In 1966, Alan Greenspan wrote his famous "Gold and Economic Freedom" essay. Originally appearing in The Objectivist, an editorial perspective explicitly based on Ayn Rand's philosophy of Objectivism, Greenspan's brilliant exposition urged citizens to keep their politicians accountable through a gold standard.

In 1966, Alan Greenspan wrote his famous "Gold and Economic Freedom" essay. Originally appearing in The Objectivist, an editorial perspective explicitly based on Ayn Rand's philosophy of Objectivism, Greenspan's brilliant exposition urged citizens to keep their politicians accountable through a gold standard.Greenspan's "Gold and Economic Freedom" opens:

An almost hysterical antagonism towards the gold standard is one issue which unites statists of all persuasions. They seem to sense—perhaps more clearly and subtly than many consistent defenders of laissez-faire—that gold and economic freedom are inseparable, that the gold standard is an instrument of laissez-faire and that each implies and requires the other.Beautiful words.

Greenspan continues in his essay advocating gold as a critical element of any monetary organization. He concludes:

In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. If there were, the government would have to make its holding illegal, as was done in the case of gold. If everyone decided, for example, to convert all his bank deposits to silver or copper or any other good, and thereafter declined to accept checks as payment for goods, bank deposits would lose their purchasing power and government-created bank credit would be worthless as a claim on goods. The financial policy of the welfare state requires that there be no way for the owners of wealth to protect themselves.Upon reading all this, many are puzzled.

This is the shabby secret of the welfare statists' tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists' antagonism toward the gold standard.

They compare this Alan Greenspan to the man known as a "three-card maestro" with a "lack of sincerity" who, "by repeatedly shilling for whatever the Bush administration wants, has betrayed the trust placed in the Fed chairman."

What happened?

The simple fact is ol' Al sold out on gold and went for the money and the fame in the end.

And in the end. . .when the American people are finally hit with the sobering realities of Greenspan's grossly irresponsible monetary policy and its subsequent fallout. . .he'll go down as the most destructive currency terrorist of the 20th century.

The Fallout of Greenspan's Toxic Legacy Examined

In a recent Bloomberg article, Boston University professor Laurence Kotlikoff explained why the U.S. is bankrupt and how utterly insane our true debt picture has become.

Kotlikoff took a hard look at the Congressional Budget Office's (CBO) Long Term Budget Outlook, released in June. And his findings were truly frightening.

Based on the CBO's data, Kotlikoff calculates the U.S. has a fiscal gap of $202 trillion!

This is more than 15 times greater than the official debt listed by our government.

Kotlikoff explains the reasoning behind the gargantuan discrepancy between our "official" debt and our actual net indebtedness saying, "It reflects what economists call the labeling problem. Congress has been very careful over the years to label most of its liabilities 'unofficial' to keep them off the books and far in the future."

Kotlikoff continues:

For example, our Social Security FICA contributions are called taxes and our future Social Security benefits are called transfer payments. The government could equally well have labeled our contributions "loans" and called our future benefits "repayment of these loans less an old age tax," with the old age tax making up for any difference between the benefits promised and principal plus interest on the contributions. The fiscal gap isn't affected by fiscal labeling. It's the only theoretically correct measure of our long-run fiscal condition because it considers all spending, no matter how labeled, and incorporates long-term and short-term policy.Kotlikoff has no solution for the mess we are in, but notes the government will be forced to start reverting to drastic measures—and very soon.

Another noted economist who's speaking out for serious changes to monetary policy is Gerald Celente. Celente and his group of very bright people at Trends Research Institute are calling it like they see it. . .and "it" doesn't look good.

Gerald and crew have been predicting things for over 25 years and have an uncanny track record for being right. Back in August, Celente said:

Following the "Panic of '08" and the subsequent "Great Recession," Washington, Wall Street and the media united to promote the belief that extreme crisis management measures enacted by governments had rescued the world, and staved off even worse disaster.Few argued that the measures could not work; but only Gerald Celente predicted that they would fail completely.

"Recovery" was in the air. "Recovery" was the word on the public's lips. "Recovery" was fervently preached and endlessly pitched.

On the macro-level—and for those who invested everything they had in the recovery—there will be no avoiding future losses.

However, on the individual level, there is still time to take both evasive action and proactive measures.

But be warned. . .While we see a split second left to take evasive action, some of the biggest names in business still blindly persist in minimizing the danger.

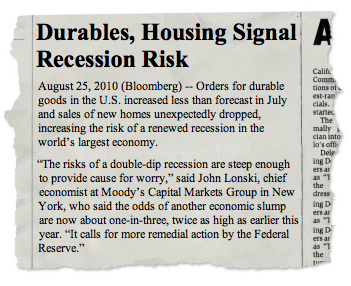

Take a look at a recent Bloomberg article:

Renewed recession? Odds of recession?

