Today's bounce was not much of a surprise for several reasons:

- Overall trend is up, one day selloffs are generally profit taking

- I don't think they will let the market fall before the November election

- Intermediate cycle is turning up this week, three weeks of upward momentum

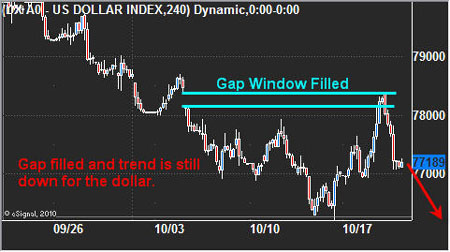

The dollar put in a big bounce this week filling its gap window. Remember, most gaps get filled with virtually every investment vehicle; so, when you see them, remember this chart. . .

SPY ETF—Daily Chart

SP500 has been riding the key moving average up and Tuesday's selloff tagged the 14MA along with extreme market internal readings telling intraday traders that a bounce is about to take place.

Gold Futures—Daily Chart

You can see gold has done much the same—a sharp profit/stop running selloff, which took the price back down to support. We took a long position to catch this bounce and, hopefully, a larger move going forward.

Market Sentiment Readings

Tuesday's pullback was a great reminder of just how overextended the equities market was. These heavy volume selloffs are typical in a bull market. Without regular pauses in price, traders tend to place trailing stops moving them up each day. With traders chasing stocks higher, bidding them up instead of waiting for a pullback, we get a very large number of stop orders following the price up each day. Then it's only a matter of time before a key short-term support level is broken, at which point the floodgates open and everyone's stops turn to market orders flooding the stock exchanges with sell orders causing a rapid decline and panic selling. This is exactly what happened on Tuesday, which I show in the chart below.

Understanding how to read market internals provides great insight for short-term traders looking to make quick, high-probability trades every week. Market internals are just part of the equation but very powerful on their own with proper money/position management. Both of these intraday extremes were bought on Tuesday in the advanced chat room (Futures Trading Signals). We quickly booked profits and moved our stops up in order to protect our capital as the market surged higher.

Midweek Market Trend Analysis

In short, the U.S. dollar is still in a downtrend overall. The Fed's, I would think, will continue to hold the market up into the election. It works well for them. . .they print money, which devalues the dollar, and in return boosts stocks and commodities—plus they get trillions of dollars to spend. I'm sure it's like kids in a candy store over there.

While everyone is trying to pick a top in this overextended market, I think it is crucial to stick with the overall trend and not fight the Fed. Using the key moving averages on the daily chart, as shown in the charts above, continue to buy on dips until the market closes below the 20-day moving average, at which point you should abandon ship.

Get my reports and trade ideas here for free: http://www.thegoldandoilguy.com/specialoffer/signup.html.

Also follow me on twitter in real-time: http://twitter.com/GoldAndOilGuy.

Chris Vermeulen