At the time, there was much speculation about where the markets were headed as we recovered, post-flash crash and Eurozone sovereign debt crisis. The month of August certainly gave hope that a junior resource bull was pending when the financial world returned from vacation after Labor Day.

That hope turned into a "September to Remember," in particular for the rare earth sector. Molycorp's unremarkable IPO in late-July at $13.85 turned into the primary catalyst for a raging REE bull in the late summer and fall when it went as high as $40.90 before pulling back to a current $30 range. Geopolitical events, including China's increasingly restrictive export quotas, the Japan-China skirmish over disputed islands, potential petroleum resources in the East China Sea and 300% average price increases in the rare earth metals since January have led to wild volatility in a very speculative sector over the past four months.

Because I was one of the first analysts to cover REEs beginning in June 2007, returns on investment have been nothing shy of stupendous. I accelerated my coverage of the sector beginning in May and continued thru November with four television appearances on Business News Network (Mercenary Videos), numerous radio and transcribed interviews (Mercenary Interviews), and a brief, productive, and controversial tenure as an editor of Rare Metal Blog (10 mini-musings: The Mercenary Geologist's REE Review).

I currently cover three companies in REE space. Let's look at the phenomenal runs and extreme volatility these companies have had over the past four-plus months:

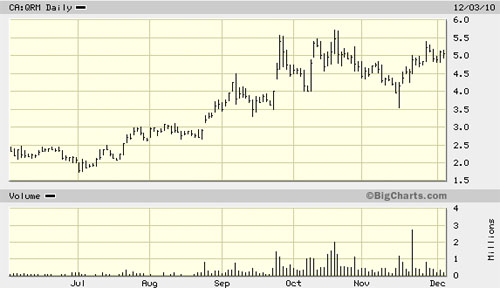

Quest Rare Minerals Inc. was covered in late-March at $2.85 and was at $2.69 on July 23. It subsequently reached a high of $5.72 on the sector's peak on October 20, giving savvy readers who follow my investing philosophy a double in less than seven months. QRM's recent low was $3.55 in mid November and it closed today at $5.06. Its six-month chart illustrates the strong performance of REE stocks and the extreme price swings of these speculative plays:

I recently wrote a dedicated musing on Quest (Mercenary Musing, November 22, 2010) so will not regurgitate my analysis in today's work. After the report, Quest began adding to its staff with the hiring of a vice president of Operations as it transitions from explorer to developer at Strange Lake.

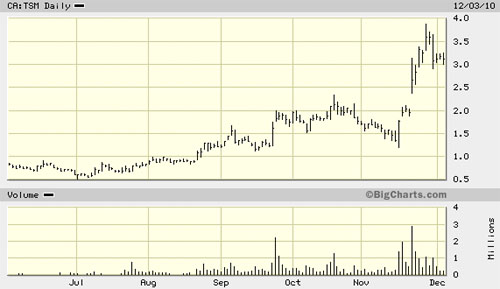

I initiated coverage of Tasman Metals Ltd. in late-May, just a week before the June swoon. It was at $0.97 at the time (Mercenary Musing, May 31, 2010) and promptly fell to 51 cents on July 1. On July 23, Tasman was still a bargain at 68 cents. We've had our double of TSM in less than four months and it's recently gone on another tear setting an all-time high of $3.88 before positive news this week led to profit-taking and today's close of $3.12:

Since my July update, Tasman has had significant material news. It reported on final Phase II drill hole results and commencement of bench-scale metallurgical testing at its flagship Norra Karr project in southwestern Sweden, acquired additional ground and completed an airborne geophysical survey at another promising project, Otanmaki in Finland, and raised $7.5 million at $1.50. The news that led to profit-taking was report of an initial 43-101 inferred resource estimate for Norra Karr of 60 million tons grading 0.54% TREO, of which 53% was HREO, 1.72%ZrO2, and 0.034% Hf at a cut-off grade of 0.40% TREO. Next steps for Tasman include a winter drilling campaign, preliminary metallurgical results and a scoping study at Norra Karr. With excellent infrastructure, low–strip open pit configuration, simple REE metallurgy, low uranium and thorium contents, and a mining-friendly country, Norra Karr appears an ideally situated deposit to supply Europe with a complete suite of rare earth elements.

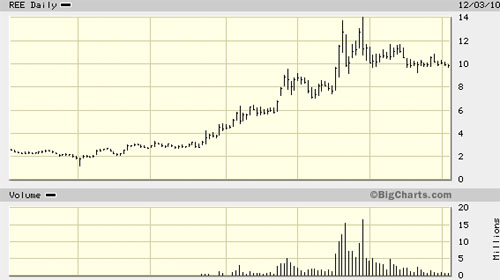

Rare Element Resources Ltd. (TSX.V:RES; NYSE.A:REE) has been the big winner in the sector. From a 52-week intraday low of $1.15 on July 1, REE (great stock symbol, no?) has gone up and up, and then up some more. It reached an all-time high of $14.17 on October 28 before correcting that same day to close at $11.48. Folks, that's a 12 bagger in four months! The company has been trading in a general range of $9.70 to $11.70 since then with today's final tally at $9.82:

I have never written specifically about Rare Element Resources because it is a site affiliate of my website and not a paying sponsor. However, I have spoken extensively about the company in radio and television interviews. REE sponsors my weekly radio segment for The Ellis Martin Report.

