Canadian junior MAG Silver Corp.'s (MAG:TSX; MAG:NYSE American) agreement to acquire Gatling Exploration Inc. (GTR:TSX.V; GATGF:OTCQX) gives it a new avenue for exploration that fits well into its portfolio, several analysts said.

As part of the transaction, MAG gets Gatling's 3,370-hectare Larder gold project in a jurisdiction that's favorable to mining.

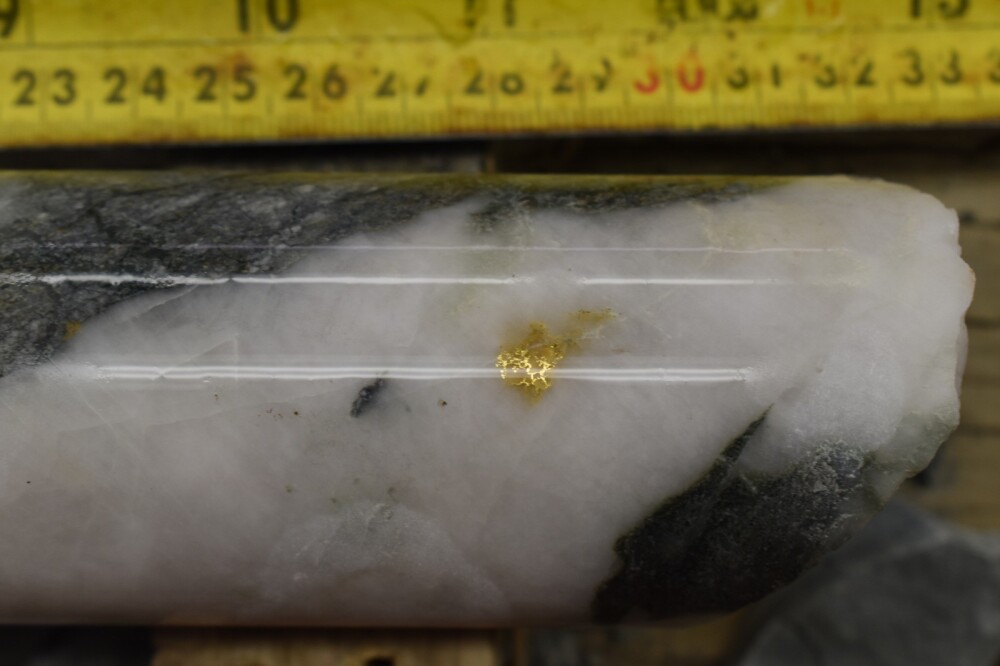

Larder spans 4.5 kilometers in northern Ontario's Abitibi Greenstone Belt, 35 kilometers east of Kirkland Lake, an established gold camp where more than 70 Moz of gold have been produced. It hosts three connected, high-grade deposits — Bear, Cheminis, and Fernland— and is only 7 kilometers from the Kerr Addison mine, which produced 11 Moz of gold.

Larder spans 4.5 kilometers in northern Ontario's Abitibi Greenstone Belt, 35 kilometers east of Kirkland Lake, an established gold camp where more than 70 Moz of gold have been produced. It hosts three connected, high-grade deposits — Bear, Cheminis, and Fernland— and is only 7 kilometers from the Kerr Addison mine, which produced 11 Moz of gold.

"This acquisition provides an additional growth avenue for MAG whereby cash generated from Juanicipio can be reinvested into exploration at Larder," Stifel GMP analyst Stephen Soock said in a March 13 research report.

At its flagship high-grade, large-scale Juanicipio project in the Zacatecas state of Mexico, MAG is moving to being a producer and opening a 4,000-tonne-per-day processing plant in the second quarter of this year. It also is continuing its exploration at its Deer Trail property in Utah.

Several analysts maintained their ratings for MAG after the move to acquire Gatling, including Richard Gray of Cormark Securities Inc., who continued to rate the company Market Perform with a target price of CA$23.00.

"This acquisition provides an additional growth avenue for MAG whereby cash generated from Juanicipio can be reinvested into exploration at Larder."

—Stifel GMP analyst Stephen Soock

"With commissioning of the Juanicipio plant expected to commence in Q2/22 (with operations ramping to 85-90% capacity by year-end), we are encouraged to see MAG reprioritize exploration," Gray wrote March 14. "The company is in the midst of its Phase 2 drill program at its Deer Trail project in Utah and will now look to leverage Gatling's existing exploration team (and) expand resources at the Larder project in Ontario."

In the deal for Gatling, each Gatling shareholder will get 0.017 of a common share of MAG for each share of Gatling held. The consideration values Gatling at approximately CA$0.40 a share, representing a premium of 47.4% to Gatling shareholders, based on the five-day volume weighted average price of each company as of close on March 10. Upon completion, Gatling shareholders will hold 0.79% of MAG shares on an outstanding basis, MAG said.

The boards of directors of both companies have approved the arrangement, which should be completed by late May, MAG said.

According to Gatling, a 2021 global mineral resource estimate (MRE) pegged the Larder resource at 388,000 indicated ounces gold, with another 933,000 inferred ounces. The resource spans all three gold deposits. All parts of the property are accessible by truck or all-terrain vehicles on non-service roads and trails.

"Gatling represents a really good opportunity for MAG Silver," MAG President and Chief Executive Officer George Paspalas told Streetwise Reports. "What's made us successful is our ability to get on the properties that tick the location location location box."

Juanicipio Plant on Track

MAG's Juanicipio plant in Mexico was dealt a blow over the holidays when an electricity regulator's decision delayed its commissioning. But the company said the operator of the project, Fresnillo plc, is processing extra loads to take up the slack. MAG joined with Fresnillo in 2005 to develop the property, which it calls a "robust, high-grade, high-margin underground silver project exhibiting low development risks."

The JV is mining the Bonanza and Deep zones of the Valdecañas vein in the Zacatecas state of Mexico. A 2017 preliminary economic assessment on the project estimated a 19-year mine life of 4,000 tonnes per day.

MAG owns 44% interest in Juanicipio, while Fresnillo owns the remaining 56%. The mine generated a total of 251,907 tonnes of mineralized material in 2021, resulting in 3.2 million ounces of silver and 6,577 ounces of gold, the company announced Jan. 26.

Paspalas said the Juanicipio plant was still on track. "I think people are going to be surprised when they see the grade of what we're processing, the tonnage, the cashflow," he said.

On Monday, MAG also announced the appointment of a new chief financial officer. Fausto Di Trapani is replacing Larry Taddei, who stepped down after 12 years with the company. Di Trapani has held roles at BHP Billiton Ltd. (BHP:NYSE; BHPLF:OTCPK), Norilsk Nickel (GMKN:RTS; NILSY:NASDAQ; MNOD:LSE), and Mantra Resources Ltd. (MRU:TSX) before most recently serving as chief financial officer at Galiano Gold Inc. (GAU:NYSE)

Disclosures:

1) Steve Sobek compiled this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: MAG Silver Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of MAG Silver Corp., a company mentioned in this article.