MAG Silver Corp.'s (MAG:TSX; MAG:NYSE A) joint venture with Fresnillo Plc (FRES:LSE) is gearing up to begin silver production at the high-grade, large-scale Juanicipio property on the Fresnillo Silver Trend in Mexico. MAG has a 44% interest in the project, and first production from the underground mine should begin in the next few months, with commissioning of the flotation plant likely by mid-2021.

MAG Silver is on the radar of numerous securities firms; all give the miner at minimum a Buy rating, with BMO and National Bank of Canada rating it Outperform. Target prices range from CA$32 to CA$18 per share.

Don DeMarco, analyst with National Bank of Canada, wrote on April 27, "our Outperform rating considers Juanicipio's large, long-life and low-cost asset with steady cash flow, exploration upside and motivated operator in Fresnillo."

BMO's investment thesis on MAG Silver is the company "offers investors 44% exposure to the world class Juanicipio mine. Juanicipio is expected to deliver robust economics and FCF [free cash flow] given its high grades."

ROTH Capital Partners analyst Joe Reagor wrote on March 30, "MAG Silver Corp. is one of our Top Ideas for 2020 and an emerging silver producer set to enter production this year. . . we rate the company Buy with a US$23 price target as we believe it is poised to rerate as a producer."

What is going on with this project in Mexico to garner such interest? "MAG Silver is the highest grade developing silver asset of size in the world today," Michael Curlook, MAG's Vice President of Investor Relations and Communications, told Streetwise Reports.

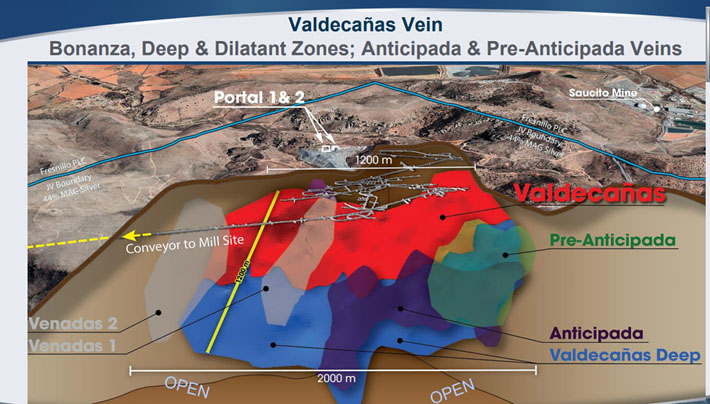

The joint venture is developing the underground mine on the Juanicipio property to mine the Bonanza and Deep zones of the Valdecañas vein. The 2017 preliminary economic assessment (PEA) on the project estimated a 19-year mine life of a 4,000 tonne per day mine, and an after-tax internal rate of return of 44%. Despite minor Covid-related delays, the partners expect underground production to begin mid-year.

Covid-19 restrictions have been put in place in Mexico, and while exploration and development of the mill have temporarily stopped at Juanicipio, underground mining continues. "Miner safety protocols equip them with respirators, and machinery can be run by one person and in a work distanced environment, so not too many adjustments have needed to be made," Curlook said. As far as supplies for the construction of the mill, the long-lead items were ordered in November 2018, and major components, such as the ball mills, the SAG mill, settling tanks, etc., have been delivered and are sitting on site, awaiting assembly.

H.C. Wainwright & Co. analyst Heiko Ihle, in an April 28 report, stated, "While COVID-19 disruptions are likely to slightly delay the start of production at Juanicipio, we nonetheless expect this impact to be minor and temporary."

The company recently closed a CA$60 million private placement with veteran investor Eric Sprott that will help fund its US$60 million capex requirement at Juanicipio.

The private placement was viewed positively by analysts. Heiko Ihle of H.C. Wainwright & Co. noted, "We continue to believe that the market is not yet fully appreciating the near-term producing nature of the mine, as evident by the overwhelming support of Mr. Sprott."

Craig Hutchison, an analyst with TD Securities, wrote on April 27, the "equity offering significantly de-risks any financing overhangs for MAG particularly in light of the volatility in the equity markets combined with the potential for development delays at Juanicipio related to COVID-19."

MAG noted that its stockpile of mineralized material is steadily growing on surface. Sometime this summer, the joint venture plans on trucking mineralized material to the nearby Fresnillo mill for processing.

In addition, MAG cited other advantages of beginning the processing now. "It will enable us to start claiming back our 16.5% VAT tax. Also, processing the mineralized material through a mill that is nearly identical to the mill we are constructing on site will give us information on how the material performs through the process, which will have a positive effect on the ultimate time needed to commission the new mill. Fresnillo has said that we should be at 85% of nameplate capacity by the end of 2021," Curlook said.

