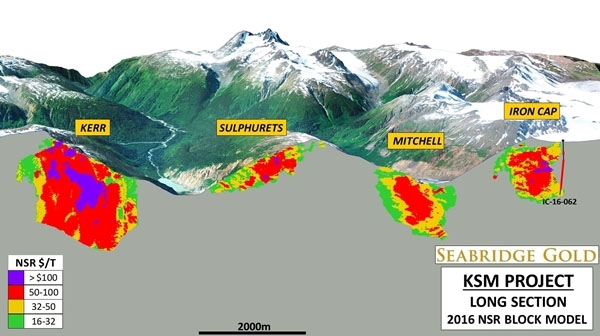

An expansion of Seabridge Gold Inc.'s (SEA:TSX; SA:NYSE.MKT) massive KSM project in British Columbia’s Golden Triangle would produce an estimated 14.3 billion pounds copper, 14.3 million ounces (14.3 Moz) gold, 68.2 Moz silver, and 13.8 million pounds molybdenum over a 39-year mine life.

A preliminary economic assessment (PEA) released Wednesday said the underground block cave mine with a small open pit at the copper-rich Iron Cap and Kerr deposits would have a peak mill feed production of 170,000 tonnes per day.

The mine is separate from the site detailed in an updated preliminary feasibility study (PFS) released in June that predicted a 33-year mine life with an annual production of 1 Moz gold, 178 million pounds copper, and 3 Moz silver from an open pit plan for the Mitchell, East Mitchell, and Sulphurets deposits.

“What this does, I think, is break down the development at KSM into manageable bites,” Matt Badiali, the founder and chief executive officer of Mangrove Investor Media, an independent investment research publisher, told Streetwise Reports. “The first one makes the most economic sense—open pit gold, copper, silver, and (molybdenum) mine, with good economics, but a hefty capex. And then a copper-gold block-cave underground project with a more manageable capex and big economic upside.”

The June PFS for Mitchell, East Mitchell, and Sulphurets has an initial capex of $6.4 billion and a post-tax net present value at a 5% discount rate of $7.9 billion. The PEA released this week for Iron Cap and Kerr adds $1.5 billion in capex and has a post-tax net present value at a 5% discount rate of $5.8 billion.

In an Aug. 4 research note, Red Cloud Securities analyst David Talbot said the PEA provides “considerable value” to the company, and maintained his Buy rating and raised his target price from CA$49.60 to CA$51 per share.

“This add-on project requires minimal infrastructure capital, as roads and other infrastructure, including a mill, would have already been built,” Talbot wrote.

In an Aug. 4 note, Red Cloud Securities analyst David Talbot said the PEA provides “considerable value” to the company and raised his target price to CA$51 per share.

Seabridge knows it needs to attract a potential partner to build the mine into production. The copper-rich deposits demonstrate the variety at the site—one of the largest gold-copper projects in the world.

“We are very mindful that a deep deficit in mined copper is projected to be on the horizon as the world electrifies and moves towards a net zero carbon future,” Seabridge Gold Chairman and Chief Executive Officer Rudi Fronk said. “We, therefore, wanted to highlight KSM’s potential to contribute to addressing this need more fully than the mine plan contained in our updated preliminary feasibility study. We think this opportunity will be attractive to a prospective partner.”

‘Too Much Copper There’

The red metal is an inescapable part of the world’s green future. Electric vehicles (EVs), would not exist as they are now without copper. They use three times the amount of copper as internal combustion engine cars.

One out of five vehicles sold worldwide could be an EV in less than two years, and Ford and General Motors have set a goal of achieving 40–50% of their sales from EVs in the U.S. by 2030.

This is expected to cause demand for copper to rise 16% and outstrip supply by more than 6 million tonnes by the end of the decade, according to independent energy research company Rystad Energy.

Badiali said the copper amounts at KSM alone are reason enough to consider taking a position.

“There just isn’t enough copper in the world,” he said. “There’s just too much copper at KSM for it not to become a mine.”

KSM Resource Has Grown

The PEA describes a block cave mine at Iron Cap with a small open pit mine at Kerr, with mill feed ramping up to 170,000 tonnes per day by year 12.

The PEA assumes that the PFS plan for the other deposits has been completed. Open pit equipment would be relocated to the Kerr deposit to begin pre-stripping while the Iron Cap block cave is developed.

KSM has the permits it needs to start construction. The company plans to apply for the government’s “substantially started” designation to ensure the continuity of its approved Environmental Certificate sometime after 2023.

KSM’s resource has grown from when it was bought in 2000 from about 3.4 Moz gold and 2.7 billion pounds copper to 88.4 Moz gold and 19.4 billion pounds copper in the measured and indicated category.

Seabridge has a market cap of $1.37 billion with 80.3 million shares outstanding. It trades in a 52-week range of $28 and $14.28.

Sign up for our FREE newsletter

Disclosures

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Seabridge Gold Inc. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.