Now if we look at the U.S. dollar chart, we see the exact opposite price action. We see sharp rallies during October and November of last year. It's normal to say that gold and silver move inverse to the Dollar so this price action makes perfect sense.

The interesting thing with the U.S. dollar is that in Nov-December it rallied breaking through a key resistance level and has been consolidating above support ever since. If this bullish pattern (bull flag) plays out, then it's just a matter of time before the dollar makes another strong rally upwards, which will put downward pressure on stocks and commodities.

Take a look at the charts below. . .

U.S. Dollar Daily Chart

The 50 period moving average has provided key support/resistance levels for the previous trends and if it holds true going forward then we are not far from another rally in the dollar.

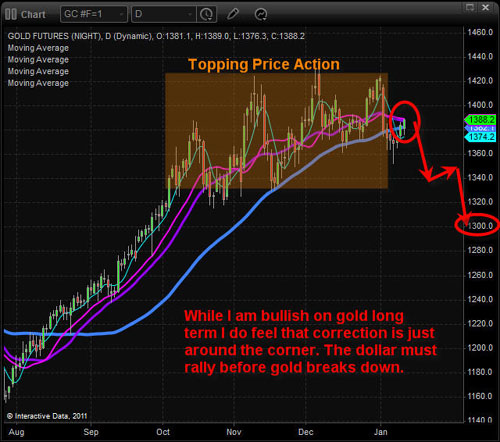

Gold Futures Daily Chart

Gold moves inverse to the dollar; so, if we get a higher dollar, look for gold to have a stair-step pattern lower.

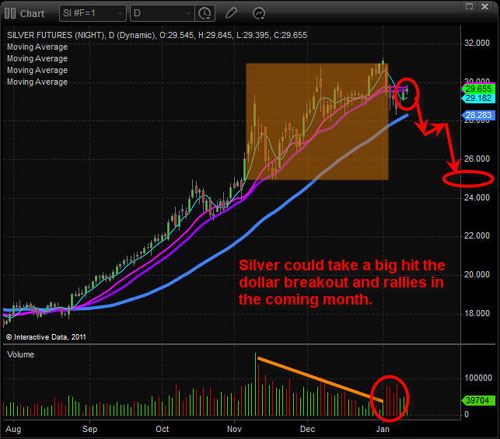

Silver Futures Daily Chart

Silver looks about ready to do the same thing as gold.

Precious Metals and Dollar Trading Conclusion

In short, we could see a major shift in momentum from up to down in both precious metals and the equities market. Keep in mind the market has a way of dragging out patterns/moves; so, while the chart looks bearish and I think a reversal is near, things could just chop around for another month or so before a definitive breakout is made. This is why you don't want to anticipate moves (pick a top). Currently, I am neutral on metals and the dollar waiting for a setup that must have clear risk/reward characteristics.

If you would like to receive these reports please join my free newsletter: http://www.thegoldandoilguy.com/trade-money-emotions.php

Chris Vermeulen