Regular readers of my Musings know that a majority of the junior resource sector is toast. Financial markets are a mess, venture capital might as well be one of George Carlin’s infamous “Seven Words”, and the junior wannabes are not going to come back because they had nothing to start with, were simply in a shell game, and are now out of the money with nothing to show for it. (Except for some mighty pissed-off shareholders who probably will never come back to this table.)

Note that I said a majority. There is big-time undervalue out there; perhaps more so than since the darkest days of 2001.

A good example is Animas Resources, Ltd. (ANI.V). This is one of those really neat companies where excellent management has its sole interest aligned with shareholders. ANI is cashed up into early 2010 and is working in a district that that has the size to be a company maker. Professionals like me who invest risk capital in resource stocks for the grand slam home run, aka a granny in baseball parlance, know this is rare.

Please refer to my previous technical evaluation of Animas Resources (March 28, 2008) for additional background on the company’s share structure, people, and projects.

On October 20-21, 2007, I conducted an evaluation of Animas Resources Inc.’s (ANI.V) Santa Gertrudis project, Santa Teresa district, Sonora, Mexico. I was accompanied and guided by CEO and geologist Greg McKelvey, consulting geophysicist John Reynolds, and project geologists Miguel Angel, Sebastian Mollepaza, Jeff Geier, Brian McFarland, and Francisco Carrillo. I thank the geological staff for their hospitality and eagerness to help me understand the significant gold potential of this district.

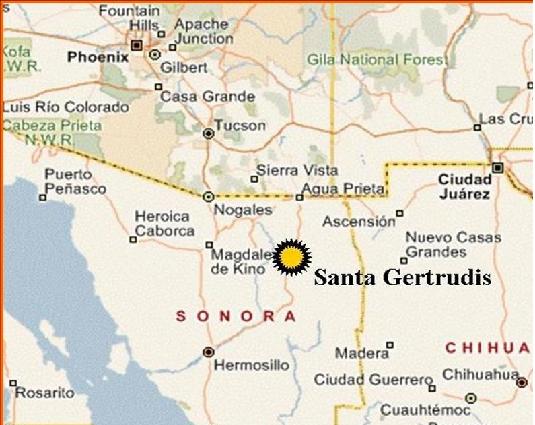

I flew from Albuquerque to Phoenix in the mid-morning of October 20 and was met by Greg McKelvey at the airport. We drove south to Mexico, went thru the checkpoints with no delays or problems (Note that Mexico is now advertising the Nogale-Santa Ana-Hermosillo-Guaymas toll road on highway billboards as a “Hassle Free Zone”; likely to entice snowbird tourism to the beaches at San Carlos, Bahia de Kino, and Puerto Penasco). With one stop for lunch, gas, and supplies, we were in Magdalena de Kino in about four hours and in the Santa Gertrudis camp by late afternoon. This was much easier access than most of my recent examinations.

Santa Gertrudis Project Location Map

Animas Resources Inc. has consolidated the Carlin-type, sediment hosted gold deposits and prospects in the Santa Teresa district with land holdings covering 447 sq km. The company has options either to earn 100% or presently controls 100% of the ground. Animas Resources’ stated mission is to expand the near surface and deep resources at the Santa Gertrudis project to economic decision points that will increase shareholder value.

