TICKERS: AREVA, BNNLF, BHP; BHPLF, CCO; CCJ, DML; DNN, ERA, EXT, PDN, RIO; RTPPF, RGT, , RSC, URG; URE, , UEC, UUU, U

Geordie Mark: Uranium and Mining Stocks Recovering

Interview

Source: George Mack and Karen Roche of The Energy Report (10/28/10)

Uranium has been radioactive for investors who have stayed away in droves since the metal crashed into a prolonged slide beginning in early 2007. Now in a cautious recovery mode from multiyear lows, Haywood Securities Senior Analyst Geordie Mark says a rising uranium price is the driver for select mining companies. In this exclusive interview with The Energy Report, Geordie discusses uranium demand and brings some specific ideas to the table for investors.

Uranium has been radioactive for investors who have stayed away in droves since the metal crashed into a prolonged slide beginning in early 2007. Now in a cautious recovery mode from multiyear lows, Haywood Securities Senior Analyst Geordie Mark says a rising uranium price is the driver for select mining companies. In this exclusive interview with The Energy Report, Geordie discusses uranium demand and brings some specific ideas to the table for investors.

Geordie Mark: That's a very good question. Certainly it has had a lot of technical support at $40 with a lot of buying strength coming in at that level. I'd say there's been even more buying strength recently. So that's a lot of strength. For the ultimate strength of investment health of this sector, I think we're looking at numbers north of $65. In fact, it would probably have to be higher than that to warrant risking venture capital for exploration. Also, you need to see higher prices for investment in large-scale, leveraged development-stage projects. Spot is now around $52, and we see positive movement there in terms of pricing with the long-term price at $60.

TER: You see positive movement, but it sounds like mining uranium is risky now. Is that right?

GM: Yes, mining does have technical risk. That's correct. As part of an offset to that, the projects we see going into production, certainly over the next year or so, are the lower-cost projects involving lower capital expenditure for development. Those are called in-situ recovery operations and they have a low-cost basis. So you're looking at cash costs of $30 per pound or less. They are the ones that can accommodate the current commodity price, but not the larger-scale projects requiring significant injection of capital. That's why we've seen delays in that development pipeline; $40 spot prices make it difficult to justify large, higher-cost projects. However, in our view, we do need those larger projects to sustain increasing demand.

TER: On a percentage basis, why has uranium lagged other metals? What market pressures have put downward pressure on the metal?

GM: Well, this year and late last year we actually saw a significant increase in production—probably larger than anticipated—out of Kazakhstan, which had a massive run from about 19 million pounds (Mlb.) in 2008 to about 36 Mlb. of production in 2009. With that continuing, we expect +40 Mlb. this year.

That really put a blanket on the uranium price for the first seven months of 2010 and moved it down to lows close to $40. But over the last few months, we have seen a 20% increase in the spot price.

From the low $40s to today, where it's about $52, we've seen an increase and a recovery in the price that has been a response to production shortfalls from some of the larger mines. For instance, both the Ranger uranium mine operated by Energy Resources of Australia Ltd. (ASX:ERA) and BHP Billiton Ltd.'s (NYSE:BHP; OTCPK:BHPLF) Olympic Dam experienced production shortfalls. These miners have had to buy material on the market to meet contracts. So production shortfalls have offset some of the production expansion coming out of Kazakhstan. We're seeing that balance swing a little bit more to the demand side in 2010.

TER: Are there any companies in your universe that are involved in the Kazakhstan projects?

GM: None in our universe. Obviously, the main one there is Uranium One Inc. (TSX:UUU). Cameco Corp. (NYSE:CCJ; TSX:CCO) and AREVA (PAR:CEI) have operations there also, but we don't cover those formally.

TER: Geordie, you explained how Kazakhstan production put a blanket on the price of uranium and dropped it down to about $40, and that it has now rebounded to $52 due to expected production shortfalls in Australia and elsewhere. Going forward, would you expect to see big price swings when one mine increases production and another decreases it?

