I first wrote about uranium exploration and development companies in private analyst reports beginning in March 2007, over a year before the birth of MercenaryGeologist.com in late April 2008.

But also, I foolishly entered the uranium sector in May 2007 during the hedge fund-driven uranium bubble and only two months before the spot price crashed. Luckily, my exposure was limited and one bad stock was used to generate tax losses in 2008. A lesson was learned and hopefully the mistake will not be repeated.

The uranium boom from mid-2005 to mid-2007 soon became the uranium bust. As a contrarian, I started buying uranium explorers and developers in mid-2008. Publicly preaching the gospel of that other yellow metal commenced in January 2009 in a transcribed interview with The Energy Report.

I expected 2009 to be a good year for uranium and the stock sector but the spot price and the markets were flat thru mid-2010. One good thing about a contrarian view is often a longer term view and so I adopted a philosophy of patience.

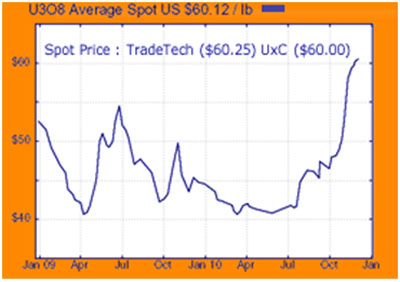

The situation changed dramatically beginning in mid-July with the spot price soaring over 45% in the past five months. I have gone on the offensive with respect to the uranium market via a series of radio and transcribed interviews (Mercenary Interviews), a musing (Uranium: The New Green Metal), a recent BNN appearance (Uranium Stock Picks) and an invited presentation at an investment conference (Uranium: The Next Big Thing).

Simply put, I am bullish on the supply and demand fundamentals of uranium and junior explorers and developers in the short to mid-term. Here's a chart illustrating the recent rise in the uranium spot price:

Now let's get down to company business:

Strathmore Minerals Corp (TSX.V:STM) was my first foray into the junior uranium sector in June of 2007. I hardly could have picked a worse time as the price crash was just around the corner. Nevertheless, I have reported on Strathmore in a series of private analyst reports and public musings since then and repeatedly invested in the company. This is a long term investment as I have not sold any shares of STM.V since first buying. By averaging down during the darkest days and flat times in the sector, I am now solidly in the black on my purchases. But I think bigger profit potential lies further down the road.

My most recent dedicated musing was in April upon sale of the Reno Creek ISR development project in Wyoming to Bayswater Uranium (BYU.V) for cash, stock and royalty considerations totaling about $25 million in net present value (Mercenary Musing, April 7, 2010).

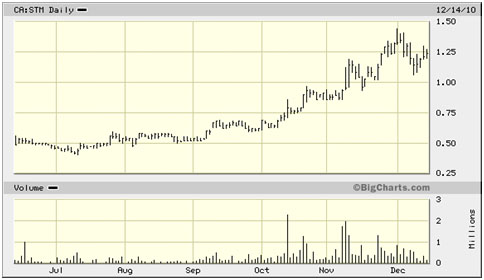

Strathmore was a 22 cent stock when I initiated coverage in early March 2009, an 82 cent stock one month later and a 50 cent stock on my update sent to subscribers on July 23 (Mercenary Musing, July 26, 2010). STM hit $1.44 on December 1; its highest close since early January 2008. Folks, that's nearly a threebagger in less than five months. It closed today at $1.15:

Strathmore is focused on a three-pronged business plan:

- Permitting and development of Roca Honda, Grants Mineral Belt, New Mexico with joint-venture partner Sumitomo. The Grants Mineral Belt remains the world's second largest uranium producer despite no significant production since 1985. Roca Honda is arguably the best undeveloped uranium deposit in the United States and will be mined by conventional underground methods. STM is preparing a bankable feasibility study with delivery expected in 2012.

- Permitting and development of Gas Hills, Wyoming: STM has the commanding land position in the U.S.' second largest uranium district with open-pittable resources and high potential underground targets. Gas Hills is currently undergoing delineation drilling, environmental studies and the mine permit application process.

- Monetizing non-core uranium assets as a project development generator. In early November, Strathmore completed sale of the Juniper Ridge project in Wyoming to Crosshair Exploration (CXX.V) for staged payments of cash, stock and a retained royalty interest. In the past seven months, the company has sold its interest in two major uranium development projects.

Strathmore Minerals Corp remains the most undervalued uranium developer listed on the North American exchanges. Rest assured—given the current time and price—that I am not selling.

