Cruise line stocks remain well below pre-pandemic valuations, but it appears a recovery is starting to accelerate across the industry. Several cruise lines have announced their future bookings are rising at a record pace as they ramp up their fleets to prepare for a massive post-pandemic surge in demand.

Cruise operators remain optimistic that a return to normal operations is attainable during the spring of 2022. Industry executives noted that a surge in delta variant cases was a speedbump on the road to recovery and are likely to view future potential spikes similarly. Best of all for cruise lines, ticket prices remain significantly elevated compared to 2019 levels.

Related Stocks: Carnival Corp. (CCL:NYSE), Norwegian Cruise Line Holdings Ltd. (NCLH:NYSE), Royal Caribbean Group (RCL:NYSE)

Cruise Industry Still Set for Success Despite Delta Variant

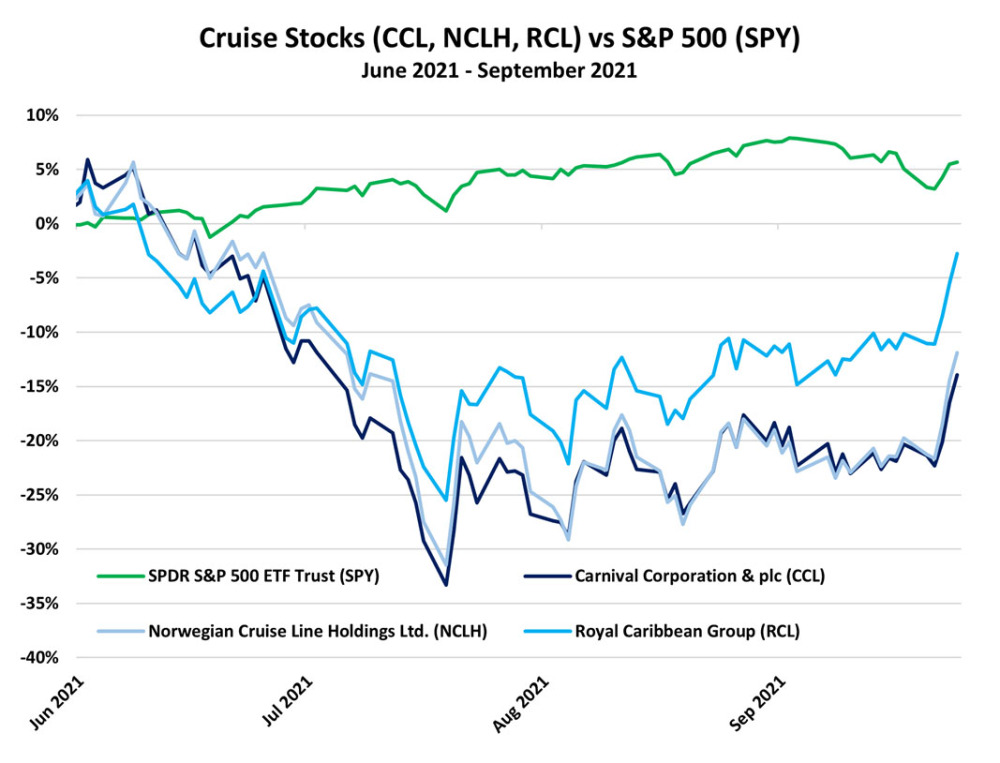

As the entire travel industry grappled with another surge in COVID-19 cases amid the spread of the delta variant, consumer demand for leisure and travel plummeted. However, the recent uptick in cases is largely viewed as a minor setback in a longer-term path toward the normalization of operations, and demand is slowly recovering.

