Gold and copper exploration company Zacapa Resources Ltd. (ZACA:TSX.V) recently announced that it successfully lined up financing for up to CA$3,000,000 via an unbrokered private placement which is scheduled to close within a few days. The company expects to utilize about two-thirds of the amount raised to fund its upcoming drill program at its South Bullfrog gold property located in the Walker Lane trend of western Nevada.

Shortly after making the announcement, the company reported that it has taken steps to reorganize its gold and copper operations into separately incorporated businesses and is pursuing strategic and financial measures that it expects will enhance its operations and boost shareholder value.

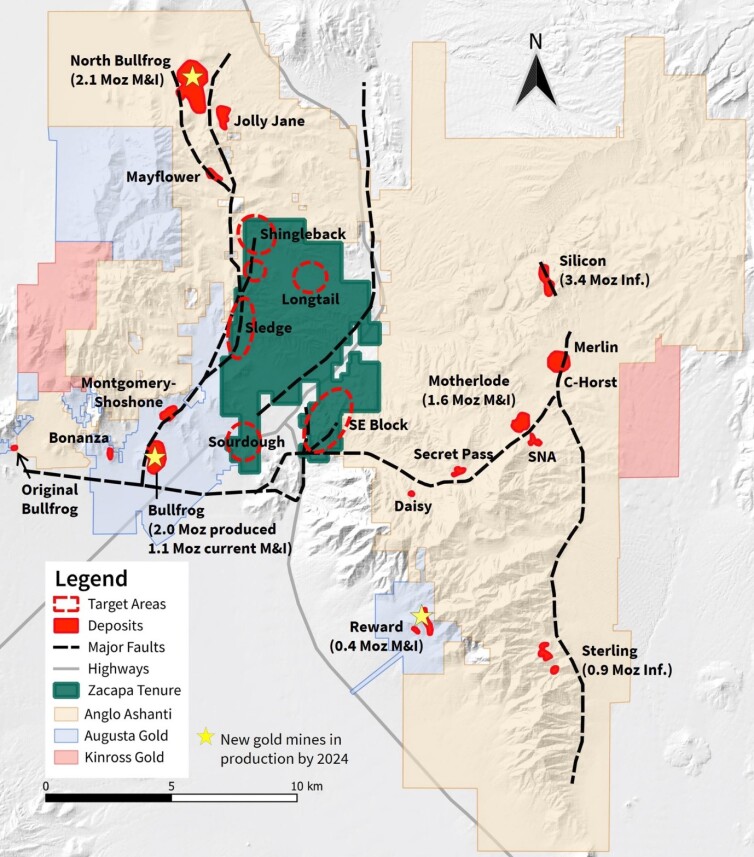

Zacapa Resources' South Bullfrog gold property is located in the center of eight to nine multimillion ounce gold deposits in Nevada's Beatty district and is adjacent to Augusta Gold Corp.'s (G:TSX.V: AUGG:OTCQB) Bullfrog Mine, which was previously owned by Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) and to date has produced 2.33 Moz Au (million ounces of gold).

Industry majors such as AngloGold Ashanti Ltd. (AU:NYSE; ANG:JSE; AGG:ASX; AGD:LSE) specifically have come in aggressively and now own three large properties which combined show potential for hosting up to 10-20 Moz Au within the Beatty District.

Following its acquisition of Corvus Gold Inc. (KOR:TSX; KOR:NASDAQ) in January 2022, when the firm purchased 80% of the shares that it did not already own for US$370M, AngloGold Ashanti announced that it agreed to acquire the nearby Coeur Mining Inc. (CDE:NYSE) Crown and Sterling exploration properties for US$150M (million), and that price could rise to as much as US$200M if the resource is later verified to contain 3.5 Moz Au or higher.

Zacapa Resources' CEO & Director Adam Melnik told Streetwise Reports that the company finds itself in an ideal position as "South Bullfrog offers an unparalleled property position, and maybe district-like, and it literally cannot be reproduced as the company is investing at a time when you've got a super major (AngloGold Ashanti) that's acquiring deposits, building new mines and actively acquiring other counterparties and competitors in the district."

Melnik commented that he believes that practically all of the value ascribed to the company in the marketplace is based strictly upon the value of the firm's South Bullfrog project, as the property is adjacent to several majors and lies within five kilometers of three or four potential new mines.

