When the market is trying to top and roll over, it tends to be more of a process than a two-day event. It's this lengthy topping process that has a lot of choppy price action, which sucks traders into a position much too early or shakes them out of the position before the market does what they anticipated.

On the flip side, bottoming is more of an event because it tends to happen after a strong wave of panic selling. Fear is the most powerful force in the market (other than the Fed/manipulators, but that's another topic). That being said, when you know what to look for in bottoms you can generally see the market starting to bottom and prepare for it.

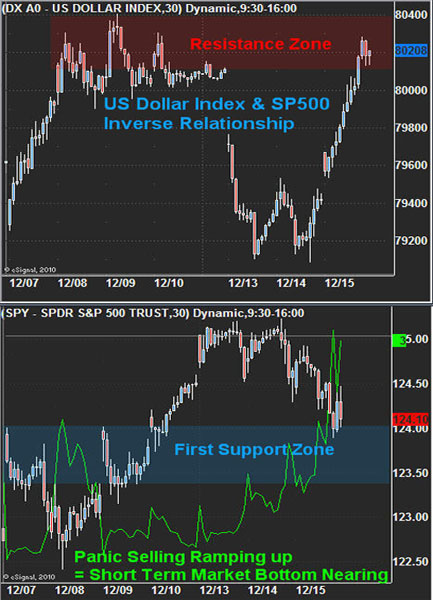

The charts below of the U.S. Dollar Index and the SPY clearly show their inverse relationship. Right now, it seems everything is directly connected with the dollar—it's been like that for most of the year. I will note, however, it's not normally this clear. The dollar is currently trading at resistance, which means there is a good chance it will turn back down. If the dollar drops, it should boost the SPY (equities market) and put in a bottom for stocks.

Looking at the lower chart of the SPY ETF, you can see that recent prices have dropped down to a support zone. The important thing to note here is how selling volume is ramping up. To me, this means more traders are getting worried and cutting their losses or locking in gains before it gets worse. We typically see panic selling enter the market near the end of pullbacks. Just like a bull market wherein the retail trader (John Doe) is the last to buy before the market falls, it's the same but flipped in a downtrend. Retail traders are the last to panic and sell out of their positions before the market bounces/rallies.

Currently, the equities market shows signs that a bottom is nearing. Over the next session or two, the rest of this equation should come to light as a tradable bottom or start playing the downside of the market, only time will tell.

If you would like to learn more and get my trading alerts along with my pre-market morning videos, so you know what to look for in the coming session, I recommend taking up a subscription with my ETF trading newsletter here: www.TheGoldAndOilGuy.com.

Chris Vermeulen