Markets were eagerly awaiting GDP and consumer sentiment data, which was still dominated by one overriding preoccupation—what the Fed might (or might not) announce Wednesday.

GDP data revealed that U.S. output grew at a nearly 18% faster pace in Q3 as the fallout from improving consumer spending helped cement the vigor in the ongoing recovery process.

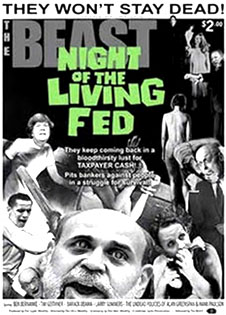

The reality is that most Americans don't believe their government has done something to help the economic expansion. . .twice as many folks believe Americans' taxes have risen, the U.S. economy has shrunk and TARP money will never be recovered (a sentiment status quo 100% at odds with the facts).

Because Halloween is upon us, let's at this cognitive dissonance 'thing' and how it relates to all things scary (American economy). The concept was first delved into by Leon Festinger around 1957. The team conducted a participant observation study of a cult that believed the earth was going to be destroyed by a flood. What happened to the cult's members—particularly the very committed ones who had given up their homes and jobs to work for the cult—when the flood didn't happen, was the focus of the Festinger team's findings. Certain "fringe" cult members were more likely to recognize they'd discredited themselves and ascribed the whole thing to "experience." Those of you familiar with the emotional displays that are omnipresent in various PM forums might just recognize a good dose of cognitive dissonance.