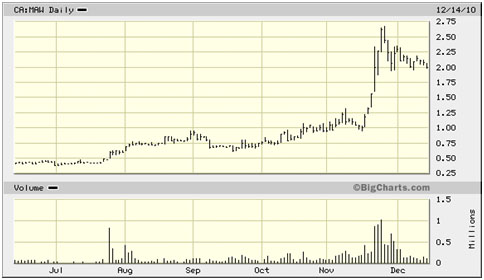

The second favorite issuer in the uranium sector is my latest top pick: Mawson Resources Ltd (TSX:MAW). I alerted free email subscribers to this company before the market opened on November 17 and after the stock had closed at $1.00 the previous day. Subscribers who were quick to react were awarded with doubles in a mere four trading days!

If you are not currently a free email subscriber, you can sign up here and then will be afforded access via email to my exclusive report: Mercenary Special Alert: Mawson Resources Ltd.

Mawson's chart speaks for itself reaching a three and a half year high of $2.68 on November 25. It currently trades in the $2.00-$2.20 range and closed today at $2.14:

The company has two 43-101 qualified uranium resources in Sweden and one in Finland with a grand total of 15.4 million pounds-in-the-ground. However, these projects are not the reason I own the stock and it sponsors my website. I chose the company because of this acquisition:

In late April 2010 Mawson Resources signed an agreement with uranium giant Areva to acquire 100% of its uranium exploration portfolio in Finland and an extensive exploration database for a 9.5% equity interest in the company. Included was the Rompas uranium-gold project in northern Finland. This is an early stage exploration play with only surface sampling to date. However, there is a known strike length of 6.5 kilometers on the zone of interest, it is 150 to 200 meters wide and the 300 known outcrops and subcrops are returning bonanza grades of uranium and gold.

I am a uranium bull and think good times lie ahead for the sector. But you should not rely on me. I own Strathmore and Mawson and each pays a fee to sponsor my website. With a significant financial interest, my opinions are obviously biased.

These two stocks recently went on major runs before correcting this week. That said, downside risk is significant in the current uranium sector.

If you are a junior resource player, I encourage you to conduct careful due diligence and research before deciding if Strathmore Minerals and/or Mawson Resources meet your specific speculating criteria.

Ciao for now,

Mickey Fulp

Mercenary Geologist

The Mercenary Geologist Michael S. "Mickey" Fulp is a Certified Professional Geologist with a B.Sc. Earth Sciences with honor from the University of Tulsa and M.Sc. Geology from the University of New Mexico. Mickey has 30 years experience as an exploration geologist searching for economic deposits of base and precious metals, industrial minerals, uranium, coal, oil and gas and water in North and South America, Europe and Asia.

Mickey has worked for junior explorers, major mining companies, private companies and investors as a consulting economic geologist for the past 22 years, specializing in geological mapping, property evaluation and business development. In addition to Mickey's professional credentials and experience, he is high-altitude proficient and is bilingual in English and Spanish. From 2003 to 2006, he made four outcrop ore discoveries in Peru, Nevada, Chile and British Columbia.

Mickey is well known throughout the mining and exploration community due to his ongoing work as an analyst, writer and speaker.

Contact: [email protected]

Disclaimer: I am a shareholder of Strathmore Minerals Corp and Mawson Resources Ltd and both companies are sponsors of my website. I am not a certified financial analyst, broker, or professional qualified to offer investment advice. Nothing in a report, commentary, this website, interview and other content constitutes or can be construed as investment advice or an offer or solicitation to buy or sell stock. Information is obtained from research of public documents and content available on the company's website, regulatory filings, various stock exchange websites and stock information services, through discussions with company representatives, agents, other professionals and investors and field visits. While the information is believed to be accurate and reliable, it is not guaranteed or implied to be so. The information may not be complete or correct; it is provided in good faith but without any legal responsibility or obligation to provide future updates. I accept no responsibility, or assume any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information. The information contained in a report, commentary, this website, interview and other content is subject to change without notice, may become outdated and will not be updated. A report, commentary, this website, interview and other content reflect my personal opinions and views and nothing more. All content of this website is subject to international copyright protection and no part or portion of this website, report, commentary, interview and other content may be altered, reproduced, copied, emailed, faxed, or distributed in any form without the express written consent of Michael S. (Mickey) Fulp, Mercenary Geologist.com LLC.

Copyright © 2010 MercenaryGeologist.com. LLC All Rights Reserved.