of things.

We kicked off with a polite inquiry about our wish to purchase both gold and silver coins and bars for investment purposes. The shop owner, resplendent in apron, goggles, head bands and high-powered magnifying glasses gave us a perplexed look.

'Do you know,' he said, 'that I took delivery of both—enough to last this shop five weeks—and it all went in a day and a half. However, I have placed another order and when you are certain of exactly what you want you can piggy back on the back of my order; but we cannot give you a delivery date as things are a bit manic at the moment.' He went on to say that investment demand was now outstripping retail demand for jewelry. And although he was happy to get the business, he was surprised at just how fast it was moving.

He also told us that people who had bought three months ago returned in the first week of January 2011 and paid cash for immediate possession. He likened his business to the bakery next door with the proviso that he was handling much bigger numbers. He wasn't prepared to tell us just how big as we had just walked through the door and he didn't know us. We asked how much gold and silver his customers brought back to make a profit when the price had increased, he laughed and gave us that look! None of his customers who had purchased precious metals for investment purposes had tried to sell it back to him, however, he was getting a steady flow of broken jewelry that people would cash in and his pride and joy as a craftsman was to repair the objects and display them in his window.

This is not a scientific experiment but the owner did dwell on the supply side difficulties that he was experiencing, so this would appear to be in line with most of what we have picked up from our peers, the media, other sites, etc.

It suggests that the physical supply and availability of gold and silver as we have alluded to in the past and has been reported on many other sites, such as King World News, is still very tight indeed.

The difficulty we wrestle with is can silver do it again, put in a repeat performance equal to that of last year, especially in the latter half of the year when it went from $18/oz. in August to $30/oz. in December 2010. Normally, we would say this is highly improbable but every time we have a knock-down-and-drag-out session we come back to very similar conclusions that silver will indeed have another very good year. Gold prices may steal the limelight and power ahead making record breaking headlines, however, silver prices will be there or thereabouts. We lean toward the theory that the sheer number of people in China, India, Asia, etc., that are steadily increasing their wealth will be able to afford some silver as their financial positions improve; and, should they gain some traction, gold prices will appear less daunting and so they start to accumulate some gold too. Also, the investors/speculators who have made some good profits in silver may decide that the time has come to change horses and allocate some of their capital to gold in the hope that a better percentage gain can be had. It's going to be a very interesting year and a pretty bumpy one at that.

Just our thoughts, of course.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices newsletter, completely FREE of charge. Simply click and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

Bob Kirtley

www.gold-prices.biz

www.skoptionstrading.com

DISCLAIMER: Gold-prices.biz makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.