There is an old joke about being 'kept in the dark and fed manure' (i.e., people being treated like mushrooms). The joke refers to how mushrooms are grown in moist, dark conditions; however, they are not fed manure anymore, yet people still are. The knowledge that corporations and governments have been treating clients and their constituents in this manner could be why WikiLeaks is so popular. WikiLeaks is supported by some high-profile people, which is causing embarrassment to people in high places and is of great interest to large numbers of people. It appears education and disclosure are well sought—there is big demand. People need and, sometimes, want to know the truth and they certainly need to learn financial intelligence.

So, with the broader gold community, GoldOz has been biased toward education and data rather than pure data alone. Our belief is that people don't like being made fools of, being kept in the dark or lied to; yet governments, banks and corporations have grown extremely large doing just that over a long period. Thanks to the World Wide Web, this is changing and the people now have a much greater voice. At this particular point in history it has never been more dangerous to travel without knowledge of financial matters.

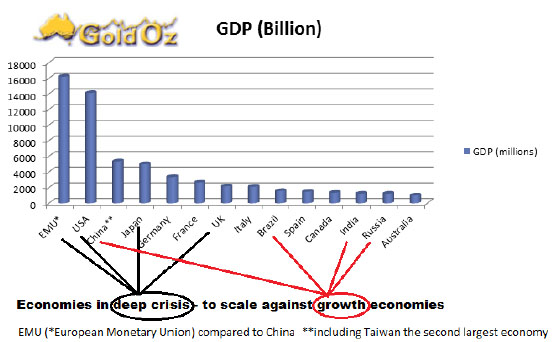

The world has pinned economic salvation and escape from the debt pyramid onto growth economies and financial stimulus. Yet the size of the economies expected to carry us through, as displayed graphically below, indicates they are just too small to carry all the much-larger weaker economies. Therefore, much stimulus will be required even after the current quantitative easing two (QE2). This means quite simply that the crisis will continue to drive gold for many years yet.

Note: EMU highlighted in black includes individual European nations Italy and Spain. The problems in France and Germany are more due to counterparty risk and EMU issues at this stage of the crisis.

Don't listen to the lies—you have to read between the lines. A quick study of monetary history, a full disclosure on the present monetary system and an understanding of the greatest debt bubble in history make gold and silver investment a "no brainer." The need is huge, the supply is limited and the saturation level amongst the general population is almost nonexistent. The need for education and disclosure is paramount at this point in history and I want to commend these web sites and professionals that have been spreading the word since the early naughties—back in 2001, or even as early as 1999, when the seeds of this need germinated in the beginnings of the greatest gold bull in history.

It is important to look at your own scorecard to see if you have been on track or not. As I am on public record, it is even more important to be objective and continue to improve one's act.

We have had a great 2010 year, predicting the markets at GoldOz. Back in January, we saw gold going to US$1,400 by May; but the grind up was uncommonly slow. The price did reach US$1,400 as we stuck to our guns on the price target through the year. Gold stocks disconnected from the general stocks in April 2010 here in Australia. We have been cautious on the sector for a few months; however, all we have seen is isolated falls and rises resulting in a net sideways consolidation as Aussie gold stocks have been accumulated. We are articulating this in detail in our newsletters for gold members, along with our ideal educational portfolio draft contained at the end of our "Ratings Table."

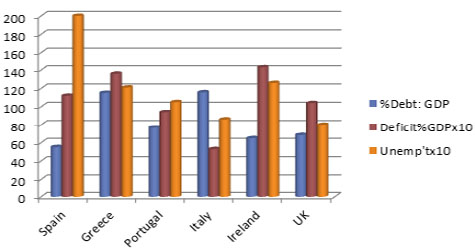

We were spot on with the euro, stating back in January that it would be like a flightless bird this year—and it got smashed down to 1.2 against the USD. I also stated that the eurozone was likely to take center stage after the U.S. hogged the news flow in 2009 for all the wrong reasons. We detailed how the debt collapse would be slow and painful, stating the problem was not going away; and, as we have seen, it did not. Here is a recent excerpt from a newsletter showing the troubled Eurozone members and the UK—these are the bars of doom and the metrics from hell.

