Over the longer term, the outlook for gold and silver has never been brighter. This is because the fiat money system is at last meeting its nemesis, spiraling into a self-destructive vortex from which there is now no escape. This ignominious end to a despicable monetary system was its guaranteed fate from the outset (when President Nixon signed away the gold standard) because the principal flawed characteristics of the fiat money system are indiscipline and profligacy, which is of course what makes it so attractive to politicians. However, now that they have taken indiscipline and profligacy very close to their ultimate extremes, payback time is arriving. Faced with the stark choice between global depression caused by the massive debt overhang and accelerated monetary easing, we can rely on politicians and business leaders to choose the latter course as this will buy them more time. That means currency wars and more quantitative easing, not just in the U.S. but worldwide. Other countries are not going to stand idly by and watch the U.S. trash the dollar in order to wriggle out of honoring its debts and gain a competitive advantage—they are going to get in on the game and do some easing of their own, and in fact they already are. We'll get the depression the politicians are trying so strenuously to avoid anyway, not because of deflation, but instead as a result of hyperinflation caused by the expanding money supply whose growth will become exponential as the race to patch the gaping financial wounds by creating ever more money becomes more and more frenzied.

So you see, we are now in the endgame, and the countless millions who don't understand what is going on and believe the talk in the mainstream media about recovery and a return to "the good old days" are going to be financially wiped out and end up as bloated, fly-ridden corpses floating down the river. A Category Five financial hurricane is bearing down on us, and the eye of the storm is headed for the U.S. While the whole world will be affected by it, the worst effects by far will be experienced by the overstretched debt-wracked countries, such as Britain and the U.S., which are parasitic service economies with little manufacturing capacity that nurture the mistaken belief that the rest of the world will continue sending them cheap goods produced by real labor in exchange for electronically created worthless credits and IOUs, including junk such as Treasuries in perpetuity. Tough luck when the Chinese decide to supply their own needy people with the goods they manufacture—no more massive Wal-Mart boats laden with cheap goodies cruising the high seas to the U.S. Where are Americans going to get the goods from then? It's difficult to buy domestically manufactured goods if there are no factories at home. For reasons associated with graft and imperial overreach, a massively disproportionate amount of the U.S.' productive capacity is directed to its military. As the economy finally implodes under the strain imposed by unserviceable debt and commitments (including healthcare and pensions, etc.) it will no longer be possible to finance this military, which means that a dangerous period may lie ahead as the U.S. is tempted to acquire by force what it cannot acquire by negotiation while it still has the military capacity to do so. With respect to all this, it has already has some achieved some notable successes, acquiring Afghanistan and the Iraqi oilfields, and now has its eye on Iran and the states on the southern Russian flank. The absurd excuses of the "War on Terror" and the "weapons of mass destruction" for the invasions of these countries were only ever intended to placate the masses, who will believe anything they see on the telly—follow this logic back and it isn't hard to figure out what motivated the nexus event of the attack on the World Trade Center in New York and who was really behind it.

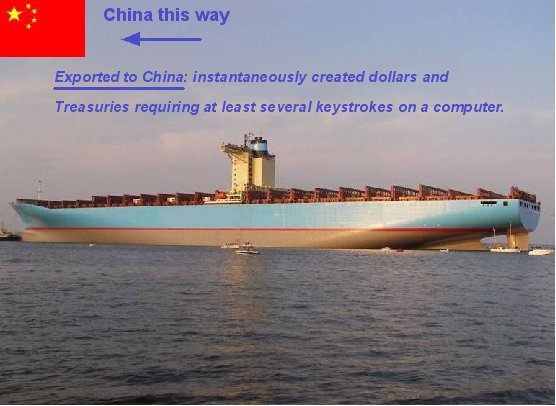

In the two pictures below, we see the ultimate, perfect expression of the Master—Servant relationship, where in this case the servant supplies millions of hours of work in exchange for a mountain of worthless IOUs and dubious paper, and gets a kick up the backside as he goes out the door in the form of the Master then proceeding to devalue the IOU's and other paper to near zero, as is his plan right now. It then only remains for the servant to humbly thank the Master for this consideration. . .

The photos above are actually no joke—the ship shown was commissioned by Wal-Mart to transport its Chinese made goods to the U.S. and it has another two like it in service, with a further two in the pipeline. Each of these ships can transport 15,000 containers and can be unloaded by a bank of 11 cargo crane rigs working simultaneously to completely unload the vessel in less than 2 hours. Needless to say the ships return to China empty, and is it Maund's suggestion that the return trip be used to carry the dollars, IOUs and Treasury certificates etc used to "pay" for the goods, although admittedly this will require a lot less space.