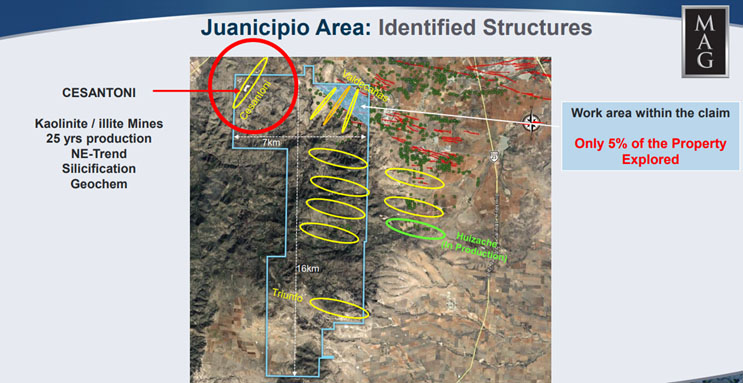

While construction continues on the Juanicipio underground project, less than 5% of the Juanicipio property has been explored, and exploration is moving ahead on several fronts. The first is at the Valdecañas vein, where the Juanicipio project will start underground production soon. The deposit is open at depth and it is open east and west. In addition to expanding the deposit, the company is also conducting infill drilling, with the goal of raising the resource from the Inferred to the Indicated category. "For almost three years, we've continued to drill and keep finding more resources, adding more and more tonnage with every successive year," Curlook stated.

"In order to achieve true-width intersections at the depths of the Valdecañas Vein, we needed to step out farther laterally across the property before angling down, and in doing so we have found two new veins, the Anticipada and Pre-Anticipada zones," Curlook said. "They are significant and also very close to Valdecañas: the Anticipada is about 100 meters away and the Pre-Anticipada is about another 120 meters from the Anticipada."

"This gives us increased mining flexibility," Curlook explained. "These veins allow us more optionality."

Also in the area are the Venadas 1 and 2 veins, located on the left of the map above, but they are north-south structures. "In 450 years of mining in the district they've never encountered a significant NS vein," Curlook said.

The second exploration area is Cesantoni, a north-south structure located at the top left of the Juanicipio property. It is a clay open pit that has been excavated for many years. The Cesantoni company produces porcelain tile and bathroom fixtures from the kaolin mined. In the floor of the clay pit lies a silica ridge, which is another potential indicator of one of these veins, Curlook said. "We need to know if it's mineralized, and if it is, comparatively speaking, it has the potential to be another Valdecañas."

This target is likely to be drilled next year. "It is one of the priority targets of the exploration program for Juanicipio," Curlook explained.

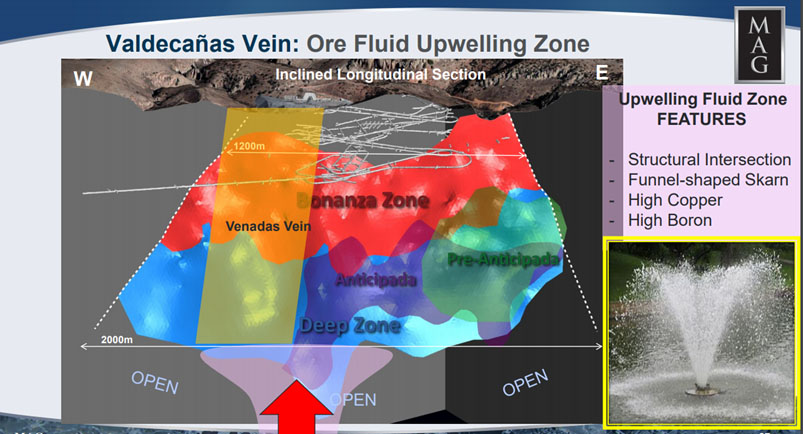

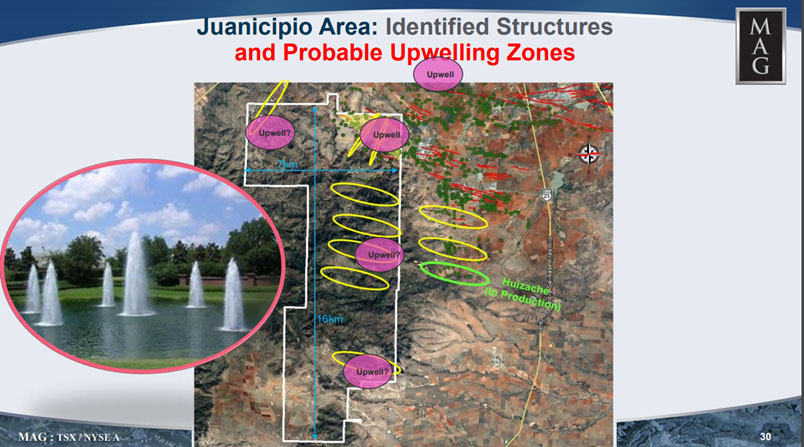

Another exploration target is the ore fluid upwelling zone. "MAG's Chief Exploration Officer Peter Megaw tells me the Fresnillo district is characterized by swarms of veins all of which appear to be fed by a 'master vein' that sits atop an ore fluid upwelling zone. Several are historically known in the district, spaced 2 to 8 km apart and the Valdecañas Vein is clearly one also. The surface over the Valdecañas Vein shows distinctive alteration and other geological features that are seen elsewhere in the 7 x 16 km Juanicipio property, suggesting that additional mineralization centers remain to be found," Curlook explained.

Analysts have homed in on the exploration potential. "While the near-term focus remains on advancing Juanicipio to commercial production, MAG's outlook beyond that remains on (1) organic growth, and unlocking the upside potential of the Juanicipio project, and (2) establishing a shareholder dividend at some point in the future," Craig Hutchison of TD Securities wrote on April 27.

MAG Silver has approximately 93 million shares issued and outstanding, and 95 million fully diluted. Approximately 80% of the shares are owned by institutions, including Fresnillo Plc, Sprott Asset Management, Blackrock Asset Management, Eric Sprott and Van Eck Associates.

Read what other experts are saying about:

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: MAG Silver. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.