The primary molybdenum miners, such as Thompson Creek and General Moly, are up today on speculation that China will curb molybdenum production as it classifies the metal as a natural resource. General Moly (GMO) released its earnings today and mentioned that China remains a net importer of 5.5 million pounds (Mlb.) year to date. This development will have a huge impact on the global supply of molybdenum, as China is the largest producer and supplier—providing more than one third of global supply. These primarily molybdenum producers will receive a premium as molybdenum is usually a byproduct of copper production, which is usually fixed. Primary molybdenum producers will receive a premium for their assets as demand accelerates.

The price of molybdenum is more than 50% off pre-credit-crisis highs, yet demand is seriously exceeding supply. China has imposed mining quotas in the past and is expected to curb exports again in 2011. China also needs high-strength steel. Even though it produced 50% of the world's steel, China consumed only 30% of global supply. If the country consumes more molybdenum, similar to other producers, it will demand a much higher amount of imports. And it needs high-strength steel, which requires molybdenum. China's recent stimulus, which focused on infrastructure, requires a large supply of molybdenum for bridges, power plants and pipelines.

This trend has a huge impact on many emerging markets that were relying on Chinese supply. Korea and the Japanese are under pressure to find supply for their own needs. Other growing economies that require high-performance steel will look for ways to control future supply.

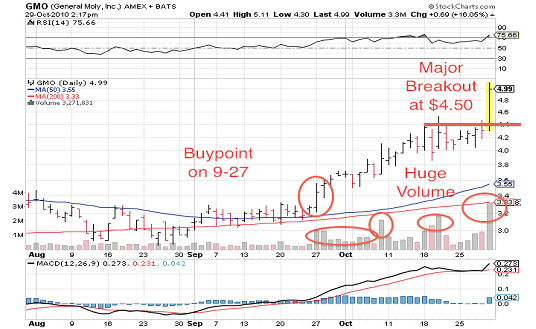

Recently, the Chinese government accelerated and approved funding through Hanlong Investments for General Moly's Mt. Hope project accelerating the funding and showing its commitment to the project. Mt. Hope is the largest and highest-grade primarily molybdenum project in development. Shares have soared on the news and the enthusiasm from the Chinese government.

I expect to see more transactions occur in natural resource stocks in 2011, especially in molybdenum and uranium. Buying these assets provides investors with a hedge against currency devaluation and leverage to emerging market growth. As many nations will be forced to devalue their currencies in order to increase economic growth, major natural resource assets will gain interest from countries experiencing economic growth. Shareholders in these key junior mining companies that control these world-class assets may receive a premium in 2011 and beyond.

To stay updated with key junior miners about to make major moves, visit http://goldstocktrades.com.