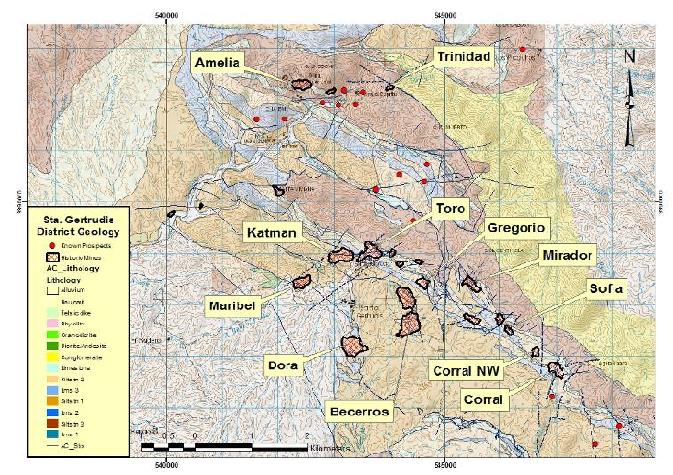

Mines, Geology, and Historic Resources

The Santa Gertrudis project was discovered by Phelps Dodge in 1986 and advanced to open-pit, heap leach gold production in 1991. Campbell Resources purchased the project from Phelps Dodge in 1995 for $10 million. Adjacent and to the north, the Amelia area was mined by Minera Roca Roja, an Australian concern. From 1991 to 2000, 9.3 million tonnes were mined from small deposits in 22 pits with about 650,000 oz gold produced. Strip ratios were high and averaged 6.5:1. Production was from open pits with heap leach cyanide processing and recovery was poor due to the intermixed nature of oxidized and carbonaceous sulfide ores. Both Campbell and Roca Roja ceased mining due to low gold prices during the late 1990's and the various properties were ceded for debt to Mexican contractors. ANI has systematically consolidated ownership of the district over the past few years.

Past Producing Open Pit Mines of the Santa Gertrudis Project

The Santa Gertrudis district is located in the Basin and Range province of northern Mexico. Carlin-type disseminated, stockworks, and structural gold deposits are hosted by a Cretaceous sedimentary sequence of silty carbonates and sulfidic, calcareous black shales in a northwest-trending fold belt with most known deposits located on the southern limb. Structural controls are very important with intersections of northwest and northeast high angle faults localizing ore bodies. Circular magnetic highs with peripheral deposits on the edges indicate likely buried intrusive sources for alteration and mineralization. Shallow pediment gravel cover on the southwest is adjacent to historically mined deposits.

Historic resources for the Santa Gertrudis project are currently inventoried at 16.4 mm tonnes grading 1.36 g/t Au for a total of 718,000 oz gold. Animas has developed six priority exploration targets from analysis and interpretation of a voluminous historic database, mapping, and sampling. An initial Phase I, 25 hole, 5700 m drill program recently was completed on these targets. Mine Development Associates of Reno, Nevada has reviewed historic data for quality control and will table a 43-101 resource estimate upon receipt of all assays from the current drill program.

Field Tour

After arriving at camp in the late afternoon, settling in, and following the requisite introductions, we just had enough time to look at drilling near the abandoned Campbell Resources’ office, plant, and Berta pit before dark. This is an interesting target with deep oxidation. I observed altered orange-red calcareous siltstone at 285 m drill depth.

Here’s a look at the core rig drilling for extension of the Corral deposit in mid-summer:

Core Rig Drilling at the Corral Project in July 2008

After dinner and much needed refreshments, the evening was spent reviewing the geological setting of the gold deposits and the main district-wide targets were presented by the respective mapping geologists: Geier, Mollepaza, and Angel. I was impressed with the detail of the mapping at various scales ranging from 1:5000 to 1:500 and their on-going attempts to understand the structural, host rock, and intrusive rock controls to alteration and mineralization.

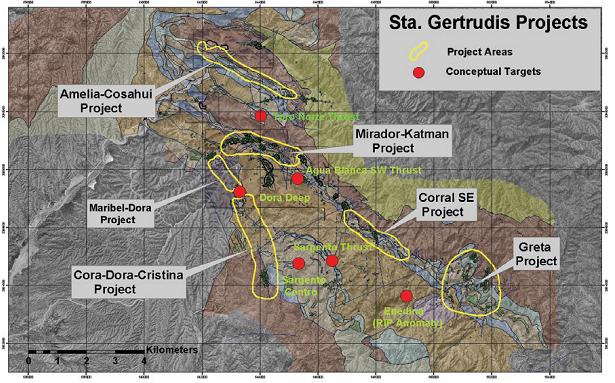

The company has designated the six highest priority targets defined by the historic database and recent geological mapping, rock sampling, and geophysics as individual “project areas”. These defined projects have strong potential for both lateral and depth extension from and between known deposits, including under post-mineral gravel cover. There are several additional targets more conceptional in nature that have been developed and will be drill tested as time and budgets allow:

Animas’ Project Areas and Conceptional Targets within the Santa Teresa District

The following morning started with a review of consulting geophysicist John Reynolds’ compilation, processing, and interpretative work on archived and recent geophysical data, including ground magnetics, induced polarization-resistivity, and airborne magnetics, electromagnetics, and radiometrics. Cowboy John worked here previously for Phelps Dodge in the early ‘90’s and knows the district well. He is a practical “geowizard” with a degree in geology so rock jocks like me can talk easily with him. His geophysical targets of intrusive bodies and altered zones have been proven recently by the truth tool (the drill) with granodiorite drilled beneath gravels four km southwest of the Dora pit and thick hornfels-sulfide zones drilled below the Corral pit.

