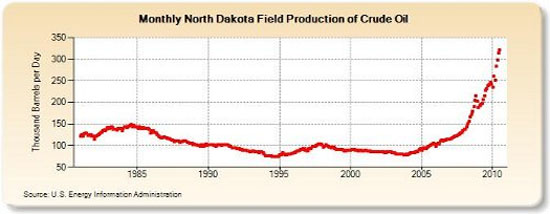

And without a doubt, North Dakota's oil fields have been one of the best—if not the best—story of 2010.

If things continue on the same path, it's already in contention for next year, too. Activity in North Dakota is running wild. With approximately 157 rigs drilling in the state, roughly 95% of them are drilling the Bakken formation. Lynn Helms, director for the state's Department of Mineral Resources, is expecting that number to exceed 200 next year.

The state's crude production is barreling higher, too—up to a record 342,000 barrels per day. Further, there are nearly 870 well permits already in place for 2011.

We already know who's drilling in the Bakken. And now, with conventional oil going the way of the dodo, tapping into these "unconventional resources" is becoming critical to our oil and gas production.

Conventional vs. Unconventional: Clearing the Air

Today, I want to clear some of the confusion surrounding our unconventional opportunities.

What comes to mind when you think of unconventional oil?

You would be surprised how many different responses I receive. And based on the variety of those answers, it's even more imperative to set the record straight. The problem is that most people toss the word unconventional around too lightly. As you'll find out, there are significant differences.

The biggest misconception in our unconventional sources concerns the oil shales. Now, I'm not talking about the billions of barrels of oil beneath the North Dakota soil but rather the kind of oil shales found in the Green River formation. (Believe me, making that mistake can cost you dearly. Almost a year ago to the day, a few of my readers nearly mistook the Bakken Formation for the Green River formation.) The cold, hard truth about the Green River oil shales is that we aren't any closer to producing that resource than we were decades ago.

I remember one of my readers mentioning his personal experience in that article:

"I am a petroleum and mining geologist who has been looking at the Green River oil shale & Mahogany Ledge for 60 years. . .the literature would have you believe oil from this rock was coming tomorrow, except the papers were dated in 1910 and we are now in 2010 and still not there."

As much as I'd like to, I'm not going to completely write off the Green River oil shale for one reason: You should never underestimate technology. I'll show you why in just a minute.

Also at the top of the list of unconventional oil sources: Canadian oil sands deposits.

Unlike the Green River oil shales, companies have been successfully extracting and upgrading the bitumen sands in Alberta since the Great Canadian Oil Sands (better known today as Suncor) mine opened 43 years ago.

Also lumped into the unconventional mix are offshore oil and shale plays like the Bakken.

We know that drilling in the deepwater (I consider deepwater wells to be in depths greater than 500m) isn't easy; BP found that out the hard way. I save the deepwater prospects for another day—especially as the U.S. government has put the kibosh on deepwater drilling for the time being.

Shale plays like the Bakken, however, are a different story. Should we even consider these shale plays as unconventional? The oil being pumped from shale formations isn't even in the same ballpark as the Green River shale or the bituminous oil sands in Alberta, which must be heated to extract the heavy oil.

No, the Bakken holds the same light-sweet crude that would make any Texas driller envious—perhaps even more so, considering Texas oil production has plummeted 56% during the few decades.

Although Bakken oil is more akin to the conventional, free-flowing crude we've enjoyed in the past, it's located in an unconventional reservoir rock with a low degree of permeability.

And that's why drillers must use the latest fracturing techniques to get that oil to flow. Lately, those North Dakota drillers have been doing something right.

But as I mentioned earlier, 2011 will be a much different game. . .and if you're looking to get ahead of the pack, follow the technology.

The Key Is to Unlock the Shale

One look at the surge in shale activity in areas like North Dakota, and we know those companies are in it for the long haul.

However, the problem isn't finding those drillers. As I said, we already know who they are—as does every other investor with a Google search engine. It's all about staying ahead of the technology. . .

Take this small company still flying underneath Wall Street's radar. These guys are perfecting their "petro-frack" technology, which is attracting the attention of the major players.

For early investors, these opportunities are ready to break wide open—especially as the controversy over hydraulic fracturing heats up. The best part? This technology has been used in nearly every major shale formation in Canada and the United States.

Until next time,

Keith Kohl

Editor, Energy and Capital