News flow since July 23 has been constant and positive. Arguably, the most important item was an AMEX listing on August 17 that immediately increased trading volume 10-fold. Since gaining the U.S. listing, Rare Element has been the best performer in its peer group.

Other news on its flagship Bear Lodge, Wyoming rare earth project includes positive preliminary metallurgical results, robust drill results from the resource area and other targets, drill assays from its adjacent Sundance gold project, collection of a bulk sample for a pilot plant metallurgical test, and receipt of $5.8 million from warrants and options.

Most importantly, REE delivered a positive scoping study to the marketplace for a 1000 ton per day truck and shovel open pit mine operation, onsite crushing, and mill facility with a hydrometallurgical concentration plant. The study showed robust economics for the deposit using $165 million life-of-mine capital expenditures, $245/ton operating costs, a 15-year life-of-mine and REE prices at the three year trailing average. The analysis gave an After-Tax NPV of $213 million using a 10% discount rate, with 40% IRR and a 3.1 year payback.

In mid-November, the company announced a proposed financing of $50 million with a 15% overallotment provision to fund a pre-feasibility study, pilot plant testing, and exploration on the Bear Lodge REE project, and general working capital. It is expected to close December 9.

. . .The past four months has been a remarkable and unprecedented time for my favorite rare earth element companies. Yes, folks, this speculative bubble will burst at some point in the future. But I think it's still early and using a baseball analogy, we are in the top of the third in a nine-inning game.

The key to successful speculating in the rare earth bubble is no different than any other. Choose companies with the right combination of share structure, people and projects, sell half upon double, take profits on the uptick, and set profit-losses on the downtick. These three companies are, in my opinion, the "cream of the crop" in REE space, are built to be successful over the long haul, and could reward their long-term shareholders handsomely.

I have taken fantastic profits in each company. But I remain a committed shareholder in all three. QRM, TSM, and REE are investments not trades for me. That said, with market capitalizations in the $165-$350 million range, there is very high downside risk here. The rare earth companies are particularly sensitive to world economic health and more global sovereign debt woes as we witnessed in May and June would wreck havoc on the sector again.

Please remember my opinions are colored because I hold shares and have working relationships with the three companies covered today.

As Otto always says: DYODD, Dudettes and Dudes.

Ciao for now,

Mickey Fulp

Mercenary Geologist

The Mercenary Geologist Michael S. "Mickey" Fulp is a certified professional geologist with a B.Sc. Earth Sciences with honor from the University of Tulsa, and M.Sc. Geology from the University of New Mexico. Mickey has 30 years experience as an exploration geologist searching for economic deposits of base and precious metals, industrial minerals, uranium, coal, oil and gas, and water in North and South America, Europe, and Asia.

Mickey has worked for junior explorers, major mining companies, private companies, and investors as a consulting economic geologist for the past 22 years, specializing in geological mapping, property evaluation, and business development. In addition to Mickey's professional credentials and experience, he is high-altitude proficient and is bilingual in English and Spanish. From 2003 to 2006, he made four outcrop ore discoveries in Peru, Nevada, Chile and British Columbia.

Mickey is well known throughout the mining and exploration community due to his ongoing work as an analyst, writer and speaker.

Contact: [email protected]

Disclaimer: I am a shareholder of Quest Rare Minerals Inc., Tasman Metals Ltd. and Rare Element Resources Ltd. Quest and Tasman are sponsors of my website. I am not a certified financial analyst, broker or professional qualified to offer investment advice. Nothing in this report, commentary, this website, interview or other content constitutes, or can be construed as, investment advice or an offer or solicitation to buy or sell stock. Information is obtained from research of public documents and content available on the company's website, regulatory filings, various stock exchange websites, and stock information services, through discussions with company representatives, agents, other professionals and investors, and field visits. While the information is believed to be accurate and reliable, it is not guaranteed or implied to be so. The information may not be complete or correct; it is provided in good faith but without any legal responsibility or obligation to provide future updates. I accept no responsibility, or assume any liability, whatsoever, for any direct, indirect or consequential loss arising from the use of the information. The information contained in a report, commentary, this website, interview and other content is subject to change without notice, may become outdated and will not be updated. A report, commentary, this website, interview and other content reflect my personal opinions and views and nothing more. All content of this website is subject to international copyright protection and no part or portion of this website, report, commentary, interview, and other content may be altered, reproduced, copied, emailed, faxed, or distributed in any form without the express written consent of Michael S. (Mickey) Fulp, Mercenary Geologist.com LLC.

Copyright © 2010 MercenaryGeologist.com. LLC All Rights Reserved.