The group then proceeded in mass to the field. The tour included eight stops:

Stop 1: Dora pit. We looked at a mined pit in oxidized orange-red siltstones and unoxidized black shales. Jeff Grier commented that the original deposit was largely gravel covered, on the spatial association of ore with altered felsic dikes, and that orebodies are bounded by low angle faults. This deposit produced from mixed oxide-sulfide ore and there is an 89,000 oz historic resource remaining. As can be seen on the map above, there is a five km mineralized corridor from the north of the Maribel and Dora pits to the unmined Cristina deposit with a 126,000 oz historic resource. Much of this is gravel-covered and remains undrilled.

Stop 2: We looked at another felsic dike outcrop with sericite alteration and quartz stockworks veining between the Becerros N and S pits. These felsic dikes are an important component to the alteration and mineralization.

Stops 3 and 4: Corral pit. 39,000 oz were produced but gold recovery was poor in the mixed oxide-sulfide ore. Historic resources are about 46,000 oz gold. A district-wide feeder structure is shown in the accompanying photo which juxtaposes red oxidized ore and black sulfidic ore. The main targets on this project are along the feeder fault between the Corral, Corral NW, Hilario, and Sofia pits and targets to the north and south, a distance of over two km. My only suggestion to the field crew was to stock more goldfish and maybe some shad in these pit lakes so the largemouths can get fat.

Corral Pit with Red Oxide and Black Unoxidized Ore along NW-Trending Feeder Fault

Stop 5: Mirador pit which produced over 10,000 oz gold with a 45,000 oz historic resource. Pit and outcrop mapping by Sebastian Mollepaza, Reynolds’ geophysics, and rock sampling have defined a two sq km target surrounding and below the mined area. A recent deep drill hole confirmed the work and intersected a very wide zone of hornfels with intense quartz-sulfide-sericite stockwork veining and flooding. Assays on this potentially promising new zone are pending. Take a look at what I’m talking about:

Multi-Stage Silica Veinlets/Flooding with Pyrite Stringers in Core Below the Mirador Pit

Stop 6: Becerros North pit. This was the district’s largest producer at 106,000 oz gold and a 31,000 oz resource remains on the trend. A mafic sill apparently acted as a dam to ore which ponded below.

Stop 7: Berta pit area. We returned to the drill rig near Berta which continued in oxidized and altered rock at 320 m.

Following lunch and a few logistical arrangements, the crew set out for the field again.

Stop 8: Amelia pit. We drove on a rough road to the Amelia group of deposits on the north end of the district. Amelia and satellites produced nearly 100,000 oz gold and were the highest grade mines in the district. A key interior concession, the Lixiviant, was recently acquired by ANI here to consolidate ownership. Miguel Angel’s mapping and rock sampling have defined promising new stockworks alteration and skarn targets south to southeast of the previously mined deposits. To the east, the Trinidad mine has a 61,000 oz historic resource.

We then retraced back to the Animas camp, packed up, and bombed down the road to the Hotel El Toro in Magdalena de Kino. Over local beers and arguably the best steak in northern Mexico, Greg, John, and I had an interesting confabulation regarding the bear market, junior explorers, major mining companies, and regaling each other with tales of aventuras en el Tercer Mundo (several of which could not be repeated here).

The following morning, John Reynolds and I made our way to Hermosillo (with only a one hour detour back to the hotel to retrieve our respective forgotten essentials). I went to another job and he got to go the annual Mexican mining show.

Discussion

Animas Resources has a well-reasoned corporate plan formulated by CEO Greg McKelvey and his core management, technical, and advisory teams that read like a veritable “who’s who” in the exploration, development, finance, and marketing worlds. It has the requisite people, tightly controlled share structure, and prospective flagship project. They have enough cash on hand to advance the project into 2010 and, with exploration success in a district of this size, may find many interested strategic partners.

