If you like buying stocks cheap, TraceSafe Inc. (TSF:CSE) might pique your interest here. Tracesafe started out as a contact tracing company but has since gravitated into other areas. As we can see on its latest five-year chart, it has been brutally beaten down in a severe bear market from its high early last year at about CA$1.90, and it fleetingly approached CA$2.40 soon after its inception in 2018.

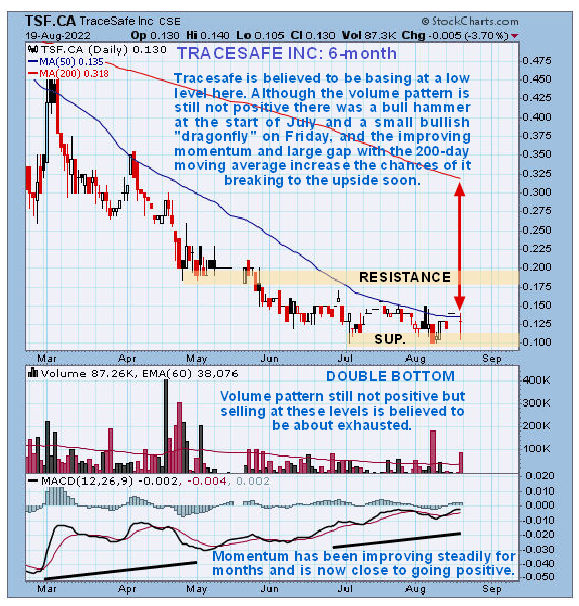

It is now believed to be basing at a cyclical low at support in the vicinity of its 2019 lows and is as low as it has ever been. Although its volume indicators remain weak, they are showing some relative strength long-term compared to the price, and although of some concern, they should improve rapidly on any upturn in the price.

Before leaving this chart, observe the recent light volume denoting lack of interest such as often precedes a reversal, and the continued improvement in the MACD indicator as downside momentum has dropped out.

The six-month chart is looking increasingly positive with the brutal bear market seemingly ending with a pronounced bull hammer early in July, whose intraday low provided support for the price this month, and it is suspected that the low of about a week ago marks the second low of a Double Bottom with the early July low.

If so, then the minor dip on Friday has presented a good point to buy near to the lows after the rather bullish “dragonfly” candle on Friday that probed the support at the lows again.

Other positive factors to observe are the steady improvement in momentum (MACD) that we looked at above, which has arrived at the zero line that by itself suggests that the stock is ready to advance, and the large gap with the falling 200-day moving average which is the measure of how oversold it still is, that opens up “snapback” potential.

Tracesafe is therefore regarded as an Attractive Speculative Play here, especially because the current low price creates the potential for large percentage gains even on a relatively modest advance from here.

Tracesafe Inc.'s website.

Important postscript added on the morning of the 22nd at 8.45 am: the following news was released by the company at 6.30 am EDT this morning — TraceSafe Announces IoT Wearables Partnership with solutions by stc.

Solutions by stc is the most prominent IT Services Provider in Saudi Arabia, with over 25 years of experience and more than 24,000 clients in technology services across 35 cities in Saudi Arabia. In line with the Saudi Vision 2030 objectives, the Kingdom has started the implementation of the Smart City project in multiple areas across the region, which will include such developments as THE LINE.

This certainly sounds like big news that should get the stock moving, although it would have been better for us if this news had emerged sometime during the trading day today so that we could buy at the best price.

Nevertheless, the stock should rally and hold its gains, so it is worth those interested in buying it as near to the open as possible.

Tracesafe Inc. closed at CA$0.13. $0.08 on August 19, 2022.

Want to be the first to know about interesting Technology investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter.

Subscribe

CliveMaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Disclosures

1) Clive Maund: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with TraceSafe Inc. Please click here for more information.

portant disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Tracesafe Inc., a company mentioned in this article.