Gold has already breached $1,000, and there's every reason to suspect this is only the beginning. Even after this tremendous run-up, we expect gold to head much higher because gold's "true" high is actually closer to $2,000!

Comparing yesterday's gold price to today's is like comparing apples to armadillos. Adjusted for inflation, a $35 oz. of gold in 1971 would be worth $175.55 today; 1975 gold rockets to $697.02. In today's dollars, 1980 gold—the peak year at $850—clocks in closer to $2,275.99.

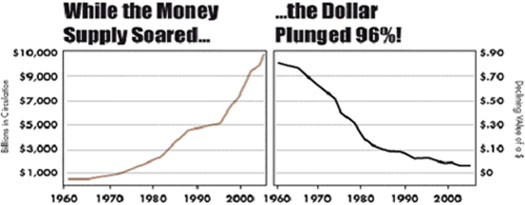

So, in real terms, gold has a long way to go before it reaches its top. The question is, how likely is that? The chart below illustrates two of the biggest problems in today's economy.

The amount of money in circulation has been skyrocketing for >40 years, because the Fed knows regular cash and credit injections make everyone feel rich. With cash and low-priced credit, companies and consumers borrow and spend. For a while, it seemed to worked—U.S. GDP growth averaged 3.2% over a 5-year period. But while that sounds good, there is a serious downside. . .debt.

Money can't escape the natural law of supply and demand. When there's too much of it floating around, each dollar is worth that much less relative to the whole. Suddenly, there's price inflation and every dollar you hold is worth less.

Hemingway called it the "first panacea of a mismanaged nation."

Already this disastrous stance has plummeted the USD purchasing by a mind-blowing 96%. Today it's worth just pennies compared to what it bought a century ago. Or even what it was worth the last time gold boomed, in the 1970s.