One thing we can be sure of is that the rest of the world is "not going to take this lying down"—what is sauce for the goose is sauce for the gander, so we can expect this new fashion for massively ballooning the money supply to catch on increasingly around the world, as various countries seek to maintain adequate liquidity and remain competitive in global trade by taking the same proactive hands on approach to manipulating their currencies in a downward direction as the US.

So let's now be crystal clear about what we are talking about and looking at here—we face the prospect of massive global across the board currency debasement and inflation resulting from same. Where does hot money go in such circumstances?—it goes into tangibles, commodities, collectibles and the like—and especially into the Precious Metals—anything which provides a bulwark against the ravages of inflation. Sure—there are massive deflationary forces out there, but since politicians and business leaders like to make money and be popular for as long as possible, they are going to keep these forces at bay for as long as possible, regardless of the future consequences. A deflationary collapse means riots and politicians being chased through the streets and being strung up from lamp posts etc. That collapse must come, and come it will but hard on the heels of a massive hyperinflationary episode that leave the broad swath of the middle and working classes destitute and ruined. The upper classes and elites will by then have fled to their tax havens where they can sell the gold bars they have stashed away and continue to live lives of ease and comfort, far from the madding crowd, who will set about cannibalizing each other in conditions of anarchy and mayhem. This will be the time of "the great global reset" when the absurdly astronomic debts and derivative pyramids etc will be completely wiped clean by the simple expedient of being rendered totally worthless. If you are a creditor at this time tough luck—you won't get enough back to buy yourself a pretzel. This will also be the time when a new generation of leaders will rise up who have galvanized and harnessed the energy of the mob and go on to become future politicians who will reinstate some kind of gold standard and a new order will rise up from the ashes of the old. At this point former political leaders who may be getting bored with island life, however comfortable, would be well advised to avoid a premature attempt to go back and do a Mrs. Gandhi or Mrs. Aquino, as they might come to an untimely and sticky end.

Even without the benefit of hyperinflation, most major bull markets end with a parabolic blowoff move, so it is clear that if we do end up with hyperinflation—and all the signs are pointing to that—the parabolic acceleration in gold, which our long-term chart shows has not even started yet is going to be that much more pronounced and it could rise to levels which would seem to many now to be insane. Here we should note that while gold's rise will of course be real money, which is what gold is, simply moving to compensate for the loss in value of fiat, it should actually be gaining in real value as gold becomes a magnet for hot money seeking speculative gains, which will be an important driver for the final vertical ramp that is expected to mark the end of the bull market.

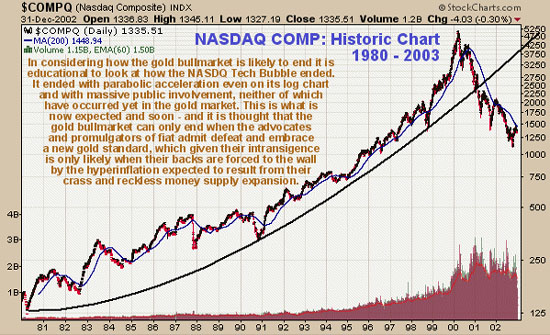

What would such a parabolic blowoff move look like? To get an idea we need look no further than the parabolic blowoff that ended the tech bubble 10 years ago. While the acceleration is dramatic and pronounced on an arithmetic chart, it is obvious even on a log chart, it is quite clear that gold hasn't even begun the parabolic acceleration phase yet, which fits with the fact that even after 10 years of a strong steady bull market, the broad investing public are only now starting to sniff around and get interested in gold.

We haven't looked at a long-term chart for the dollar index for a long time so it is worth doing so now. Our chart going back 11 years shows that overall the dollar index has not lost all that much ground since its late 2004 low, which is rather surprising given the abuse that the dollar has been subjected to in recent years. However, the key point to focus on here is that if all currencies have been "going down the gurgler" more or less together, then gold should have been rising against most or all of them, which it has, and referring back to our 11-year chart for gold in dollars, we can readily see that the relentless advance is a symptom of the general malaise of fiat. So even if the dollar index stages a technical bounce here from the support shown on the chart, it is unlikely to stop gold.

The reaction in gold in recent weeks was not as deep or as long as we had expected. Our 6-month chart shows that the Fed announcement last week "lit a fire" under gold which rose very strongly to break out to new highs on Thursday. This very positive action is believed to mark the start of an accelerated growth phase, even if we do see a minor reaction first.

There is good news for the many PM stock investors who have been perplexed by the refusal of many PM stocks, especially the larger ones, to perform well given the continued ascent of gold and silver. Last week's surge in gold saw the large gold and silver stock Philadelphia XAU index break out to clear new highs for the 1st time. This was the last piece missing in our jigsaw—now everything is in place for a thumping great rally in PM stocks across the board. You can see this breakout on our 4-year chart for this index below.

We will close with a word about tactics with regards to PM stocks. There are few things worse than watching an entire sector take off higher, and finding yourself stuck with a bunch of lemons that hardly do anything. The way to avoid this is to go for, or redeploy into, stocks that are in established steady uptrends, or look like they are just entering into such uptrends, provided that they have not gone up a lot already or are otherwise showing signs of topping out, like very heavy volume.