Solar is back. This 10-year chart of the Invesco Solar ETF (TAN) of solar-based stocks shows the surge in price and volume. This pull-back in the sector provides a buying opportunity.

Greenbriar is filing a form 20-F to the SEC for a NASDAQ listing. This is a sample of junior NASDAQ-listed solar companies and one on the OTC. They all spiked up in price around the same time the TAN ETF did above and have now settled back considerably with the recent market correction.

- Recent price $2.60, Recent high $25

- Annual revenue $37.9M

- Market Cap $75.6M

Solar Integrated Roofing Corp. (SIRC:OTCMKT)

- Recent Price $0.43, Recent high $3

- Annual revenue $17.0M

- Market Cap $72.2M

SPI Energy Co. Ltd. (SPI:NASDAQ)

- Recent Price $3.62, Recent high $15

- Annual revenue $97.8M

- Market Cap $81.6M

VivoPower International Plc (VVPR:NASDAQ)

- Recent Price $2.62, Recent high $18

- Annual revenue $40M

- Market Cap $48.5 M

I first bought Greenbriar mostly because of their Montavla project in Puerto Rico. However, the speed at which politics moves there is probably slower than any U.S. State. I expect this will come to fruition this year with a final Power Purchase Agreement signed, but Montavla has dropped to third position among Greenbriar's assets that will positively affect the stock first, before Montavla during this year.

Greenbriar Capital Corp. (GRB:TSX.V; GEBRF:OTC)

- Shares outstanding — 29 million, approximately

- Insiders own 21%

- Market Cap $30M (less Captiva, CSE:PWR share value)

In no way I am down playing Montavla as it is the largest solar/battery project in the Caribbean and will replace the highest cost and dirtiest energy in North America. The realized power price for Montavla is about 400% higher than the US mainland and the project area has the highest solar radiation in Puerto Rico. There is also an existing 115 kV PREPA transmission line across the property.

If it wasn't enough that hurricane Maria destroyed infrastructure, including the electrical grid in 2017, an earthquake destroyed their largest power plant in 2020.

Montavla will be very very lucrative to Greenbriar and its shareholders, but solar projects in Alberta, Canada will start construction before Montavla.

Greenbriar has executed a long-term solar energy supply agreement with West Lake Energy, a privately owned oil and gas company based in Calgary. Under the agreement, Greenbriar will build, own and operate 90 megawatts of solar power and West Lake will purchase all of it.

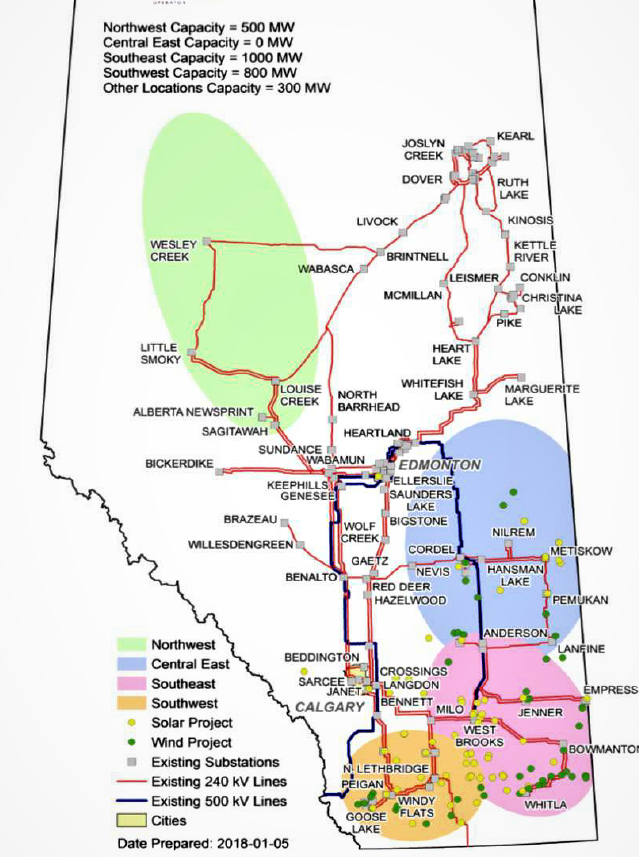

Many oil and gas companies, especially the seniors, are doing similar type things with green energy projects so they can offset their carbon foot print and be perceived as good corporate citizens. As for solar in Canada, Alberta has the best solar radiation in the country. At left is the electrical grid map from the Alberta Electrical Systems Operator indicating lots of grid capacity except in the Central East area.

Many oil and gas companies, especially the seniors, are doing similar type things with green energy projects so they can offset their carbon foot print and be perceived as good corporate citizens. As for solar in Canada, Alberta has the best solar radiation in the country. At left is the electrical grid map from the Alberta Electrical Systems Operator indicating lots of grid capacity except in the Central East area.