We have altered the scale of the deficit as a percentage of GDP and multiplied the unemployment percentage x 10 to fit all these important metrics on the same chart. There is Spain with a 200 reading for unemployment, which equates to 20% unemployment. Deficit to GDP is supposed to be less than 30, which is the 3% agreed on under EMU rules—Greece is pushing 14.3%. The percent of debt levels sort of look normal here because they are at similar levels. This is just government debt and therein lays the problem—these excessive levels are actually the tip of the iceberg. When you add personal, business, municipal and state debts throughout the world, the problem is far worse. Greece recently "found" a large amount of off balance-sheet debt not disclosed on entry into the EMU. Unfunded government liabilities are even larger and harder to quantify.

Other predictions included: Stimulus to continue—we got QE2, property crash not this year in Australia—but sector weak and it has fallen into extremely flat times at year-end. I believed the Australian dollar (AUD) would weaken faster, but this proved wrong as the USD won the currency-devaluation war.

In January 2010, I did feel confident to predict the Aussie gold stocks all the way past June and said the top was due in April (XGD, Australian gold index). In June, that top was exceeded slightly to make a new H1 high. A correction did occur past that, but it was small. There was no major correction for the rising Aussie gold sector last year.

On June 8, I penned the following: "Many of my colleagues and I have been telling you to invest in gold and silver for years and those that have done this have benefited tremendously. From 2000 on, the U.S. citizens benefited more than any other from precious metals because they are a hedge against a falling currency. As this crisis hits certain points, the price of gold will rise dramatically against all currencies. This phase may have already started and the gold stocks are going to launch next."

Then, on June 23rd 2010. . .

Volume was solid as we approached the tip of the apex of this formation. We had an excellent chance of upward price action here in H210. This preceded a large break out in H210the second half of the year. It did not happen instantly, it took several weeks to begin—but I am still extremely happy with this call.

Just a quick note on Europe—yes, I know I harp about this, however, I cannot believe how poorly debt is understood. Confidence is creeping back there, too—but for how long? The recent stress tests in Europe proved nothing because they valued the Greek, Spanish, Irish, etc. debt at par. This has everything to do with gold, so please let me persevere. This is the source of the next burst of interest in gold—the eurozone—which will be strong and likely produce another burst of currency volatility.

That is exactly what happened. We also highlighted the rare earth blast off and many hot investments in the gold sector in our newsletters, which form a part of our gold membership service. We know you were happy due to the exceptionally high re-subscription rate. But, what about 2011 you say?

2011 Forecasts

As we start this calendar year, we have to stay alert that the global system has not returned to broad sustainable growth despite continued efforts and massive injections of capital. We still face a world in disequilibrium. The largest "first world" economies (EMU, USA, Japan) are still on stimulus-induced life support. Their troubled GDPs still dwarf the BRICS (Brazil, Russia, India, China and now South Africa).

Massive deficits are staving off recession in stronger economies and sovereign defaults in the PIIGS of southern Europe (for now). The surplus economies appear to be stealing jobs from deficit nations. Capital controls and protectionism are the only recourse of the weaker nations. To make it even more interesting, we now face a mature bond market cycle (fixed income is finished). Unfortunately, this situation is getting worse—not better.

Interest rates are heading up now because the bond bubble has burst—this is not the time to be invested in bonds because you get killed on rising yield. They lose value as yield rises so there is a huge capital wave heading out of the debt markets. Too bad if you bought the "low risk" lies at the top of this market. When a country is forced to restructure the bondholders cop a haircut—they lose capital. Many bond investors know this and are now withdrawing their capital in response to increased risk.

Two logical things happen here: 1) It gets harder to borrow and refinance; and 2) The shift in momentum is to equities. Make no mistake—stocks markets will rally on the crest of this capital wave. Miners appear to be the logical choice for equity funds and the gold sector will benefit greatly. After all, who would want retail, property trusts, finance sector or many industrial stocks when growth is lousy, discretionary spending is shrinking and risk is unacceptably high for banks and property.

Banks face funding shortages and so does everybody else. The banks are already turning their attention to comply with Basel 3 and the new reserve requirements. Balance sheets have to shrink and interest rates will continue to rise putting pressure on the banks' clients. Then there are the legal problems arising from the CDO administration bungle—title concerns on mortgages in the U.S. JP Morgan has set aside $5B for legal battles as the U.S. banks face a messy five-year period on that front.

As troubles intensify in Europe and interest rates rise in the U.S., the Fx boys will probably rally that USD. Remember their box is specialized so they operate with their own set of criteria. Will they ask if the U.S. can pay back? We expect not. Is USD investment logical when the total U.S. debt is awful? No. Once the Fx boys see they are going to be paid to hold USDs, they will buy and cause a rally. Will it be long lived? No, this would be a short-term or intermediate trend. If this happens, it will buy time for this dying currency and push down the AUD providing a benefit for the Aussie gold stocks.