"All six maiden drill holes completed at Red Top have encountered long intervals of variably altered rocks consistent with a proximal, large-scale porphyry system;t he project is worthy of a dedicated multi-phase drill campaign."

— Quinton Hennigh, Geologic and Technical Director at Crescat Capital

CEO Melnik remarked that "the whole Beatty District is really being transformed and that over the last five years, the area has gone from having a couple of non-core oxide deposits kicking about to having upwards of 10 Moz of new discoveries with three mines expected to come online within the next two years."

According to CEO Melnik, at the time Zacapa Resources completed its initial public offering (IPO), the firm raised close to CA$10 million with the objective of deploying that capital for exploration at South Bullfrog as well as its other projects.

The company conducted several advanced geochemistry, geophysics, and spectral imaging surveys and, with that information, has identified some very compelling drill targets at the South Bullfrog project.

The company is now poised to commence a 5,000m, 15-hole drill program in November 2022 and expects that during Q1/23, it will be able to demonstrate positive results, which will provide a strong catalyst for investors.

The company also owns another gold property called the Miller Mountain Project in west-central Idaho, which includes 238 unpatented mining claims that encompass a little over 4,900 acres and covers about a 7.5 km strike length along the Trans-Challis fault zone.

The property is within 10 km of the Boise Basin, which is an area that had historically produced greater than 2.5 Moz Au. Multiple rock chip samples at Miller Mountain have returned high grades of up to 27 g/t Au (grams per ton gold), and historic drilling at the property intersected 6.7m of 23.7 g/t Au.

The company plans to begin drilling at this project in the summer of next year.

The firm's leading copper asset is its Red Top project which covers 3,600 acres in Arizona's Laramide porphyry copper province and is located close to several significant mines and giant copper deposits.

The company drilled six holes earlier this year at the property, which is just 8km northwest of the enormous underground Resolution project co-owned by Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK) and BHP Billiton Ltd. (BHP:NYSE; BHPLF:OTCPK) which is projected to produce as much as 40 Blb Cu (billion pounds of copper) over a 40-year period.

Quinton Hennigh, the geologic and technical director at Crescat Capital, a leading institutional investor in Zacapa Resources, commented in a recent roundtable presentation that "Red Top is my favorite project in the company, and they're chasing big stories. Right next door to Red Top is the Resolution copper project, which is the biggest, highest grade porphyry deposit in the lower 48 states."

In a July 15, 2022, Prescat presentation, Hennigh noted that "All six maiden drill holes completed at Red Top have encountered long intervals of variably altered rocks consistent with a proximal, large-scale porphyry system," and added that "the project is worthy of a dedicated multi-phase drill campaign."

The Catalyst

Zacapa Resources has recently made arrangements to secure an unbrokered private placement in the amount of CA$3,000,000, funded primarily by the company's directors and other long-term common shareholders.

The offering is for up to 20,000,000 units at a price of CA$0.15 per unit, with each unit consisting of one common share and one purchase warrant.

The warrants are priced at CA$0.22/share and are valid for up to 36 months. The offering remains subject to certain regulatory approvals and approval by the TSX Venture Exchange and is expected to close on or around October 7, 2022.

Approximately two-thirds of the net proceeds (CA$2,000,000) will be utilized to fund the company's drill program at its cornerstone South Bullfrog gold project in Nevada, where the firm plans to drill around 5,000 m (meters) across 15 drill holes starting in November 2022. The firm intends to use the remaining proceeds (CA$1,000,000) for general corporate purposes and working capital.

At present, the company is focusing its attention on its South Bullfrog gold project and indicated that any positive results that come in from South Bullfrog that demonstrate grades similar to the other nearby Bullfrog and Beatty district mining properties would serve to cement the project as a highly prospective gold resource.

The firm's CEO pointed out that "we can create the most value in the near term through a discovery at Bullfrog where there's a glaring, very clear path to crystallizing value, through a partnership or sale to one of the other majors and mid tiers operating in that district."

According to CEO Adam Melnik, the company has hired a team of fantastic drill contractors at a very low cost due to current market conditions. CEO Melnik commented, "we have a strong view that the gold price, in particular, is going to be in a different place in the first half of next year when we'll be announcing drill results from this project."

