Data Communications Management Corp. (DCM:TSX; DCMDF:OTCQX) is suspected to have formed an intermediate base pattern in recent weeks toward the lower boundary of a large trading range, and with results due to be released today after the close, it is thought likely that once they are it will at least make a run towards the top of the trading range, which would result in good percentage gains from here.

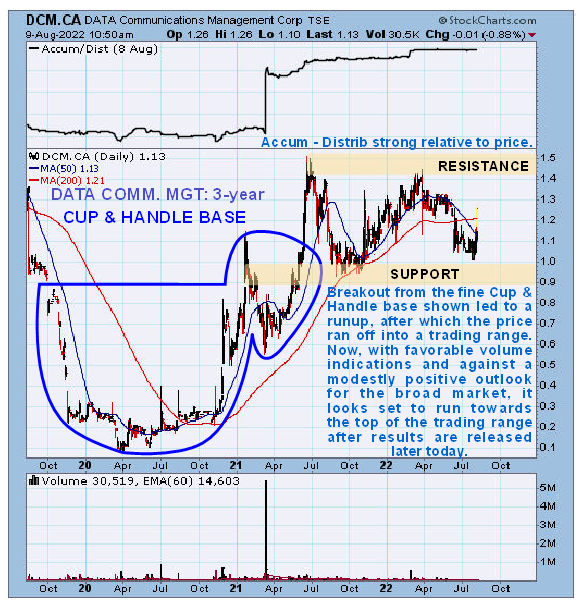

Let’s start by looking at a longer-term three-year chart on which we see that a fine large Cup and Handle base formed from late 2019 through early 2021.

Upon breaking out from this base it raced higher briefly before settling into the large trading range shown that has continued up to the present.

As it retreated back across the range for the second time from its March high its Accumulation line has remained buoyant and at a high level, which is a positive sign that suggests it has just made an intermediate base above the support towards the bottom of the range from which it should soon advance.

On the six-month chart we can see in much more detail the retreat from the March high and how it appears to have marked out a Cup pattern above the support since early–mid June.

After starting to advance again this month there was a sudden flurry of activity early today, which was no doubt due to the conference call and webcast, although since this has so far been been on relatively light volume it doesn’t mean much and is the result of jockeying ahead of the release of the second quarter results after the close today.

With the technical factors that we have reviewed suggesting a high probability of a significant rally once results are released, Data Communications Management is rated an Immediate Speculative Buy today ahead of them. The stock is very thinly traded on the US OTC market where limit orders should always be employed.

Data Communications Management website

Data Communications Management Corp. closed for trading at CA$1.11, $0.86 at 12.23 pm EDT on August 9, 2022.

Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

CliveMaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Disclosures

1) Clive Maund: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: Data Communications Management Corp. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.