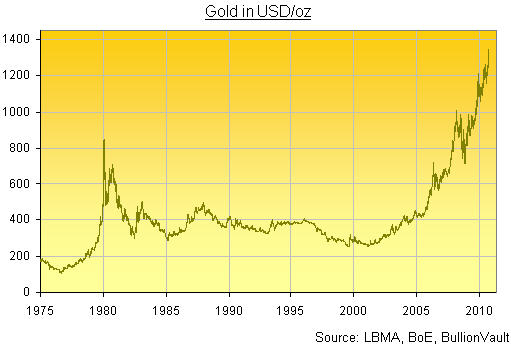

It shows gold priced in Dollars per ounce across what the TV anchors would call the "very" long term. . .

As the gold story goes mainstream (the BBC news apparently quoted gold prices alongside its cursory glance at the FTSE and Dow last night), that long-term shape in dollar-gold is due for ever-more comment.

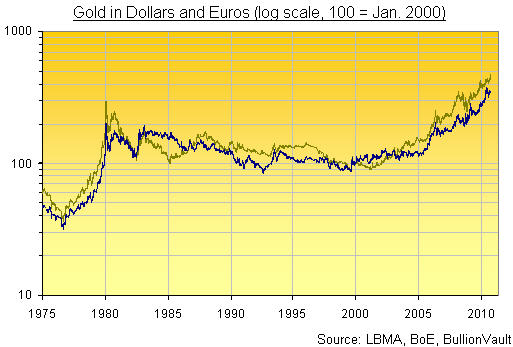

To get a little perspective, you might also want to look at gold from another angle. Such as this one. . .

Seen from the Euro-end of the telescope, gold's current bull market didn't really get started until 2005, rather than its 2001 start in Dollars.

All told, in fact, gold priced in Euros didn't really go anywhere – net-net – for 15 years starting 1990. You can see that Dollar prices were little changed across that period, too. Whereas, over the last half-decade, the Euro-gold price hasn't shot up quite so high as Dollar-gold. Because, to date at least, the European Central Bank hasn't set about destroying its own currency with quite the same verve as the Fed.

Then again, that apparent "spike" in gold prices measured in both Dollars and Euros during 2010 is worth squinting at, too. Because those recent moves might give you vertigo when viewed across 36 years.

But unlike the 1980 spike, they're both somewhat less than vertical when viewed on a logarithmic scale.

Better showing the rate-of-change, this third and final chart puts the current "record-high gold!" headlines in context, at least on a numerical basis.

Gold's ascent in the Dollar clearly began earlier than it did in the Euro. But the bull market in gold (or bear market in money, depending on how you see it) has been much steadier against both than the present "frenzy" might suggest.

Adrian Ash

BullionVault

Gold price chart, no delay | Buy gold online at live prices

Formerly City correspondent for The Daily Reckoning in London and head of editorial at the UK's leading financial advisory for private investors, Adrian Ash is the editor of Gold News and head of research at BullionVault—winner of the Queen's Award for Enterprise Innovation, 2009 and now backed by the mining sector's World Gold Council research body—where you can buy gold today vaulted in Zurich on $3 spreads and 0.8% dealing fees.

© BullionVault 2010

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events—and must be verified elsewhere—should you choose to act on it.