Infinitum Copper Corp. (INFI.TSV.V) has released results from the first two of 12 diamond drill holes at its flagship La Adelita project in the Sonora and Sinaloa states of Mexico.

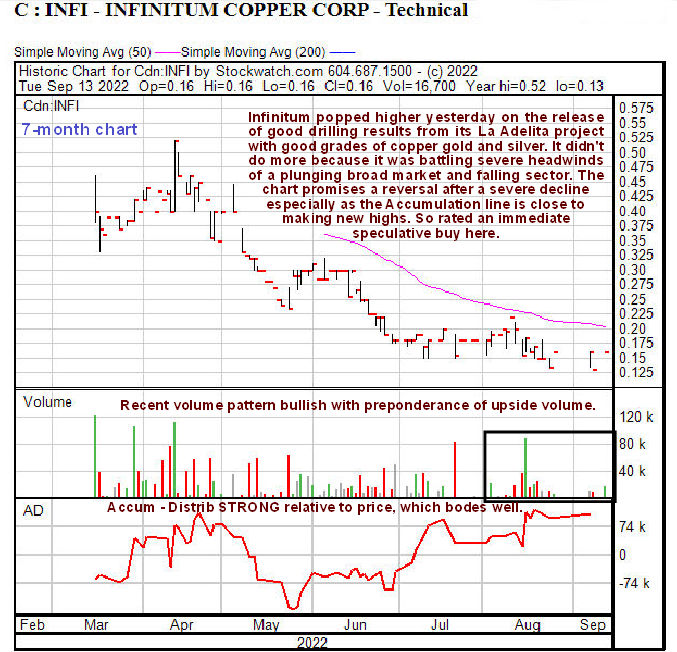

Technical analyst Clive Maund said the stock looked set to break higher into a new bull market.

In one hole, the company intersected 20.6 meters of 1.915 copper (Cu), 2 grams per tonne gold (g/t Au), and 40.91 g/t silver (Ag) starting at 163.15 meters downhole in the Cerro Grande Zone.

The hole, AD-22-0018, is open in all directions. Asset manager Chen Lin, who follows the company, said the results were “beautiful.”

“It’s a very good start to a very exciting drilling program,” Chen said.

Technical analyst Clive Maund said the stock looked set to break higher into a new bull market.

The company started its two-phase, 9,000-meter drilling campaign at La Adelita in March. Results from the remaining 10 holes of Phase 1 are expected in the next few weeks. Phase 2 will be 6,000 meters of drilling to begin after the rainy season ends.

“The recent positive volume pattern and strong accumulation line suggest that Infinitum Copper is about to reverse into an uptrend, which is supported by (Tuesday's) positive drilling results,” he wrote on clivemaund.com on Wednesday.

Infinitum Chief Executive Officer and Director Steve Robertson said La Adelita is “clearly a big system.”

The 6,446-hectare project is comprised of seven mining claims. The company has identified three zones of significant copper, silver, gold, and zinc mineralization at the Cerro Grande Footwall, Las Trancas, and Pericos zones.

The past-producing silver mine Alamo Dorado mine is just 5 kilometers away from the project, and the copper-producing Piedras Verdes mine is 60 kilometers northwest.

The Catalyst

The company started its two-phase, 9,000-meter drilling campaign at La Adelita in March. Results from the remaining 10 holes of Phase 1 are expected in the next few weeks. Phase 2 will be 6,000 meters of drilling to begin after the rainy season ends.

It will target follow-ups from Phase 1, mineralization identified in the ongoing trenching program, prospective anomalies generated by the geophysical survey, and extension of known zones.

“If we can continue to hit mineralization on that sort of grade, it’s going to get us to where we want to be in fairly short order,” Robertson said. “We’re very pleased with the way we continue to see high grades over fairly significant geographic distances from each other. These are the sort of hallmark features that we look for in big multiphase systems, the ones that get big and rich.”

The two holes released Tuesday were drilled to seek the extension of the high-grade copper, gold, and silver mineralization of the Cerro Grande zone and the recently discovered Cerro Grande Footwall zone. Mineralization there consists of chalcopyrite, bornite, and covellite.

The magnetite content is estimated to be from 15% to 75% over the 20.6-meter length of hole AD-22-0018, and iron values average 24%. A detailed magnetometer survey will be undertaken once vegetation dies back after the rainy season.

The company is working toward eventually having a resource estimate for the site.

“We’re still finding things as we go,” Robertson said. “We’re still expanding in both directions. … I think it will take quite a bit more work.”

Red Metal Is Hot

The red metal is hot right now as it’s helping to drive the new green economy. Copper conducts heat and electricity and is a vital part of the move toward clean energy. EVs use three times as much of it as combustion engine cars do, and solar panels require it, as well.

Demand is expected to rise 16% and outstrip supply by more than 6 million tonnes by the end of the decade, according to independent energy research company Rystad Energy.

New uses are popping up all the time, Robertson said, including in the biomedical industry, where copper’s antibacterial properties are prized.

“We’re going to see an increased consumption of copper in the modern economy,” Robertson said. “There’s a freight train coming for us, it’s going to be a shortage in copper. … We just don’t know where the copper is going to come from.”

To help close that gap, the company continues to “look for additional projects and opportunities” for exploration, he said.

Share Structure and Institutions

Infinitum has 45.6 million shares outstanding, 23 million of them free floating, according to the company. Among its major shareholders are Minaurum Gold Inc., which owns 13%; insiders including directors; institutional investors including MCM and Terra Capital; and retail investors.

Its market cap is CA$7.63 million, and it trades in a 52-week range of CA$0.52 and $0.13.

| Want to be the first to know about interesting Gold, Base Metals and Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Infinitum Copper Corp. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Infinitum Copper Corp., a company mentioned in this article.