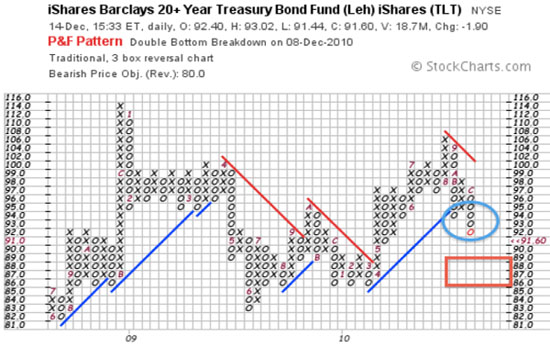

The long-term Treasury ETF (TLT:NYSE) is making a classic double-bottom breakdown. I have been warning readers of a breakdown in Treasuries and a rise in yields. I believe this trend will continue and could bring the equity markets down and provide a ceiling on commodity prices. Treasuries are making a double-bottom breakdown and the Volatility Index is reaching new lows, which shows investor complacency and signals a near-term correction in equities and commodities.

China and the U.S. are making a sacrifice for global growth to make conditions easier for the near term. The long-term outcome may be disastrous as U.S. debt is reaching new lows very rapidly. This precipitous drop should be sending a signal to central bankers that the policies of keeping interest rates low in order to spur borrowing and spending is backfiring. Although Bernanke mentions there is no inflation, gold is up close to 25% this year and silver is up over 50%

China is combating the highest inflation in two years, deciding to let inflation run high as the global recovery of equity markets have become dependent on the Chinese growth story. This story has become a driving force for the world equity markets and commodities. Fear of interest rate hikes from China saw huge volume reversals in gold, meaning large institutions are demonstrating they share this concern.

Institutions are taking profits going into year-end and price volume action looks poor on bullion. The selloffs have been high volume and the place to be right now is in the recommended miners I have been alerting readers to, which are significantly outperforming the world markets and bullion. The U.S. dollar is at a key support level that needs to be monitored. Surprisingly after QE2, the U.S. dollar has rallied. Recently, the U.S. Dollar ETF (UUP) is testing an important support at $22.75—a 50% retracement of the rally from November lows.

It is also near the 50-day moving average, which is turning higher. The rapid rise in bond yields is indicating investors are looking for risk. The VIX, which is a gauge of market fear, is reaching new lows. Investors are taking on increasing risk at dangerous price levels. Caution is urged at these levels and new buys will await less-frothy times.

You are invited to partake of a free 30-day trial of my premium service at http://goldstocktrades.com/premium-service-trial.

Jeb Handwerger

Gold Stock Trades