"The most effectual means of preventing the perversion of power into tyranny are to illuminate, as far as practicable, the minds of the people at large, and more especially to give them knowledge of those facts which history exhibits, that possessed thereby of the experience of other ages and countries, they may be enabled to know ambition under all its shapes, and prompt to exert their natural powers to defeat its purposes." - Thomas Jefferson: Diffusion of Knowledge Bill, 1779.Last night, U.S. Federal Reserve Chairman Ben Bernanke, went on "60 Minutes" and said that he is not printing money and that the first two rounds of quantitative easing does not constitute printing and did not increase the money supply. Mr. Bernanke never went so far as to say exactly what it is or where the four trillion dollars comes from. The Fed doesn't have four trillion dollars and it never did, no one loaned it the money, it shows assets of almost US$3 trillion on its balance sheet so where did these assets come from? Then he went on to say yet another round of quantitative easing (QE3) may be necessary. Mr. Bernanke must think he is talking to a nation of brain dead individuals, and maybe he is, because how else do you explain how we got into the mess we're in now.

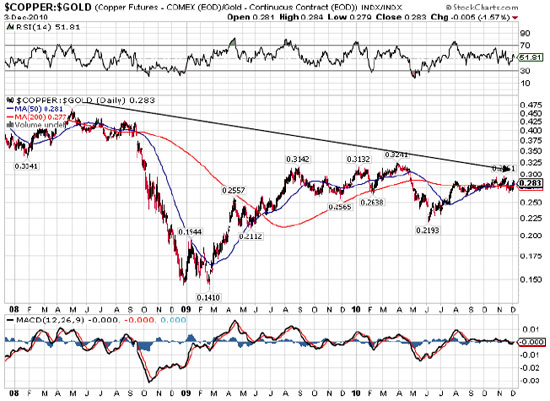

Everybody is concerned that quantitative easing will lead to inflation and that could be the case but I have my doubts. In the first place, it all depends on what measuring stick you use when calculating the rate of inflation. If you measure inflation in dollar terms, or even Euros for that matter, you may have a point. That is a nominal measurement. In order to understand if we have inflation in real terms you need to use a real measuring stick, and nothing is more real than gold. The yellow metal has been in a bull market for more than a decade and the secondary trend has been decidedly up since October 2008. It has rallied with and against the Dow, with and against fiat currencies and with and against commodities. If you want to see if things are truly inflating, measure the movement of their prices against the movement of the price an ounce of gold.

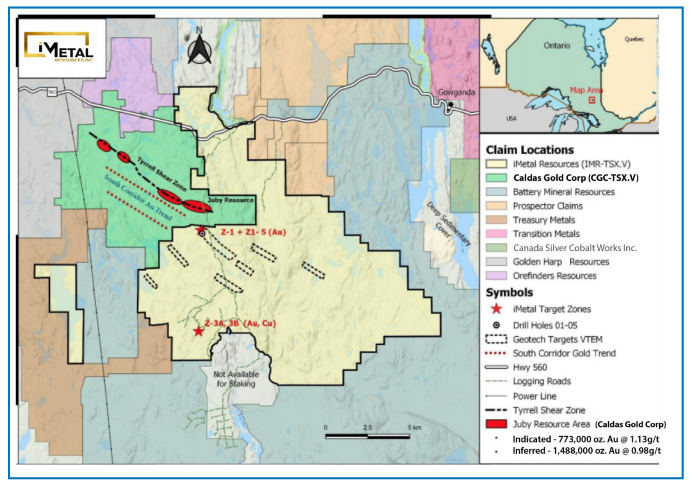

Here I am measuring the rise of the prices of a number of commodities in terms of oil, copper, grains and cotton and over the last two years, all of them have deflated in terms of the price of gold.

Only cotton has come close to holding its value in real "gold" terms. Also, you may recall that in the December Newsletter I demonstrated that the Dow, as good as it's been since the February 2009 low, has lost value against an ounce of gold over that last two years, and by the way so have bonds (not shown).

So with Bernanke openly talking about QE3, and the ECB talking about increasing their permanent rescue fund, it should come as no surprise that the price of commodities, and even stocks over the short run, will rise in dollar and/or Euro terms. But in real terms, measured against a store of wealth that cannot be created by simply pressing a computer key, we are experiencing deflation and that is just what you would expect in a debt-ridden Western world. Asia on the other hand will escape most of the deflationary pressures because they save, they avoid deficits for the most part, and sooner or later they'll peg their fiat currencies to an ounce of gold. That's also why February gold is up 10.80 at 1,417.00 this morning when just about everything else is in the red. China, India, Russia and Brazil are all moving to gold in a very big way and that will drive the price much higher sooner rather than later.

Anthony J. Stills

[email protected]

www.theablespeculator.com