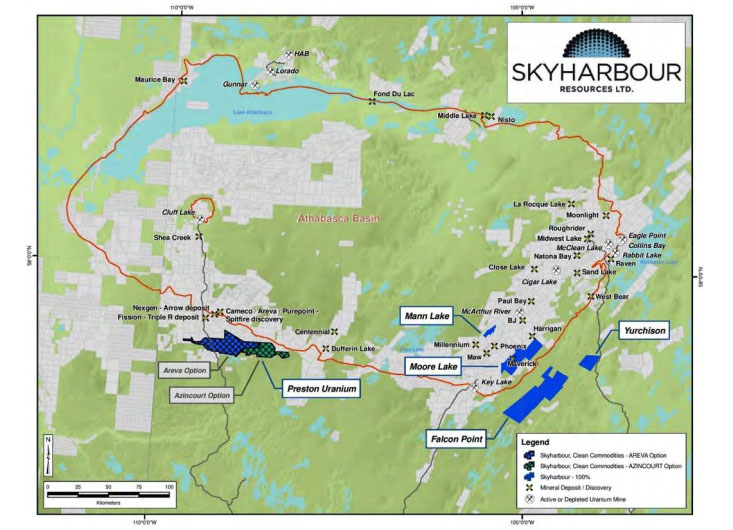

Uranium development company Skyharbour Resources Ltd. (SYH:TSX.V; SYHBF:OTCQB) holds six projects in the Athabasca Basin in northern Saskatchewan, home of the highest grade depository of uranium in the world.

The company has been actively exploring and drilling the flagship Moore Lake project over the last several years and is planning an upcoming program that holds the potential to be a key catalyst in the near term. It acquired the project from the company's largest shareholder and strategic partner, Denison Mines. Denison CEO David Cates sits on Skyharbour's board.

For its other five projects, Skyharbour employs prospect generation, bringing in partner companies to advance and fund exploration. Currently Skyharbour has deals on two projects. Orano, France's largest uranium mining and nuclear company, is spending up to $8 million to earn up to a 70% interest on the Preston project. That project is located next to Fission Uranium and Nexgen's high-grade properties. Plans for a 2020 exploration program are expected to be announced shortly. "Orano has been pretty aggressive with the exploration carrying out several drill and work programs over the past few years. They are a large company with a long history in the Athabasca Basin making them a great strategic partner to have," Skyharbour CEO Jordan Trimble told Streetwise Reports.

Skyharbour's other partner is Azincourt Energy, which is smaller, and in a 2017 deal, the company can earn in 70% of the East Preston project by spending $3.5 million. Azincourt recently announced a 2,500-meter drill program slated to start later this year or early next year. "Azincourt has conducted a lot of reconnaissance work over the last few years to get these targets. So it's an important program for both them and us," Trimble stated.

At Skyharbour's flagship, high-grade Moore Lake project, the company plans on initiating a 2,500-meter drill program early in the new year. "This could very well be our most important drill program on the project and the reason for that is we are now primarily testing basement-hosted targets that have been refined by new geophysical techniques," Trimble said. "When you look at most of the major discoveries that have been made recently in the Athabasca BasinóDenison, NexGen, Fissionóthese are all high-grade uranium deposits that are hosted in the underlying basement rocks."

Historically, a lot of the drilling and exploration was focused in the overlying Athabasca sandstone or at the unconformity, the unconformity being the border between the sandstone and the basement rock. But now the basement rocks are showing some of the highest uranium grades.

"What's exciting about Moore Lake and the upcoming drill program is there was very little historical drilling and work done testing the basement targets, which host the feeder zones. This is the source of the high-grade mineralization, up to 21% U3O8, that we have at our Maverick zone, which is hosted in the sandstone and at the unconformity," Trimble said.

One of the new techniques Skyharbour has employed is geophysics using drones, which gives the company more pinpoint accuracy of its specific targets. Not only is it less expensive than flying fixed wing airplanes or helicopters, it gives better images because drones can fly closer to the tree line and provides tighter line spacing. "We are looking for cross-cutting structures that have broken up the main corridor and have allowed the fluids to come up," Trimble stated.