The elites have been and will continue to amass ever greater fortunes as a result of these major global events and trends. They know the game plan and control the big levers. Thus, they skimmed massive profits from the stock market boom of the '90s, the tech bubble and more recently the housing bubble—and now they are into gold. The middle and lower classes thought that they had become "men of property" a few years back because their houses rose so much in value and because they had double garages, granite table tops and flat screen TVs. All they did of course was set themselves up to be fleeced when the pendulum swung the other way. The elites regard the middle and lower classes much as you might regard sheep or cattle, as an ignorant rabble to be manipulated to support and underpin their opulent lifestyle—they are farmed with their predictable thought processes being controlled by the media, a classic example being the endless circus of the Democrats versus the Republicans. Both these parties are two sides of the same coin, a duopoly of power controlled by and for the benefit of their plutocratic masters, with the clueless lower and middle classes entertaining the comical notion that they still live in a democracy. Whenever the lower and middle classes manage to acquire any significant capital, collectively speaking, they are systematically fleeced of it. That is what is happening now in the U.S. housing market—and what is set to happen in the depths of the coming depression when property becomes virtually worthless is that millions will become dispossessed of their properties. At that point, the elites will move in and buy up vast tracts of commercial and residential real estate at pennies on the dollar, and millions of former homeowners will face the choice between living in a tent city or moving back into their former home as rent-paying tenants (by the way, anyone know the codes for the stocks of companies manufacturing tents?). This is the reason why savers and the prudent in the U.S. are punished so harshly—they don't want people acquiring capital and the power of self-determination; they want them to go out and spend to generate ever greater profits for their vast business interests—so they drop interest rates to the floor (which they can of course use in their hugely profitable carry trade activities) and encourage the little guy to get up to his neck in debt. Jacked up interest rates can later be used as a tool to winkle the little guy out of his house.

Does all of this sound too cynical or like the writer has a chip on his shoulder? Listen: I'm just a fly on the wall, and to me there is something blackly comical about the whole business. What we are witnessing is nothing more than human nature in action. Be honest—if you were in the position of these elite people, and grew up in the certain knowledge that you were an exalted and superior being, you would probably be exactly the same wouldn't you?, I probably would—unless I was Angelina Jolie of course.

In order to fully comprehend the accelerating downward spiral of fiat, it is very important going forward to stand back from the usual currency cross rate and dollar index charts and to look at individual currencies expressed in real money, that is to say gold. Gold is "real money" whose supply is finite and is not anyone's else's obligation. It therefore acts as a true barometer of a currencies' (dwindling) value. An example is shown below in the form of the Swiss Franc expressed in gold and many currencies plotted against gold look much the same. It is quite clear from this chart and others like it that if this trend continues we are looking at rampant worldwide inflation. In fact, we already have it in various commodities and essentials, with governments fiddling statistics to downplay it and disenfranchise people on fixed incomes (government handouts) who are getting poorer.

Thus it is no surprise to see that gold has something like quintupled in just 10 years. There is no sign of an end to this uptrend—on the contrary, with fiat now spiraling deeper into the vortex, it looks set to go increasingly parabolic. In one sense, this is not something to get so excited about because while it might sound great to sell your gold for say $10,000 an ounce, it won't be such a big deal if it takes a wheelbarrow full of banknotes to buy a loaf of bread. Whatever happens though, gold should at least hold its value in real terms and there is a very good prospect of it doing much, much more than that, as if it becomes the only game in town, (as looks likely) investors are going to jam the entrances trying to get a piece of the action. This market is comparatively small and could very quickly become overcrowded—already physical is getting hard to come by, so if you want in you had better get on with it.

As you are probably aware the stock market is like a petulant child. U.S. stock markets have been rising for weeks in the expectation of a "treat"—that treat being a nice big generous second helping of QE (Quantitative Easing) and decision time is this coming week—November 3rd. If the market doesn't get what it thinks is its rightful due, then it is likely to throw a tantrum, and it may drop back even if it does on sell-on-the-news profit taking. However, if it is really indulged and almost buried in a massive wave of new QE, then of course it could get really happy. There is some talk going about that the QE ambitions might be scaled back to "QE lite" to avoid upsetting the Chinese and others who might otherwise do the unthinkable and start dumping US Treasuries, the so-called "nuclear option". The Chinese are stuck with warehouses full of this atrophying junk and are even now still buying the stuff although in lesser quantities and are in a catch-22 situation, having been played for suckers for years, as if they try to offload even a portion of it, they will collapse the market. On the other hand, if QE is not forthcoming in sufficient quantities the US faces an acute liquidity crisis. Should be interesting to see how they fine line this one.

Even if the broad stock market gets into a tizzy because it is upset at not having the expected helping of QE, it should not have too much of an adverse impact on precious metals stocks. This is because the growing profitability of mining companies resulting from higher metals prices is creating ever greater pressure for a big catch-up move by stocks that is likely to get going sooner rather than later. If the market actually rises, then of course PM stocks should take off strongly at once.