Even though the company expects that gold prices will increase in the coming year, it is not overly focused on daily or monthly fluctuations in metals prices. The firm believes that an opportunity exists for it to make a significant discovery in the Beatty District similar to that of AngloGold's and that such a project would likely fall within the first quartile of the cost curve if near surface, open pitiable oxide gold is found.

While this type of operation is comparatively simple, it offers consistent production with high margins. CEO Melnik remarked, "If you are going after those types of targets, whether the gold price is US$1,500 or US$2,000, you're still making money, and the rest is just gravy."

Zacapa's CEO stated that he believes that copper is currently massively oversold. Spot prices have dropped well below US$4.00 to around US$3.40, while the supply in the markets is now pretty tight overall. CEO Melnik added that if China did not implement its zero COVID policies, we would probably not have seen copper prices below US$4.00/lb.

Company Restructuring Plans

Earlier this week, the company reported that it is restructuring its business operations and advised that it has implemented steps to "spin-off" its copper assets into a separate company.

The firm stated that it has completed internal reorganization by splitting its gold and copper assets into separate wholly-owned Nevada subsidiaries. Under the new structure, the company's two gold projects, South Bullfrog and Miller Mountain will be managed and held by Zacapa Gold Corp., and its two porphyry copper projects in Arizona, Red Top and Pearl will now be held by Zaya Resources Ltd.

Zacapa advised that its Board of Directors is investigating options to spin out the copper assets to a new publicly traded entity to capture further long-term value from the copper asset portfolio.

Zacapa Resources is headquartered in Vancouver, B.C., Canada, and is focused on copper and gold exploration in the southwestern U.S. The company's portfolio includes two epithermal gold and four porphyry copper projects located in Nevada, Arizona, Idaho, and Colorado.

Regulatory Headwinds and Tailwinds

In February 2022, President Biden announced that he was invoking the use of the Defense Production Act (DPA) to accelerate domestic production of five key green energy technologies, which included solar, electric grid components, insulation, heat pumps, fuel cells, electrolyzer, and platinum group metals needed to power America's new clean energy economy.

CEO Melnik noted that for unknown reasons, the actions put forth did not include any directives to ensure the production of copper in the U.S. Zacapa's management team believes that ultimately the policy will change to include copper after the administration realizes that 90% of all copper production and 99% of all smelting and refining operations take place outside of the U.S.

Therefore, if copper is what is wiring everything together, one might expect that if the goal is to have a secure supply chain, copper would need to be included as a strategic and critical metal, the same as other commodity inputs such as lithium, graphite, and certain rare earth elements.

Melnik mentioned that less than 45 days after the DPA was called into action, government representatives from the State of Arizona introduced the Unleashing American Resources Act to resume mining operations at the Resolution copper project, which by itself is capable of boosting U.S. copper production by 25% and would allow Arizona to fill the large unmet gap for domestic copper production.

Though it may take some time to sort its way through the system, Zacapa believes that U.S. state and federal government agencies will come to an agreement regarding copper's critically important role in the path toward electrification.

When this happens, Zacapa will likely see increased interest and improved economics at its early-stage Red Top, Pearl, Dewdrop Moon, and Tomichi copper projects. The company expects that a change in policy will provide strong tailwinds for development at other large mining and development projects in Arizona and will be a net positive for Zacapa Resources and the entire group.

Share Structure

Zacapa has a solid investor base with three large institutional shareholders that, in aggregate own 25% of the company's outstanding shares. These investors include Crescat Capital which owns 14.5%, and EMX Royalty Corp. and Deutche Rohstoff, which together own 10.5%. The company's management team and directors own 18% of the outstanding shares, with the remaining 57% being owned mostly by high net-worth long-term investors.

The company has a market cap of CA$8.1 million with 53.39 million shares outstanding, and the firm's shares trade in a 52-week range between CA$0.145 and CA$1.00.

Zacapa Resources Ltd.'s shares trade on the TSX Venture Exchange under the symbol "ZACA" and last closed for trading at CA$0.15/share on October 5, 2022. The company's shares are also listed in the U.S. on the OTCQB under the symbol "ZACAF" and under the designation "BH0" on the Frankfort Stock Exchange in Germany.

Want to be the first to know about interesting Gold and Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

Disclosures:

1) Stephen Hytha wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Zacapa Resources Ltd. and Rio Tinto Plc., companies mentioned in this article.