"Thanks to the geophysics, and further geological analysis, we now have a much more accurate idea of the zones we want to drill into," Trimble noted. The company has three targets, with the main one being the basement rock to the east of the Maverick zone, to follow up on one of the last holes the company drilled in the previous program, which intercepted high-grade mineralization.

"We think this drill hole just nicked the top of a much larger, higher-grade zone, so we are going to drill down plunge," Trimble explained.

Another target is further to the northeast on the same corridor where geophysics have identified another cross cutting structure. The third target is in the Otter Grid, which is a completely separate corridor where Skyharbour discovered uranium mineralization earlier in the year.

Skyharbour is led by an experienced team. President and CEO Jordan Trimble is an entrepreneur in the resource industry, having worked with several companies, including Bayfield Ventures, which was acquired by New Gold in 2014. Jim Pettit, the company's chairman, was the CEO of Bayfield and has over 30 years of experience in the resource sector. Director Richard Kusmirski, the head geologist, has over 40 years of exploration experience in North America and overseas, and directed Cameco's uranium exploration projects in the Athabasca Basin as exploration manager. Director David Cates serves as the president and CEO of Denison Mines and Uranium Participation Corp.

Skyharbour is well structured with 64 million shares outstanding and several large, notable shareholders in addition to management and insiders include Denison Mines, the KCR Fund, Sachem Cove and OTP Fund Management.

Skyharbour is conducting exploration against the backdrop of the Section 232 ruling, which was brought by U.S. uranium producers that asked for quotas or other protections for the U.S. uranium mining industry. In July, President Trump declined to impose any trade measures, but set up a Nuclear Fuel Working Group to examine the current state of nuclear fuel production in the U.S. The Working Group is due to present its report by mid-November, but the U.S. government has no obligation to enact any of its recommendations.

"The Section 232 investigation and ruling process has created a lot of uncertainty in the uranium market," Trimble stated. "There are several U.S. nuclear utility companies that have been putting off contracting until this Section 232 and Working Group overhang is cleared up. Many of the current long-term contracts are at higher prices of $40 to $70/lb of uranium so there is an impasse right now between the producers and buyers given the current low spot price of $24/lb. Uranium miners won't sign long-term contracts at today's low, uneconomic prices, and utility companies are reluctant to sign contracts at higher prices right now. But I expect that will change."

"With the highly anticipated decision of the Section 232 investigation, and the price of uranium in the spot market rising from the low $20s to $29/lb, shares of uranium companies rose. But when no action was taken, and the spot price pulled back, share prices have fallen," Trimble explained.

"The 232 decision was perceived by investors who had come into the market over the last year and a half as a negative outcome, and the price of most uranium stocks have pulled back. But something to note is that the actual outcome for non-U.S. companies in the long run is positive, because it means we aren't going to have millions of pounds of forced production coming out of the U.S. over the next five to seven years," Trimble stated.

Furthermore, many uranium producers have cut supply because they cannot produce profitably at current uranium prices. Cameco has shuttered its McArthur River Mine and is buying large quantities of uranium in the spot market.

"Cameco needing to buy uranium in the spot market to make up for lost supply at McArthur is one of the most prominent potential catalysts in the near term," Trimble said. "Cameco's purchases in 2018 helped propel the spot price higher and I expect to see similar price action in the coming months."

A deficit is forming in uranium's supply-demand equation. "There's over 192 million pounds of demand with only about 136 million pounds of primary mine supply, so we're eating away at secondary supply very quickly right now," Trimble stated.

The World Nuclear Association, at its September symposium in London, released its bi-annual report that had some bullish takeaways for uranium miners. For the first time since Fukushima, the report projected notable increasing demand across all three of its upper, mid and lower cases.

"With climate change as such hot topic issue globally, it's important to realize that nuclear energy is complementary with renewable energy sources and will play a very important role in solving this problem going forward. It's the only source of baseload, CO2 emission-free, low-cost, reliable electricity. It's not intermittent electrical generation like wind and solar," Trimble stated.

Read what other experts are saying about:

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Skyharbour Resources. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Skyharbour Resources, a company mentioned in this article.