Past mining efforts at the Santa Gertrudis project ended up as failures. I ascertain there were four problems: Numero uno was the depressed price of gold in the late 1990’s. Other contributing factors include: The companies were trying to explore, develop, and mine at the same time; the intimately interlayered oxide and sulfide deposits were not amenable to non-selective bulk mining; and cyanide heap leaching did not work on sulfide-carbonaceous ores. With a robust gold price, current selective mining techniques allowing separation of ore types, and metallurgical advances in the past 10 years, the historic resources remaining today might be converted to economic reserves in the future. I am pleased to know the company is open to this option.

However, that is not the primary mission of Animas. Until these big boys arrived, the district was fragmented, never systematically mapped or drilled , and had not seen modern, integrated exploration techniques employing comprehensive geophysical processing and interpretation, remote geochemical soil sampling, and satellite alteration images.

Most importantly, compelling targets have never been drilled deep. In that way, it reminds me of the Carlin trend in 1986. At that time, all the producing mines were relatively low-grade, shallow, oxide open-pits. Then forward-thinkers started deep drilling for high grade sulfides, all hell broke lose, and we all know the results:

135 million ounces of gold production and reserves. Ask ex-Newmonter Odin Christiansen, now an Animas consultant, about that! (By the by, I worked for Odie at Newmont in Elko, Nevada as their very first geological consultant over 20 years ago.)

Folks, this is a geographically huge Carlin-type district. It has at least ten characteristics permissive for large, high grade, deep Carlin-style ore bodies including:

- A structurally complex area along a major regional fold/fault system.

- Numerous near-surface small deposits with significant historic production and resources.

- Major thru-going feeder faults associated with higher grade sulfide ores.

- All sedimentary rock types host ore with different styles of ore bodies; favorable units extend to depth.

- Low grade oxide and high grade sulfide zones interlayered at surface; deep oxidation in some areas.

- Alteration and mineralization postdate major thrust faulting.

- Large areas of decalcification and intrusion-related quartz-sericite-pyrite alteration.

- Post-mineral gravel cover within, adjacent to, between, and along extensions of mined ore bodies.

- Numerous untested geochemical, geophysical, and alteration anomalies thru out the district.

- Limited drilling below 300 meters depth.

And that’s all, Folks: Animas’ mission is to discover multi-million ounce gold deposits.

Recent developments, as I have shown you, are going very well for this experienced team. The rewards of their success could be very large for investors in the downtrodden resource sector.

Win, lose, or draw, it’s refreshing to know that company insiders benefit only if shareholders do. These people still hold all of their shares and options even though they could have taken substantial profits earlier this year. That in itself is rare in the Canadian junior market.

Only more boot leather, rock pounding, drilling, and of course, time and money will tell. The initial drill phase has been quite encouraging with wide intervals of strong to intense alteration encountered in at least four project areas.

But, alas, we must await assay results from the 25 holes to know if the Gold Gods were Good to Gertrudis in this first phase of an on-going multi-phase exploration program.

And so that brings me to this, a favorite quote from geo-iconoclast J.E. Spurr (1927). It prefaced my Master’s Thesis over 25 years ago:

Geologists may write Extravaganzas. But only God can make Bonanzas.

Ciao for now,

Michael S. (Mickey) Fulp

Mercenary Geologist

The Mercenary GeologistMichael S. “Mickey” Fulp is a Certified Professional Geologist with a B.Sc. Earth Sciences with honor from the University of Tulsa, and M.Sc. Geology from the University of New Mexico. Mickey has over 29 years experience as an exploration geologist searching for economic deposits of base and precious metals, industrial minerals, coal, uranium, and water in North and South America and China.

Mickey has worked for junior explorers, major mining companies, private companies, and investors as a consulting economic geologist for the past 20 years, specializing in geological mapping and property evaluation. In addition to Mickey’s professional credentials and experience, he is high-altitude proficient, and is bilingual in English and Spanish. From 2003 to 2006, he made four outcrop ore discoveries in Peru, Nevada, Chile, and British Columbia. These discoveries have led to two economic deposits for companies that are now raising debt and equity financing for mine development.

Mickey is respected throughout the mining and exploration community due to his ongoing work as an analyst for public and private companies, investment funds, newsletter and website writers, private investors, and investment brokers.