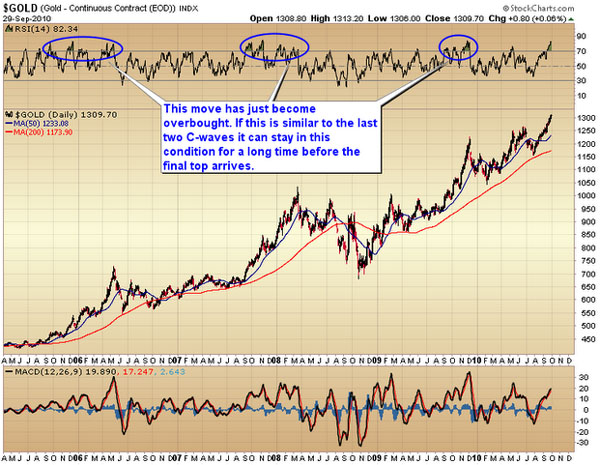

Take a look at the last two C-waves and the first leg up in the current C-wave. . .

You can see that each one of these powerful rallies, when they broke out of the trading range, had already reached overbought levels, and then stayed overbought for most of the rest of the rally.

If you didn't buy the breakout, you missed a huge portion of the C-wave as no corrective move retraced back to the breakout point.

One of the biggest mistakes investors and traders make is using oscillators after a breakout has occurred. Oscillators are great tools if an asset is in a trading range. Once that trading range gets broken, though, investors have to throw out their oscillators as they will cause them to miss huge portions—if not all of the move.

Now let me remind everyone that Bernanke clearly stated he would print money if the economy didn't improve. We know there is no way the economy can improve because we still don't have the next "new" industry to drive job creation.

Folks, this one is a no-brainer—the Fed is going to print, and that is going to cause asset inflation. The dollar is going to drop down into a yearly and 3-year cycle low. And the market is going to make Bernanke pay for his insane monetary policy with at least a mini-currency crisis in the USD by next spring. Ultimately, it's going to cause general inflation in all prices with the possible exception of real estate.

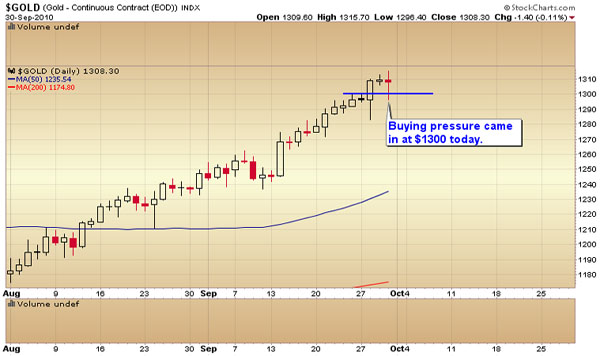

Gold is likely now in a runaway move higher. Smart money is using any and all pullbacks to get in ahead of the inflationary storm that's coming. We saw it in the action yesterday. Gold briefly traded down to the $1,300 level and miners briefly tagged 500. Buying pressure immediately came in at those levels.

I think there is a very strong possibility that the miners are never going to see sub-500 again for the duration of this bull market. And even if they do, it will be only briefly. As a matter of fact, the miners are on the cusp of a historic event that I have been discussing at length in the last several premium updates.

Toby Connor

Gold Scents

A financial blog primarily focused on the analysis of the secular gold bull market.

If you would like to be added to the email list that receives notice of new posts to Gold Scents, or have questions, email Toby.