GM: Broadly speaking, we see nearer-term market equilibrium with buying strength coming out of China as it builds strategic working inventory for future nuclear requirements. So that buying strength provides underlying support if larger projects were to produce more than expected. Alternatively, pricing pressure could be experienced more so if there were appreciable production shortfalls.

TER: So if one major mine increases production, it could more than satisfy the demand here?

GM: Well the point, in terms of Kazakhstan, is that it has multiple smaller-scale mines rather than one big mine. The large-scale mines that could have a significant or material impact just by themselves, such as Cameco's Cigar Lake, could furnish significant amounts of material on the market. But while Cameco is thinking that Cigar Lake will come into play, ramp-up and begin production in 2013, it's not really going to make a material impact until about 2017. So we think there's certainly some pricing pressure coming around 2012–2013.

TER: What's going to drive capital into this market?

GM: Ultimately, I think prices are expected to increase right along with demand. However, in terms of one of the components of the uranium sector, the nuclear sector will drive the material and incremental change in demand through the number of reactors that have gone into construction over the last 24 months.

In the last two years, the number of reactors that have entered into construction has increased 61%. Also over that time period, there's been a 54% increase in the number of reactors planned and a 45% increase in the number of reactors proposed. These are largely in non-OECD (Organization for Economic Cooperation and Development) countries, so we're looking outside North America.

We're also getting something of a sea change in views on existing reactor fleets, certainly from Europe, where we're seeing policy changes to extend reactor fleet lives. So we're seeing new demand, but we're also seeing extension of demand from existing reactor fleets in countries in Europe, including Germany, Sweden and Belgium. Also, the UK is looking at additional reactors. So significant changes in demand are taking place, but it does take a long time to get a project through the development curve. Therefore, we think there are opportunities for the development projects that can reach production in the next two, three or four years.

TER: Geordie, how does an investor play these ideas, and why?

GM: Our view at Haywood is based on increasing demand and our belief that commodity prices are going to increase. Our estimation is that, of all the companies, Uranium Participation Corp. (TSX:U) has the best correlation to changes in uranium price. It is unlevered, so it does trade quite closely to uranium price changes. There's a strong relationship there—that's the rationale. In an increasing commodity price environment, the value of the inventory held by Uranium Participation increases.

TER: So the fund is correlated with the uranium price?

GM: Exactly. The value of the company, then, is based largely on two things. One is the value of the inventory, which is obviously commodity-price driven. And two is a market sentiment component—where the market thinks the direction of the commodity price is going.

TER: Other ideas?

GM: Paladin Energy Ltd. (TSX:PDN; ASX:PDN) is the only uranium producer out there globally that isn't related to a major company or partnered with a utility. So there aren't any relationships there. It's got a good production growth profile in our view. We think the company will grow something on the order of 6.8 Mlb. this year, and then go beyond that to maybe 8.3 Mlb. next year. Paladin's got a good track record, in terms of bringing mines on, and a good growth trajectory at its African mines.

Strateco Resources Inc. (TSX:RSC) has the Matoush deposit, which in our view is very attractive—20 million pounds of almost 0.6% uranium. Those are high grades; and it is probably the most advanced development-stage project in Canada outside of AREVA and Cameco. There is also resource expansion potential. CEO Guy Hébert is doing a good job in trying to migrate through the permitting process. It's a nice scale of resource, and I think it's attractive with good growth potential.

TER: I understand that will be the first uranium production license issued by the Canadian Nuclear Safety Commission (CNSC) in 25 years. Has that license been issued; and, if so, what's the significance of it being the first one in 25 years?

GM: Well, it hasn't been issued. We think Strateco is the most advanced along in the permitting path. Obviously, it would be a huge shot in the arm, in terms of meeting the very high standards that the regulators provide in Canada, and would speak volumes about management.

TER: On Bannerman Resources Limited (TSX:BAN; ASX:BMN), you have a target price that would give an investor about 200% return on investment from today's levels. What's the driver here?