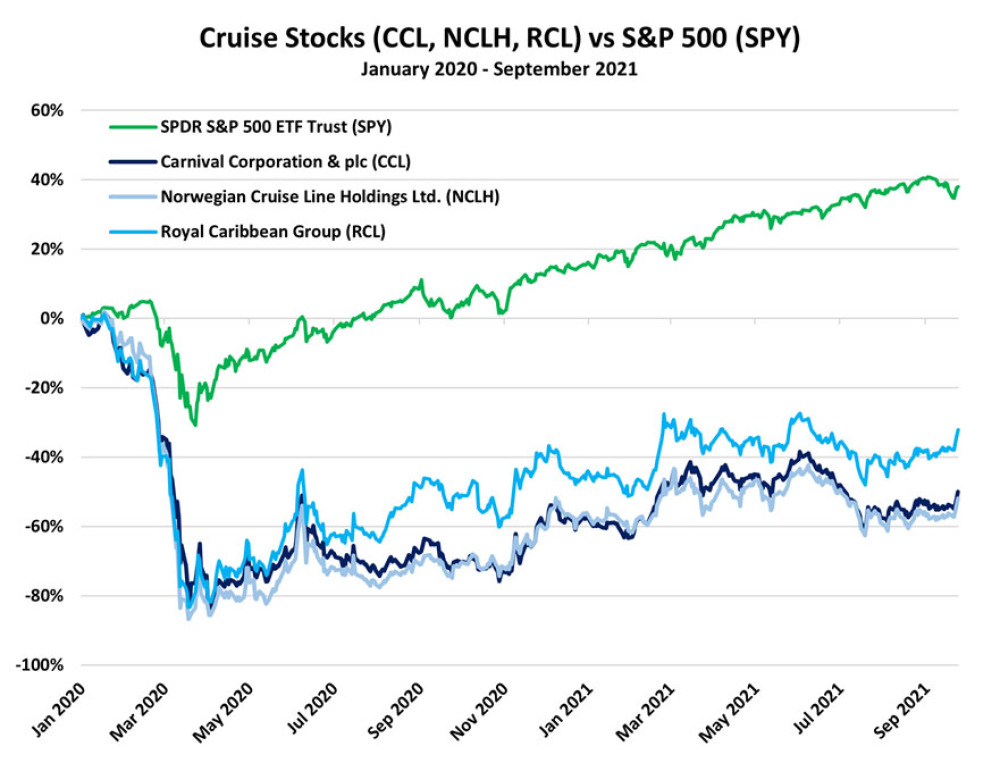

In the cruise industry, one of the hardest hit sectors during the initial outbreak of the pandemic in March 2020, valuations of cruise stocks remain roughly half of what they were prior to the crash. After completely shutting down operations, ships have begun to set sail once again as the industry ramps up its plans to return to full capacity.

To receive all of MRP's insights in your inbox Monday–Friday, follow this link for a free 30-day trial. This content was delivered to McAlinden Research Partners clients on September 27.

MRP highlighted the cruise industry’s building comeback in August, noting that significant pent-up demand is ready to be unleashed, setting up the sector for an early 2022 recovery.

Carnival Corporation recently announced that it expects to have 42 ships in service by the end of October this year, which is more than half of its total fleet, per Cruise Fever. Carnival also reported earnings that bolstered an improved long-term outlook despite temporary virus-related setbacks.

CNBC reports that Carnival’s voyages in the third quarter were cash flow positive, a trend that the company expects to continue. Further, eight of Carnival’s nine cruise lines have begun sailing with passengers on board, hoping that strong demand will return following a successful second quarter due to rising vaccination rates.

Occupancy rates on those cruises have averaged roughly 59% in August, up from 39% in June, and with a 70% peak in July amid the easing of restrictions, per Cruise Hive.

Similarly, Viking Cruises recently announced it had received record bookings for 2021 and 2022 cruises and has now added more global cruises for 2023 to capitalize on strong demand, Fox Business writes. Viking’s Chairman Torstein Hagen stated previous cruises sold out in a matter of weeks, and he is seeing more interest in extended voyages than ever before.

While effects of the delta variant cannot be overlooked, cruise industry executive and analysts alike have their sights set on 2022 as a breakout year for cruising.

Cruises Poised for Record 2022 as Prices Remain Strong

Royal Caribbean noted on its most recent earnings call that near-term demand has been hampered by the pandemic, yet demand for future bookings remains robust. Jason Ader, CEO of SpringOwl Asset Management, told CNBC in an interview that, while the recent demand for travel was above 2019 peak levels for a few months, that desire for travel has temporarily subsided over the last 60 days.

Carnival reported a similar slowdown, as Cruise Hive writes the company saw a slight slump in bookings in August but expects a continued upturn in the number of ships sailing through the end of the year.

Oceania Cruises, owned by Norwegian Cruise Lines, recently reported a single-day record for bookings for voyages setting sail in 2023, per USA Today. The company has also followed the industry trend of reporting a difficult few months but strong future prospects.

Even as delta created a temporary slowdown in bookings, pricing has remained high. Travel Weekly recently highlighted a report from Truist Securities that found that bookings have decelerated in the last eight weeks, but there has been no noticeable change in pricing growth, which remains significantly ahead of 2019 levels.

CNBC also notes that Norwegian Cruise Lines’ ticket prices are 20% higher than 2019 levels, and that pricing for 2022 remains solid.

The Truist Securities report shared additional bullish news, noting that onboard spending has surged as cruisers are purchasing drink and restaurant packages at a record pace. The spending splurge is likely due to the fact passengers are playing "vacation catch-up’," and that consumers are less fearful of modest onboard COVID outbreaks, travel executives told Travel Weekly.

Those trends are likely to continue as vaccination rates climb and travel restrictions ease.

To conclude, cruises are slowly but surely returning to normal operations and remain on pace for full capacity in the spring of 2022. While the delta variant has been a temporary setback for cruise operators, sentiment remains broadly positive.

Future bookings continue to advance at a record pace and ticket prices remain elevated compared to 2019 levels. Cruise line stocks are still significantly below their pre-pandemic levels, as the industry’s recovery has been remarkably difficult after a complete shutdown of operations for months on end.

However, the recovery is finally beginning to take shape and the cruise industry is prepared to rake in much-needed profits heading into 2022.

Originally published Sept 27, 2021.

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

Disclosures:

1) McAlinden Research Partners disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

McAlinden Research Partners:

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.

Charts and graphs provided by McAlinden Research Partners.