I want to draw your attention to your silver at this time because, after its latest drop, it looks ridiculously cheap. Both gold and silver have been artificially suppressed for years on Western markets, but more eastern powers like China and Russia, who instinctively understand the intrinsic value of Precious Metals, especially as the latest fiat experiment approaches its nemesis, have steadily built up their reserves and they have been taking advantage of recent low prices to mop up remaining supplies.

The result of this has been a shift in the balance of power from West to East to the extent that the BRICS are now creating a new reserve currency, and Russia is proposing a new international standard for trading PMs. The corruption of Western metals markets has invalidated their legitimacy, a recent scandalous example being the LME bailing out a huge Chinese short trader of nickel to the disadvantage of the longs who, without this intervention, would have made the correct call.

Many metals traders have had enough of this sort of thing and will be upping sticks and moving east as soon as China and Russia make it possible to do so. Already, vast amounts of gold and silver have been withdrawn from the London Metals Exchange. The point is that when these Eastern metals markets become fully effective, the attempts to suppress the prices of gold and silver by Western governments and interests, which are believed to prevent investors from being able to preserve their wealth, will no longer be effective, and so gold and silver will find their fair value, which already happens to be at much higher prices than they are at now.

Given all the developments now in train, this could be months away rather than years. So let’s now take a look at some charts to see why silver, in particular, looks like the such great value here.

On the 6-month chart, we can see the downtrend in force in silver from mid-April. In a Silver Market update posted in the middle of July, the opinion was expressed that silver would turn up following a severe decline. It did, but after rallying to resistance in the vicinity of its May low, it turned down and dropped again, and last week it made a new low for this downtrend, although not by much.

One important point that we can observe on this chart, because the S&P500 index is at the top of it, is that this latest decline was in lockstep with the decline in the broad stockmarket, which of course, means that if the broad stockmarket really does tank, it will probably take silver down with it.

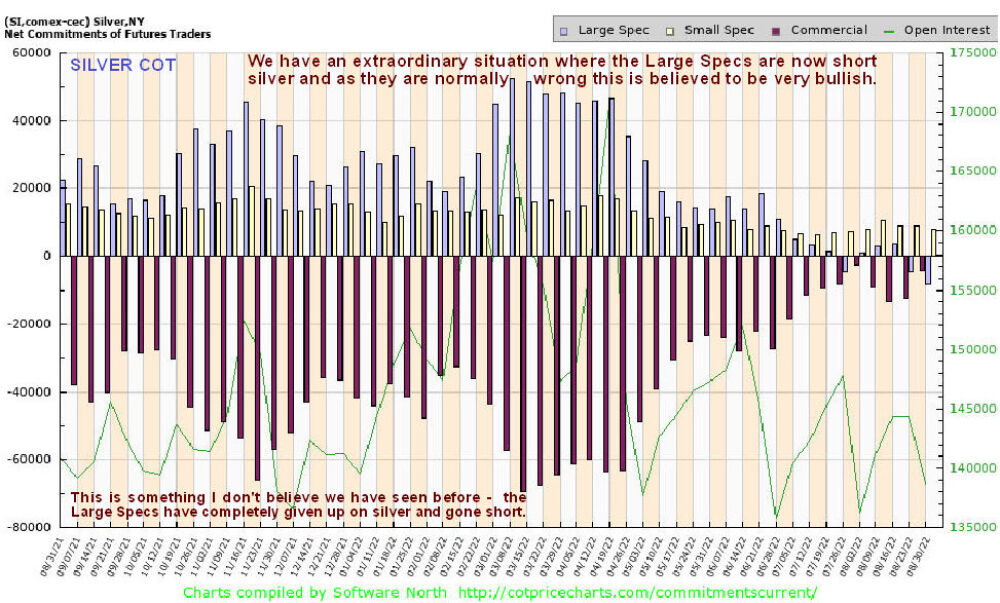

On the positive side, this downtrend is looking like it may have run its course for several reasons. One is the decrease in downside momentum — the new low was confirmed by a new low in the MACD indicator and the now much more positive COT chart, which we will look at after examining the 13-year chart.

Lastly, a somewhat bullish-looking inverted hammer candle formed on Friday on good volume, which may lead to a rally.

Some of you may recall that we had earlier thought that silver would hold the support in the $21.00 - $22.00 zone near the lower boundary of the trading range that formed from mid-2020 through the end of last year, the reason being that this trading range looked like the “Handle” of a Cup & Handle base, but the support failed to lead to this year’s downtrend, as we can see on the 13-year chart below.

This gives us further grounds to believe that silver may have hit bottom last week, and if it turns up here, we may never see such low prices again.