GM: Bannerman has the Etango Project in Namibia, which is very large with more than 160 Mlb. Effectively, it's the most leveraged play we have under coverage in the uranium sector; so it does have the upside. It's a great country and a handsome resource, but it would be one of the more expensive producers in our coverage universe. We see significant appreciation in the uranium price over the next few years, implying a significant return for Bannerman.

TER: Do weak currencies in Australia and other uranium-producing countries portend risk for investors?

GM: Yes, currency exposure is obviously a risk on margin. But it can also be an opportunity, in terms of having lower-cost production due to operations being based in a country with a weaker currency. So it definitely depends on whether you're able to hedge some of your costs in that currency. But yes, I think we've seen that over the last month or so given the changes in the relative strength of currencies against the U.S. dollar. You do get a gain or atrophy in margins. That works for any commodity.

TER: You've got very favorable upside on Ur-Energy Inc. (NYSE:URG; TSX:URE). How is that one interesting for you?

GM: Ur-Energy, and let's bring Uranerz Energy Corporation (TSX:URZ; NYSE.A:URZ) into the fold here just for a second. They hold two of the in-situ recovery projects in Wyoming that we believe have a good likelihood of wining permitting approval from the Nuclear Regulatory Commission (NRC). We're looking at that to come to fruition, probably this quarter.

When we came into the uranium sector three years ago, we looked at where we thought the next uranium producers were going to come from—and we didn't have to look far. In fact, we thought they'd all come from the U.S. The first new production in the world is expected to come from Uranium Energy Corp (NYSE.A:UEC), which we think will commence sometime in the next four weeks. That's in Texas. After that, I think Uranerz and Ur-Energy will be, due to the small capex and lower operating cost for the projects.

Back to Ur-Energy, specifically, it has some very handsome projects in its Lost Creek and Lost Soldier deposits, and we think the company has a very good cash position to get it very close to production without having to raise additional equity. So, good projects, great technical team, good cash position—that's why we like Ur-Energy. Same thing goes for Uranerz at Wyoming's Powder River Basin. It also has a very good management team.

TER: Given the demand you outlined, regarding a sea change in coming uranium demand, is there a first-mover advantage for UEC in taking market share or better pricing?

GM: UEC, potentially, could gain better pricing. I think if the company could show, technically, that it could bring things into production and reach milestones, it would get first-mover status. That will help it going forward. UEC's technical team has a lot of history in Texas, and it's been able to do this many times in terms of bringing operations into production. So, absolutely, it has a very good track record with its technical team, and we're looking forward to seeing what UEC does.

TER: You've got a nice 30% upside target price on Extract Resources Ltd. (TSX:EXT; ASX:EXT). What is driving that?

GM: Well, Extract's been an outstanding company to follow for the last few years due to its discovery of Rössing South deposit in Namibia. That, in our view, is one of the best discoveries in the uranium sector in the last 30 years. It's a massive resource, with +300 Mlb., and it is 6 km. away from the existing mine operated by Rio Tinto Ltd. (ASX:RIO). So Extract has proximity to existing facilities and existing infrastructure in Namibia—the fourth largest uranium producer that has been producing uranium for more than 30 years. The company will have its feasibility study completed by the end of the year. So we think it's in a very good position there to go forward.

TER: You also follow Denison Mines Corp. (TSX:DML; NYSE.A:DNN), which has had a good run-up during the past year.

