In the case of ETF trading, we often work with 3x bull or bear ETFs like BGZ, ERY, ERX, TZA, TNA and so forth. Using a combination of Fibonacci retracements and Elliott Wave theory, we look for high probability setups and extreme overbought or oversold situations to trigger a trade recommendation. A most recent example with ETFs was a short position we took against the rising energy stock index, the XLE.

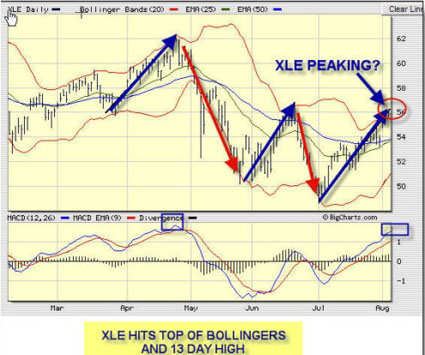

This index had become incredibly overbought in just a few weeks and, looking at prior topping indicators and Fibonacci trading day cycles, we felt it was a "low-risk" bet to short the rally. We recommended ERY at $45.40 as the XLE headed over $56 and was becoming overbought. Within seven days, we had a 15%+ gain by going against the crowd. I saw a 13 Fibonacci day-trading rally at extremes, so we used the XLE chart below, to identify the timing to enter into ERY.

We use the same approach when it comes to trading individual stocks. We look for "waterfall decline" reversal patterns, which are somewhat proprietary for ATP and our methodology. This method reduces our entry risk because we are buying stocks that have already taken a recent short-term multi-day—or even multi-week—hit as investors have exited the stock.

Recent examples include buying DCTH, a former high flier that fell from $16 down to $5.80 when ATP advised purchase. Within days, the stock bottomed and ran to as high as $9 within a few weeks for a 50% move. Another example is OREX, which took a hit in concert with VVUS several weeks ago. We felt the selloff was overdone and recommended the stock at $4.01, after it dropped from $6. The stock ran back to $5.30 within 10 days for a 30% plus gain.

Trading in a volatile market means you need to be patient and discerning—you also may have to wait at times for an oversold or overbought condition before you act). Sometimes acting early can cause you to get spooked out of positions that end up being profitable, but only after you panic sell out at a loss.

At ATP, we use a "tranche buying" methodology, which tries to help with the emotional side of entering or exiting a trade. We recommend 1/3 or 1/2 positions at a time. . .even if we are really confident in our entry point. This way, just in case you mistimed the bottom of your target by one or two days, which often happens, you reserve some powder to add additional capital into the trade to work your way in over several days. We also advise that our partners enter into these tranches over 24 hours of trading time, perhaps buying 3x–4x into our position especially on minor pullbacks.

How many times have you bought into a trade entry at say $5.00 a share; and two days later the position bottomed at $4.50, you close it for a loss and then it runs to $6? Using a tranche buying methodology keeps your emotions in check and you actually look for a further dip as a benefit—not a detriment—to your trading.

We also adjust our stops as the stock or ETF moves after we have completed our entry. The main goal as a trader or investor is to book profits and limit losses when you are wrong. Because our egos are often our worst enemies, adjusting your stops as the trade moves in your favored direction keeps you from getting too giddy and letting a profit slip away.

In addition, a reasonable stop prevents you from being overconfident and letting a small loss turn into a larger one. Another recent sample at ATP was buying into VITA, which was very oversold in the $1.76–$1.80 range. However, we also advised that our partners take profits at $1.92–$1.97, with a nice and tidy 6%–10% gain over 7–8 days of hold period. The stock then fell hard to $1.64 just a few days later. Not taking profits would have meant wiping out all of our hard work and watching our paper profits turn into a "hoping for a rebound" position.

In volatile markets, don't get off your game plan and try to keep your ego in check. Enter into your trades slowly and over 24–48 hours of trade time—no matter how confident you are. Adjust your stops and prevent yourself from getting too greedy or giving away profits. Take your time, wait for setups and also take a break every now and then. . .nobody needs to trade every day.

Come check us out at www.ActiveTradingPartners.com and join us and/or sign up for our free weekly reports!

David Banister