Bion Environmental Technologies Inc. (BNET:OTCQB) has been kept under observation in recent weeks as it looks like it is preparing to embark on a major uptrend. As its name implies the company is involved in the green technology space which is a good area to be in with the climate change movement driving a lot of changes and developments.

It certainly cannot be claimed that the company has not been preparing for the times that we now find ourselves in and the times ahead for on the very long-term chart shown below we see that it has been around for a long time and was actually trading at much higher prices back in the 1990s.

On this arithmetic chart, it looks like it has been in a giant basing pattern since 2003, so for 19 years now and that ought to be all the preparation anyone needs. Although this chart is not of much use technically, there are two important bullish points we can observe in it.

One is the steady upward march of the Accum–Distrib line during the latter part of the giant base which is a sign of an incubating bull market and this portended the strong breakout move on big volume early last year which we can just make out.

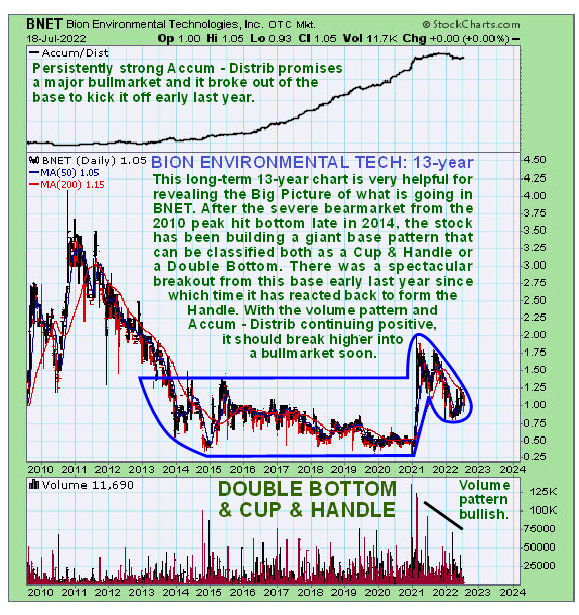

Because of the earlier high prices, the base pattern is “squashed flat” on the arithmetic chart, so we will now look at a 13-year chart which opens it out because it drops these earlier high prices in the 1990s and early 2000s.

On this chart we see that within what we took to be a giant base pattern on the very long-term chart, we can see a bear market from the 2010 peak that hit bottom late in 2014. A large base pattern then developed that really started to form late in 2013 that can be classified either as a Double Bottom or as a Cup & Handle base.

The steeply rising Accumulation line shown at the top of this chart promised a breakout from this base, which duly occurred early last year, that was quite spectacular, it occurred on huge volume and resulted in big percentage gains in a short period of time. Yet, as so often happens at the end of one of these giant base patterns, the price reacted back into the upper part of it to form a “Handle” to complement the Cup, which reflects the fact that it takes time for the fundamentals to improve enough to justify the revised higher valuation of the stock.

With the volume pattern and Accumulation line remaining strongly bullish it looks like investors are being presented with a fine opportunity to buy into BNET before its bull market really gets going in earnest.

So now we will proceed to look at recent action in the stock on the six-month chart. The reason for holding off recommending it in recent weeks, apart from broad market weakness, of course, is that having made a run at its still falling 200-day moving average to become short-term overbought, it looked like it would react back some, which it has now done.

This reaction has allowed time for the converging moving averages to come together more, creating a better environment for a sustainable advance to gain traction since any significant advance from here will quickly result in a bullish cross of the moving averages.

It is encouraging to see it dropping back intraday over the past few weeks to successfully test the support level shown, which has left behind a string of bullish long-tailed candles on the chart. So it now looks better placed to seriously challenge the resistance in the $1.10-$1.30 zone better seen on longer-term charts.

The conclusion is that Bion Environmental Tech is building up to a major bull market which it now looks very close to starting, with the reaction of recent weeks bringing it back to a good entry point and it is rated a buy for all timeframes. Given the length of time the company has been around, the number of shares in issue is very reasonable at about 43 million, so this will not be an inhibiting factor.

Bion Environmental Tech website

Bion Environmental Technologies Inc. traded at $1.05 at 9.50 am EDT on July 19, 2022.

Want to be the first to know about interesting Biotechnology / Pharmaceuticals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

CliveMaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Disclosures

1) Clive Maund: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Bion Environmental Technologies Inc. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

6) This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.