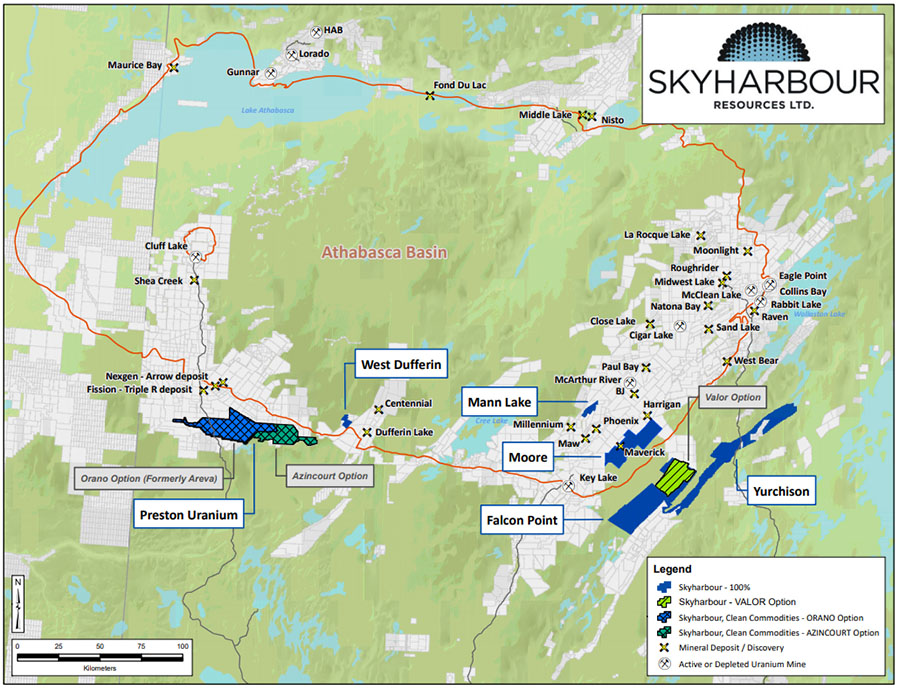

GM: I think there's a little bit of market expectation running in there behind the spot price movement, but also a release on the Phoenix Zone resource somewhere on the order of 50–70 Mlb. The company's looking to release that resource in November. With increases in the spot price, we see particular potential for Denison to have significant changes in cash flow. I think there is a lot of interest in its very attractive deposit at Wheeler River in Athabasca, Saskatchewan, Canada. The company's had some outstanding results so far in its drilling program.

TER: Are there some new uranium miners out there we haven't discussed that really excite you?

GM: We certainly track exploration-stage companies that we don't cover formally, and we have them in our Junior Exploration Report. For instance, last quarter we published a report that included Rockgate Capital Corp. (TSX:RGT) and Southern Andes Energy Inc. (TSX:SUR), formerly Solex Resources Corp., which has Peruvian assets. South America seems to be heating up in terms of exploration. Rockgate is another African exploration-/development-stage asset based in the Republic of Mali that we're following quite closely.

TER: Are these interesting because of the geographical regions or because you have a better understanding of the actual resource or potential resource they're looking at?

GM: Well, we couple everything in there; but, ultimately, you have to have something in the ground that looks interesting as a resource. Then you look at the environment—both the political and economic environment. But certainly the resource is first. You have to look at the geological potential of a project initially.

TER: Geordie, who are your buy-side clients? Are they small-, mid- or large-cap mutual funds? Who are they mainly?

GM: Our clients represent a whole range—small cap all the way up to very large. Their requirements relate to different investment objectives, of course, and to different sized companies within the uranium sector.

TER: Thank you.

Dr. Geordie Mark, a research analyst with Haywood Securities, focuses principally on uranium companies involved in exploration, development and production. He joined Haywood Securities from the junior exploration sector, where he was vice president of exploration for Cash Minerals, which concentrated on uranium and iron oxide-copper-gold targets across Canada. Immediately prior to joining the exploration industry full-time, Dr. Mark lectured in economic geology at Monash University, Australia and served as an industry consultant. He completed his PhD in geology in 1998 at James Cook University's Economic Geology Research Unit in Australia, specializing in aqueous geochemistry and igneous petrology applied to ore-forming systems.

Want to read more exclusive Energy Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Expert Insights page.

DISCLOSURE:

1.) George Mack and Karen Roche of The Energy Report conducted this interview. They personally and/or their families own shares of the following companies mentioned in this interview: None.

2.) The following companies mentioned in the interview are sponsors of The Energy Report: Strateco Resources, Uranium Energy Corp. and Uranerz.

3.) Geordie Mark: I personally and/or my family own shares of the following companies mentioned in this interview: Paladin and Uranium Participation Corp. I personally and/or my family are paid by the following companies: None.