The Cup & Handle theory may yet be correct if we change the shape of the Handle of the pattern so that it becomes droopy, as drawn on the chart, but what is perhaps more interesting here from a symmetry and timing point of view is that the price has now dropped to touch exactly the giant Bowl pattern added to the chart.

You may also recall that we had earlier dismissed the March 2020 spike lower as a freak Covid move, but what is a little uncanny is that the parabolic Bowl pattern drawn exactly under this low when produced also goes exactly below where the price is now. This gives us further grounds to believe that silver may have hit bottom last week, and if it turns up here, we may never see such low prices again.

Now we come to some rather compelling evidence that silver is at or very close to an important low now.

The latest COT chart shows that the normally wrong Large Specs have not only completely given up on silver, which is almost unheard of but has actually started shorting it.

Meanwhile, the net Commercial hedgers’ short positions have all but vanished. This is viewed as a very bullish circumstance and as the hallmark of a bottom.

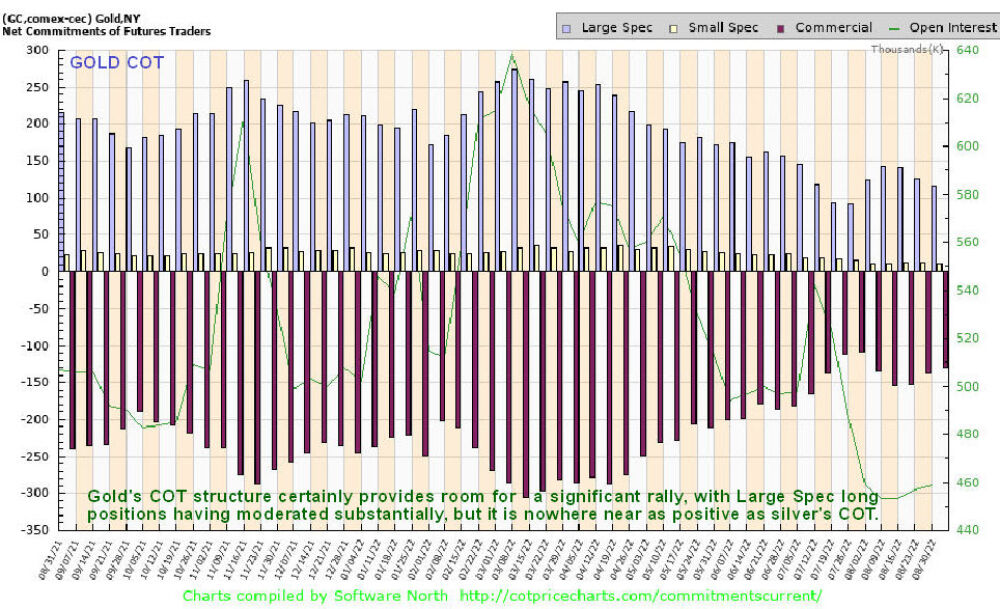

Now we will take a quick look at gold because it follows that if silver is set to turn up, then gold should too, even if its setup does not look so positive as silver’s, as is believed to be the case.

Gold’s 5-year chart enables us to see that it is now close to the bottom of a very large rectangular trading range, which is obviously a good point for it to turn higher, and it may be making a small Double Bottom with its July lows.

Whilst acknowledging that its high of March this year could have been it forming a Double Top with its 2020 highs, this is not thought to be the case, in part because of the strength of its Accumulation line relative to the price.

In the interest of completeness and to enable comparison with the silver COT chart above, gold’s COT chart is shown below.

As we can see, it is not as bullish as silver’s COT, but it shows that there is certainly room for a significant rally, with the Large Specs having substantially reduced their long positions.

Here it is worth reminding ourselves that gold remains very cheap relative to the general stockmarket, which we can easily do by looking at the 20-year chart of gold divided by the Dow Jones index.

Just by itself, this chart suggests that gold and gold and silver investments generally make more sense for investors going forward, especially those taking a longer-term view.

A key point to end on is that we should aim to take advantage of the artificially low price of silver and silver investments at this time, which is due to the market being rigged by the likes of J. P. Morgan.

When the debt market eventually blows up — and this is a question of when, not if — a tidal wave of money is going to flood into this market, and you don’t want to be trying to buy on limit-up days that may well come one after the other.

Much better to buy now when you can browse in peace before the mob shows up, like on a Black Friday sale, and it cannot be overstated how important it is to have some physical silver in your possession for use in the event of the banks slamming their doors and ATMs no longer working, which can be in the form of either coins or small bars.

When bartering for everyday items, silver is a lot more practical than gold.

Want to be the first to know about interesting Silver investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

CliveMaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Disclosures

1) Statements and opinions expressed are the opinions of the author, Clive Maund, and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.