It's bogus bookmaking—odds spun out of thin air and fobbed off as economics. The truth of the matter is. . .

The Recession Never Ended

The $13 trillion lent, spent, and guaranteed by Washington and the Federal Reserve didn't put an end to the recession; it just sent it into a brief remission.

Look at the Dow Jones. Yes, the Dow has rebounded from its 2009 low of 6,830 and currently trades under 11,000. The bounce-back is touted as a recovery bellwether.

But in reality, the Dow was trading at 11,000 in 2000. Moreover, when adjusted for inflation, the Dow Jones at 11,000 of 2010 is really the equivalent of only 8,580 in 1999.

To get back to its 1999 level in real, inflation-adjusted terms, the Dow would have to hit 13,530.

But Wall Street and the media do an excellent job of concealing such facts from the public. In their perpetually sunny financial skies, it is always, always, always a "buying opportunity."

As Gerald Celente and The Trends Research Institute have been saying all along, insiders aside, investing in the stock market is a loser's game.

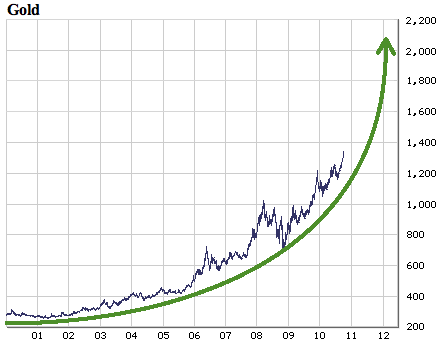

What was not a loser's game at the time of Celente's research was gold.

That's still the case today.

But the mainstream media has conveniently left that out of the story. . .

Trading at a $250 per ounce in 1999, gold currently trades over $1350—that's nearly a 450% gross increase.

Meanwhile, the Dow in is the red. And gold is headed higher. . .

Gold's Next Breakout Point: $1,450 per Ounce

We called the beginning of the gold bull market back in 2001 when gold was at $275 per ounce. The next breakout point for gold is $1450.

From that point forward—depending upon which of a handful of wildcards get played—I forecast gold prices to be in the $2,000 range, possibly higher.

Whatever your investment strategy may be, proactive measures taken now will minimize the impact of future economic troubles.

Rather than debating the probabilities of a double-dip recession, the business media will be glomming onto the financial body counts littering Wall Street as though it were another Hurricane Katrina.

All I can say is to repeat what I have been saying for many years. The only difference now is that time has actually run out.

Because of the coming events, precious metals prices will continue to push higher and higher until the dam breaks, sending gold and silver to unheard of levels.

The price action in precious metals is looking very strong as of late which is leading many to predict a very robust fall for gold and silver.

I expect we are going to see big upward momentum in prices and premiums where physical precious metals will start to be rationed once again like we saw in 2008.

I've recently had a few conversations with fund managers who control large pools of money. They're beginning to ask questions about gold.

I find it amazing how little these people know about the precious metals. One told me he has never held a gold coin in his life, but wanted to know how he could purchase $10 million or more for just one of his many clients!

This tells us there is a tsunami of physical buying for precious metals—including platinum andpalladium—coming to our market in the near future.

Safe haven buying events could drive huge sums of new money into the bullion market.

The problem, however, is that the physical gold and silver markets are extremely small compared to most other markets, and won't be able to deliver into such massive demands for physical coins and bars.

That Means the Price For Physical Gold and Silver Will Skyrocket!

Acquire as many gold and silver ounces as you can—while they are still readily available at prices that investor's years from now will refer to as "dirt cheap."

At some point, when the panic button gets pushed as the shocking financial consequences that Kotlikoff describes come to pass, people won't care what they pay for an ounce of gold or silver.

At that point, availability will have dried up and bullion dealers will have little or nothing to sell.

(This will be due to the fact that nobody will be selling and everyone who has physical metal will be holding because gold and silver have become the ultimate form of money, the strongest currency available compared to rapidly failing fiat currencies worldwide.)

As one fiat currency after another implodes, physical gold and silver will be vaulted to the top of desired holdings. Precious metals mining stocks will go parabolic as the next best choice for owning the actual physical metals themselves.

The world at large will have to suffer the consequences for believing in fiat currency fantasies, but this will provide the real catalyst for the kinds of changes our world desperately needs.

Once again, a generation of citizens is about to find out the hard way that you can't trust politicians. You must keep these power-seeking sociopaths accountable at all times.

The only way to do this is with a gold or silver standard.

Inevitably, such a standard is linked to our economic freedom and prosperity as "Ol' Greenie" used to say—before he became a corrupted stooge

In the meantime, I plan on making a ton of money from the whole debacle, while trying to help as many others as I possibly can.

Good Investing,

Greg McCoach

Editor, Wealth Daily