The initial 90 megawatt solar energy facility should have an approximate 10-year annual levelized EBITDA of CA$19,500,00 and a CAPEX of approximately CA$105 to CA$120 million. Greenbriar has engaged Nu-E Corp, a leader in renewable energy construction, to build the facility. In the longer term, Greenbriar and West Lake intend to eventually produce 400 megawatts of solar energy.

Sage Ranch, Tehachapi, California

Sage Ranch is a green/sustainable $480 million fully approved 995-unit subdivision in a prime real estate market. It is a 138-acre site located between the parallel arterial roads of Valley Boulevard and Pinon Street near downtown Tehachapi. The site is within half a mile from the City Hall, immediately adjacent to all schools, and in close proximity to many shops, restaurants, and public spaces in the Downtown District.

Non-dilutionary bank construction financing will be provided at the project level. Further, the USDA (U.S. Department of Agriculture) and other federal agencies provide 30- to 38-year, sub-2-per-cent home purchase mortgages requiring only a 3% down payment, making the mortgage payments to assist professional families, seniors, and single occupants an affordable home ownership package that is less expensive than renting.

Greenbriar owns the 995-unit project without any debt, being one of the only projects of this size in the United States to own 995 lots, debt-free. This is in, and of itself a $120 million to $150 million net value to Greenbriar.

Sage Ranch has engaged Paul Morris of Forward Living Keller Williams to lead the sales effort. You should watch this video, with California real estate expert Paul Morris. Buyers are anticipated to come from the large sophisticated population of engineers and skilled tradesmen related to the aeronautical and high tech engineering involvements in the Mojave and Kern County Area. Northrup Grumman, Tesla, Space X, Edwards Air Force Base, NASA, and numerous other engineering affiliations all have regional involvements with high paid and affluent employees.

All Single-Family homes will have PV roof panels with attached homes having shared panels. Water consumption will be reduced for parks and open spaces with reclaimed water connections.

You can view the Final Master Development Plan at this link for further detail.

You can view the Final Master Development Plan at this link for further detail.

Financial

Last financial statements at Sept. 30, 2021, show cash of CA$45,747. Since then, Greenbriar closed a CA$495,000 financing at $1.65 per unit on Nov. 8, 2021. Neither of the companies three current projects require any equity financing. They will all be financed with debt at the project level.

Summary

The unique aspect that Greenbriar's projects can be developed without equity financing gives large leverage for investors buying the stock. The company is moving from a development company to a revenue-generating one and this segment in a stock's life cycle usually produces large gains. Any one of their three projects will generate enough revenue to propel the stock much more higher than the current price.

Greenbriar has the management to get the job done and they have the incentive with 21% share ownership. Jeff Ciachurski, chief executive officer, was a founder and CEO of Western Wind, which sold for $420 million in 2013. Cliff Webb, president, is a professional engineer with 40 years of power engineering experience directly applicable to regulatory, EPC, and financing renewable energy development. Devon Sanford, president of Greenbriar Alberta, is a leading electrical contractor knowledgeable in design/construction of electrical power distribution systems including utility scale solar systems. Paul Morris, CEO of Sage Ranch, was in the video previous. Dan Kunz, chairman, was the former CEO of US Geothermal Inc., which constructed and operated three geothermal power plants in the U.S. Previous to that, he was president of Ivanhoe Mines, in charge of building the $10 billion Oyu Tolgoi copper/gold mine in Mongolia. Check out the whole team here.

The four junior solar companies on page 1 have average annual revenue of $48 million and an average market cap of about $70 million. As Greenbriar's projects move into revenue generation, this year and next they should reach in excess of $120 million in revenue per year. To move up to the average valuation to the comparable companies, it would mean a stock price 2.3 times higher. Greenbriar also owns about 36.5 million Captiva Verde, CSE:PWR shares that could add value. Currently valued at around $3 million, Captiva has the right to earn a 50% net profits interest in Sage Ranch.

I believe Greenbriar's Montavla and Sage Ranch have much higher profit margins than comparables and will warrant a higher revenue multiple. Furthermore, revenues should well exceed $100 million above the $70 million average of comparables. It is easy to put a price target of $4.00 to $5.50 on the stock for 2022.

The chart set up is very nice with a strong base to move up from and first resistance at $2 is mild.

For 27 years, Ron Struthers, founder and editor of Struthers' Resource Stock Report and Playstocks.net, has consistently beat the comparable benchmarks selecting stocks in the precious metals, oil & gas, clean-tech and disruptive technology sectors. In 2017, 35 stocks in the precious metals sector saw an average gain of 62% and energy clean-tech an average gain of 65%. In disruptive technology, 16 picks saw an average gain of 55%. Past performance is no guarantee of future gains. Struthers leverages his vast network of contacts, approaches investments from a value perspective seeking several 100% gain potential and uses technical analysis to aid in buy and sell levels.

SWR Disclosures:

1) Ron Struthers: The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication. Additional disclosures above.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Greenbriar Capital Corp., a company mentioned in this article.