Streetwise Articles

Your Personal Gold Standard

Source: James Rickards, The Daily Reckoning (6/3/14)

"If you think that the value of paper money will be in some jeopardy, or confidence in paper money may be lost, one way to protect yourself is by buying gold, and there's nothing stopping you."

More >

Ian Parkinson's Copper and Gold Names for a Fresh Round of M&A

Source: Brian Sylvester of The Gold Report (6/2/14)

Growth for the sake of growth is over, but that doesn't mean mergers and acquisitions in the mining space are finished, says Ian Parkinson, director of equity research-mining with GMP Securities L.P. Parkinson expects a fresh round of takeover bids for underperforming single asset producers and developers that could move the needle for state-owned enterprises and multinationals. In this interview with The Gold Report, we picked Parkinson's brain for some likely targets.

More >

Growth for the sake of growth is over, but that doesn't mean mergers and acquisitions in the mining space are finished, says Ian Parkinson, director of equity research-mining with GMP Securities L.P. Parkinson expects a fresh round of takeover bids for underperforming single asset producers and developers that could move the needle for state-owned enterprises and multinationals. In this interview with The Gold Report, we picked Parkinson's brain for some likely targets.

More >

Gold Prices Bounce from 4-Month Lows

Source: Adrian Ash, BullionVault (6/2/14)

"Trading more than 4% down from this time last week, gold prices rallied off $1,241 per ounce as European stock markets followed Wall Street's Friday finish to reach new record and multiyear highs."

More >

Joe Giamichael's Top Two Oil & Gas Fixer-Uppers

Source: Tom Armistead of The Energy Report (5/29/14)

Joe Giamichael likes a project. The founder of Umbrella Research & Advisory finds underperforming junior explorers and producers with fundamentals that spell success, and he works with them to achieve their potential. In this interview with The Energy Report, Giamichael describes the strategies that have allowed these companies to thrive, and why the good times are just beginning for shareholders.

More >

Pad Drilling: Innovation in the Oil and Gas Industry

Source: Visual Capitalist (5/29/14)

"Pad drilling is one of the most significant innovations in the oil and gas industry in recent times."

More >

ASCO Abuzz About Immunotherapies: A Preview of the Latest in Cancer Therapy from Stephen Dunn

Source: George S. Mack of The Life Sciences Report (5/28/14)

Working in what is arguably the hottest sector in the drug development industry, biotech researchers continue to ferret out cancer's secrets. The premier event for those in the field is the American Society of Clinical Oncology annual meeting, taking place in Chicago from May 30 to June 1. Participants have submitted abstracts for promising therapies in advance of the conference, profiling new compounds that could lead to better outcomes for patients and bolster the health of investment portfolios. In this interview with The Life Sciences Report, LifeTech Capital's Stephen Dunn walks us through some of the highlights.

More >

Louis James: Are You Ready for an Early Shopping Season?

Source: JT Long of The Gold Report (5/28/14)

Sometimes hindsight can lead to foresight. Casey Research's Louis James says now that the market seems to agree that December was the bottom for gold, the value of these companies is becoming evident to investors, and majors could start going on a shopping spree. In this interview with The Gold Report, James sees the Osisko bidding war as a harbinger for deals to come, and discusses companies that could offer shoppers real bargains.

More >

Turn Solid Gold into Biotech Gold with James West

Source: Peter Byrne of The Life Sciences Report (5/28/14)

The globe-trotting editor and publisher of The Midas Letter has decided to give his metal investments a breather, looking for new prospects in the life sciences space. In this interview with The Life Sciences Report, James West points to low-hanging biofruit ripe for the picking.

More >

The Lower the Uranium Price, the Higher the Rebound

Source: Jeb Handwerger, GoldStockTrades (5/27/14)

"Uranium prices still are irrationally low. This basing period is the best time to accumulate if you are a long-term investor who believes uranium will rebound."