We see another interest rate hike in China soon to curb its inflation woes as local and world food prices escalate. It has to pop its property bubble and cool economic activity, so China will be touching the brakes again. Up go reserve requirements and down goes growth (a little). It will remain high but for a world addicted to maximum growth in China, this is still a short-term negative factor. China seeks to control the inflow of hot money and maintain "appropriate" levels of liquidity in its banking system as it monitors and nurses the country's fantastic growth rates.

The trade surplus (reserve) in China has now reached nearly $2.7 trillion; however, most of this is caught in U.S.-denominated assets, in particular U.S. Treasuries. The latest trade surplus came in at only two-thirds the expected level ($20.8B estimated by economists) at only US$13.1B and way below the November level of $22.9B. Reports suggest that internal consumption is growing and will continue to grow over coming years, which is great for commodities. The Chinese are prudent—I could only dream of such financial vision for Australia, the U.S., et al. The country is trapped in these U.S. Treasuries, however; and it remains to be seen how this will pan out in the end.

The euro will be under duress, another flightless trajectory for the flightless EMU in the first half. This is tragic for citizens of Europe and I deeply feel for them. This will add further demand strength to gold and the USD. These are ideal conditions for local Australian gold stocks; therefore, I am moving toward less cash and more gold-focused equities myself during this pullback as I employ my own portfolio growth strategies.

Neither central banks nor sovereign funds want to get trapped in U.S. Treasuries (like China), so they are buying gold. This will continue in 2011 providing a strong floor under any gold-price contractions, such as the one we are seeing currently. Therefore, this is an accumulation phase; buy the dips—buy the base lines and get set for some profit taking later this year.

Gold and Aussie Gold Stocks

The good news is the XGD is getting more oversold with the RSI currently reading about 36 as I pen this today (1/11/11). The last time the XGD was this oversold was back on the May 5, 2010 at 35. This index has fallen 500 points or about 6% since January 4. This is mainly due to a 6% fall in NCM due to the shallow gold price correction, a sediment allegation at the Hidden Valley PNG, a small mudslide at Gosowong, Indonesia and the situation in Côte d'Ivoire (political strife). Newcrest dominates this index, so you might as well state the rest of the sector at this top end has averaged a neutral move so far this year.

The giant sovereign funds and central banks will be buying gold here, and they have very deep pockets. Nothing fundamental has changed for gold and I expect further gains for it and silver this year. The following chart shows two flat lines below the MACD and the RSI to indicate previous oversold levels.

I have also drawn two ellipses that contain very similar consolidation patterns. Given these patterns on the daily chart, I consider a dip to the 1260 area is unlikely.

Knowing markets, however, it cannot be ruled out. Probability is low—chance of upswing shortly is higher given the technical indications.

If you have missed my articles for the past few months, I apologize. We have been extremely busy delivering to our growing client base; our main focus remains the newsletters, investment tools and databases.

One of our latest developments is a free ore-valuation tool available at GoldOz. Follow this link if you're interested (we think it's useful): http://goldoz.com.au/commodity_valuation.0.html.

You heard about it first at this fine web site and it is available for full publication to other precious metal and mining web sites on request. It can be modified to suit your readers or production profile. We wish you all great success for 2011

Good trading/investing.

Neil Charnock

goldoz.com.au

GoldOz has now introduced a major point of difference to many services. We offer a newsletter, database and gold stock comparison tools plus special interest files on gold companies and investment topics. We have expertise in debt markets and gold equities that gives us a strong edge as independent analysts and market commentators. GoldOz also has free access area on the history of gold, links to Australian gold stocks and miners plus many other resources.

Neil Charnock is not a registered investment advisor. He is an experienced private investor who, in addition to his essay publication offerings, has now assembled a highly experienced panel to assist in the presentation of various research information services. The opinions and statements made in the above publication are the result of extensive research and are believed to be accurate and from reliable sources. The contents are his current opinion only, further more conditions may cause these opinions to change without notice. The insights herein published are made solely for international and educational purposes. The contents in this publication are not to be construed as solicitation or recommendation to be used for formulation of investment decisions in any type of market whatsoever. WARNING share market investment or speculation is a high risk activity. Investors enter such activity at their own risk and must conduct their own due diligence to research and verify all aspects of any investment decision, if necessary seeking competent professional assistance.