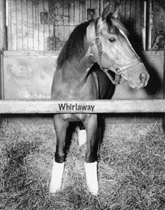

In the late 1930s, a young stallion was born in Lexington, Ky., at the legendary Calumet Farm, that went on to win seventeen major races from 1940–1942, including the Triple Crown (Kentucky Derby, Preakness and Belmont Stakes) in 1941. Named after his brood-mare mother, Dustwhirl, this record-breaking stallion went by the moniker of "Whirlaway," and was famous not only for his speed and power but also for his "quirkiness."

Whirlaway had a bad habit of "drifting out" to the middle of the track, taking him out of contention in races that were clearly his to win. This behavior was so troublesome that trainer Ben A. Jones fitted the colt with a special full-cup blinder over his right eye while preparing for the Kentucky Derby, and after cutting a tiny hole in it to allow a limited field of vision, Whirlaway stayed on course and blew the field away with a record-breaking eight-length victory.

Another trait of this magnificent horse was his preference for lagging the field, and one of the trademark phrases used countless times as the horses rounded the Clubhouse Turn was "and here comes Whirlaway!" The crowds would roar as he turned on the afterburners, passing the field in a blaze of acceleration and focus.

What, pray tell, does this have to do with the metals markets or COVID-19 or the inflation-deflation debate? Nothing. Nothing at all. But what it does perfectly describe is the behavior of the one precious metal that we love to hate and that we hate to love—silver.

Which of the metals, packed with superlative fundamentals and above average technicals, tends to "drift out" into the middle of the track, aimlessly lagging its precious metals brethren, gold and the gold mining equities? Silver. Since this golden bull market exploded out the starting gate in May 2019, there have been countless times that I have wanted to fit a full-cup blinder over silver's right eye to keep it on course.

During the summer of 2019, as I was contemplating the launch of GGM Advisory, gold broke out of a multiyear ceiling at US$1,375/ounce and rocketed to the $1,565/ounce. I watched in abject horror as the GSR (gold-to-silver ratio) flew to 95, leaving behind a trail of heartbroken silver bugs, aghast at the underperformance and outraged at the blatant interventions that capped it.

Whether it is silver's Whirlaway-like "quirkiness," or the odious machinations of the bullion banks, the metal has had a habit recently of exhibiting aberrant behavior, which has cost me and many other investors not only a lot of money but also a loss of willpower, where our bullish conviction is wrung out of us by the absurdity of silver's tape action.

However, you will recall what I said about Whirlaway's preference of "lagging the field?" There isn't a day that goes by when I don't look at the silver quote and see that mighty stallion, lollygagging at the back of the precious metals field, totally ambivalent to the thundering hooves of GLD, GDX, GDXJ and a myriad of junior miners. To describe it as "maddening" is understatement of the highest order. To call it "bizarre" is testimonial to the criminality of the exchange upon which it resides. Whatever the case, it has been agony.

However, just as I have watched the horse come from last to first in a mere quarter-mile of pulsating excitement, I have always known that my little silver "Whirlaway" was going to make his move, exactly as happened in 1941, when he captured the Triple Crown. Sure enough, it was only eight days ago that I issued Email Alert (EA) 2020-80 and wrote: "I am finally confident enough to assume that the GSR (gold-silver ratio), currently at 111, is heading back to 80 over the balance of 2020." I then proceeded to "damn the torpedoes" and doubled down on SLV (IShares Silver Trust), while adding another huge swath of the July $17 calls.

Call it whatever you wish—luck, clairvoyance, acumen (or dementia)—Friday May 15 had gold sporting a 0.67% gain and silver up a huge 4.33% (!), taking the GSR to its lowest post-crash reading at 103.65.

To put this into perspective, shortly after gold bottomed in late 2015, the GSR rose to around 83 by February of the following year, with silver "lagging the field," just like the last two months. Then, as if injected with amphetamines, silver vaulted forward, taking the GSR from 83 to 66 in three months.

Understanding silver's "quirkiness" is many times difficult, and trading around its idiosyncratic nuances can be very costly, but once you know that it has finally taken the bit in its teeth, silver gives one a ride fifty times as exciting as any amusement park "coaster" or Elon Musk stock promotion.

Writing about silver conjures up memories of superstitions of days gone by. Forecasting a sharply higher price is like being in the dressing room between second and third periods, up 3–0, and saying out loud the word "shutout." It is like Bill Murphy's LeMetropole Cafe website, where we beg him to not show a rocket blasting off with the word "silver" on it. No dearth of leprechauns, rabbits feet, four-leaf clovers or Amazonian virility symbols are enough to ward off the silver demons, because we have endured the silver jinx all too many times.

The point of this missive is this: False breakouts notwithstanding, when silver finally catches a bid, as happened in late 1979, early 2016 and August 2019, the moves are breathtaking. At the very least, a test of the September 2019 highs at US$19.75/ounce appears to be the most likely target.

The period of seasonal weakness referred to in earlier missives is mainly for gold; silver is not as suspect because it responds to different stimuli not related to seasonality. In the 2020-80 EA, I spoke of a flat gold price and a GSR of 80. If that holds, with gold at US$1,750, silver will print US$21.875, a 44.3% advance from the May 8 entry at US$15.15.

Another important consideration is this: Silver's underperformance was one of my causes for concern for the Senior and Junior Gold Miner exchange-traded funds (ETFs; GDX:US & GDXJ:US), and now that silver has assumed a leadership role, the odds of a meaningful correction in gold (and the miners) are diminished. While I have elected to stand aside on the GDX/GDXJ combo, the massive July call position in SLV will compensate in spades if we get the Whirlaway charge.

Let us not forget that our second largest portfolio position remains Aftermath Silver Ltd. (AAG:TSX.V) (CA$0.28 / US$0.208 per share); behind the mighty Getchell Gold Corp. (GTCH:CSE), so we have enormous leverage to both rising gold and galloping silver prices. As the post-lockdown period unfolds and you are trying to figure out what silver is going to do, remember the immortal words of Derby announcer Dave Johnson in 1941:

". . .and h-e-r-e c-o-m-e-s Whirlaway!"

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

[NLINSERT]Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Aftermath Silver, Getchell Gold. My company has a financial relationship with the following companies referred to in this article: Aftermath Silver, Getchell Gold. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Aftermath Silver. Please click here for more information. Within the last six months, an affiliate of Streetwise Reports has disseminated information about the private placement of the following companies mentioned in this article: Aftermath.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Aftermath Silver, Getchell Gold, companies mentioned in this article.

Charts provided by the author.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.