More >

Jeff Wright: Miners that Create Their Own Momentum

Source: JT Long of The Mining Report (5/23/14)

Jeff Wright of H.C. Wainwright & Co. doesn't anticipate a major shift in the price of gold near-term, so he doesn't expect the gold price to provide momentum for mining company stocks. Instead, he's looking at companies that can provide their own upward movement. Wright, an analyst, finds some promising candidates in some unlikely places, like environmentally friendly California, according to this interview with The Mining Report.

More >

Harnessing the Power of Nature's Perfect Cells: Robert J. Hariri

Source: George S. Mack of The Life Sciences Report (5/22/14)

Neurosurgeon and serial entrepreneur Robert J. Hariri, founder, chairman and chief science officer at Celgene Cellular Therapeutics, describes how his businesses address some of the great unmet needs in medicine in this interview with The Life Sciences Report. Hariri also discusses the special nature and advantages of placenta-derived stem cells, and an elegant solution to the scourge of muscle wasting in late-stage disease and advancing age that could apply to treatment of cardiovascular disease in the future.

More >

The Naysayers Are Wrong: Rohit Vanjani on How You Can Make Money with Generics and Diagnostics

Source: George S. Mack of The Life Sciences Report (5/22/14)

The concept that generic and specialty pharmaceutical drugs cannot command pricing power and growth is a misunderstanding, according to Director and Senior Analyst Rohit Vanjani of Oppenheimer and Co. Diagnostics also offer upside to investors: In fact, some recent returns disprove misconceptions in a spectacular fashion. The secret to making excellent margins in generics is to find markets where a vacuum has been created and product safety can be assured. The trick with diagnostics is to offer new tests that save steps, increase accuracy and reduce the burden on payers. In this interview with The Life Sciences Report, Vanjani discusses three names that fit the bill for investors seeking powerful growth in not-so-obvious sectors.

More >

Cash in on Energy in Ukraine and the Rift Basins of Eastern Africa

Source: Peter Byrne of The Energy Report (5/22/14)

Sometimes a major's trash is a junior's treasure. That's the story in East Africa, where majors began outlining resources and then ditched them for onshore assets. In their wake, junior companies with technical expertise are ready to unlock more wealth than the large caps thought possible. In this interview with The Energy Report, Canaccord Genuity Director of Research Christopher Brown fills us in on hidden opportunities in the rift basins of east Africa. He also shares an interesting perspective on how to make money on oil and gas ventures in Ukraine.

More >

Surfing the Volatility Curve with Jason Wangler

Source: Peter Byrne of The Energy Report (5/22/14)

There is money to be made as oil and gas prices fluctuate. Wunderlich Securities' Analyst Jason Wangler is no Pollyanna—he casts a cold, analytical eye on the volatility of the energy markets. In this interview with The Energy Report, Jason explains how to create a solid portfolio of attractive North American juniors—with lucrative side trips to South America and Africa.

More >

New Wave of M&A: Divestitures, Swaps and Inversions

Source: Andrew Forman, EY Life Sciences Blog (5/22/14)

"This latest quarter, which kicks off a third year of negative growth, seems to have been the tipping point for pharma companies to finally emerge from a long M&A hibernation."

More >

New Wave of M&A: Divestitures, Swaps and Inversions

Source: Andrew Forman, EY Life Sciences Blog (5/22/14)

"This latest quarter, which kicks off a third year of negative growth, seems to have been the tipping point for pharma companies to finally emerge from a long M&A hibernation."

More >

Gold Standard Ventures Consolidates Southern Carlin Trend District

Source: J. Alec Gimurtu of The Gold Report (5/21/14)

All serious gold investors know the Carlin Trend of Nevada is one of the most prolific gold producing regions of the world. Is it possible that there is an undiscovered district, not just a deposit, within that region that was missed by the majors? Jon Awde, CEO of Gold Standard Ventures, discusses how spectacular drill results have guided Gold Standard Ventures to focus on creating the southernmost mining district of the Carlin Trend—the Railroad/Pinion District. At more than 40 square miles, the district is large enough to potentially sustain a mid-sized producer. In this interview with The Gold Report, Awde describes the unique challenges of proving up a series of deposits that are in the shadow of the majors and for the first time all combined under one company in a single mining district.

More >

Pierre Lassonde: Mining Cycles Are Good for Royalty Companies and Investors

Source: Kevin Michael Grace of The Gold Report (5/21/14)

Pierre Lassonde revolutionized investing with the creation of the first gold royalty company. Three decades later, he is as confident in this model as ever, especially considering the difficulties of the majors in discovering large, high-grade reserves. In this interview with The Gold Report, this director and former chairman of the World Gold Council discusses the significance of the shift in gold ownership from West to East, the problem of mining scale and the results of the industry's failure to develop new prospecting technology.

More >

Survival Strategies in the Atacama Desert: Chilean Lithium Miners Manage by Playing the Regs

Source: Tom Armistead of The Mining Report (5/20/14)

Lithium is an essential component of batteries for small electronics and large electric vehicles as well as for materials for the housing and construction industry. In this interview with The Mining Report, economist Daniela Desormeaux, founder of signumBOX and widely quoted expert on industrial chemicals, shines a light on the lithium industry for investors looking for a new opportunity.

More >

Time Is the Trigger for Equities and Bullion: Charles Oliver

Source: Brian Sylvester of The Gold Report (5/19/14)

Charles Oliver, lead portfolio manager with the Sprott Gold and Precious Minerals Fund, believes the only thing between investors and bigger investment returns on precious metals equities and bullion, especially silver, is time. In this interview with The Gold Report, Oliver discusses silver and gold demand drivers, as well as portfolio ideas that figure to get bigger with time as the trigger.

More >

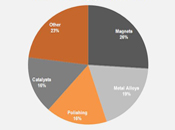

North American REE Exploration & Development

Source: Derek Hamill, Zimtu Capital Corp. (5/19/14)

"Globally, the greatest proportion of demand for REEs is for application in magnets; though in the U.S. the majority of demand is in catalysts for petroleum refining, chemical processing and catalytic converters."

More >

Which Resource Areas Show Signs of Strength?

Source: Frank Holmes, U.S. Global Investors (5/19/14)

"Global growth in 2014 is likely to accelerate, for the first time in four years, to 3.5%, according to ISI. This is constructive news for commodities."

More >

Think Like a Brain Surgeon: Dr. Christopher James Offers Fresh Perspectives on Six Exciting Biotechs

Source: George S. Mack of The Life Sciences Report (5/15/14)

New perspectives on well-followed biotech stocks are greatly appreciated. That's what we get here from Managing Director and Senior Biotechnology Analyst Christopher S. James M.D. of Brinson Patrick Securities. Something else that's treasured is discovering a brand-new biotech stock that no other analyst is covering. In this interview with The Life Sciences Report, James ushers readers to the head of the line to look at a new and exciting name with an extraordinary technology and phenomenal prospects for growth.

More >

Phil Juskowicz: How to Beat the Street to North American Energy Profits

Source: Tom Armistead of The Energy Report (5/15/14)

When differentials emerge, it's time for investors to take notice. Phil Juskowicz, a managing director in Casimir Capital's research department, smells

opportunity in micro-cap oil and gas companies, which have lagged behind the small caps for the last three years. In this interview with The Energy Report, Juskowicz explains how they are undervalued, and why they are the ultimate

leveraged plays in the (very likely) event of natural gas demand growth.

More >

Fadel Gheit: Lift Oil Export Ban, Free Domestic Profits and Defeat Russia

Source: JT Long of The Energy Report (5/15/14)

Oppenheimer & Co. Managing Director and Senior Energy Analyst Fadel Gheit knows how to thwart Russia's aggressive tendencies and encourage domestic oil and gas production: Lift the ban on oil exports. In the absence of a strategic U.S. energy policy, some companies will do better than others. In this interview with The Energy Report, conducted during earnings season, Gheit shares some of his insights on which companies have catalysts with bottom-line impacts.

More >