Streetwise Articles

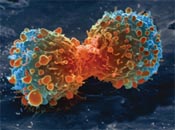

Two Cancer Stocks Take Shots on Goal: Echo He

Source: George S. Mack of The Life Sciences Report (6/19/14)

Oncology is king in biotech. Patients must be put on one drug, and then another, followed by another, as the disease progresses and becomes resistant. Multiple drugs will always be necessary, meaning multiple opportunities for drug companies. In this interview with The Life Sciences Report, analyst Echo He, formerly with the Maxim Group, serves investors two cancer drug picks that have been battered but are hot for a comeback.

More >

Is It 2003 All Over Again? U.S. Global Investors' Frank Holmes Predicts a Resurgence of the Love Trade for Gold

Source: JT Long of The Gold Report (6/18/14)

Close your eyes. Imagine India growing and importing gold again freely. China and the U.S. investing in infrastructure. What would that mean for commodities? In this interview with The Gold Report, U.S. Global Investors CEO Frank Holmes outlines the developments that could move us toward that vision and the impact that scenario could have on gold, diamonds and steel.

More >

Balmoral Resources: Two Projects, One Vision, Proven Share Price Performance

Source: Taylor Thoen, BTV/The Gold Report (6/18/14)

With two 100%-owned, shallow, high-grade properties in Canada churning out results and millions of dollars in the bank to keep the drills turning, Balmoral Resources is taking advantage of elevated nickel prices and a quiet junior mining backdrop to turn investors' heads. President and CEO Darin Wagner shares his focus for moving both projects forward.

More >

Crude Oil Prices Soaring on New Attacks in Iraq; Here's Where They're Headed

Source: Kyle Anderson, Money Morning (6/18/14)

"For now, oil exports and southern production are not impacted by the ISIL movement, but the fall of the Baiji refinery today does increase concerns over the growing turmoil in the country."

More >

It's Not About Discovering a Mine, It's About Discovering a Technology

Source: JT Long of The Mining Report (6/17/14)

Michael and Chris Berry are back for The Mining Report's second annual father-son interview in honor of Father's Day. While they don't agree on everything, they are aligned on the importance of disruptive discoveries to help companies succeed even in a sideways market. Flexibility and selectivity are their long-term strategies in any sector, from precious metals to commodities to rare earths.

More >

The LifeSci Startup with 'The Ultimate App'

Source: Stephen Petranek, The Daily Reckoning (6/17/14)

"What if when you went into a grocery store, a smartphone app could tell you which foods you were about to purchase might make your specific body sick—or which might prevent illness?"

More >

Less Correlation Among Commodities Demands More Careful Selection: Philip Richards

Source: JT Long of The Gold Report (6/16/14)

Commodities from coal to gold once traded in close correlation, but today the graph looks helter-skelter. This means Philip Richards of RAB Capital has had to think on his feet when choosing names for his company's Special Situations Fund. In this interview with The Gold Report, Richards explains how commodities markets have changed in recent years, and he lists companies of interest in the gold, silver, nickel, vanadium, zinc and oil and gas sectors.

More >

This Metal Problem Could Ignite China's Smoldering Crisis

Source: Peter Krauth, Money Morning (6/16/14)

"Despite some limited potential weakness in the very near term, the global picture for base metals looks to be heating up from both a supply and demand perspective."

More >

Will Gold Continue Its Rebound Rise?

Source: Mary Anne and Pamela Aden, The Aden Forecast (6/16/14)

"All things considered, it looks more like 2015 could be the year of a strong change to the upside."

More >

Stunning Potential for Upside in Canadian Biotech: Brian Bloom

Source: George S. Mack of The Life Sciences Report (6/12/14)

You may not have thought to look northward for biotech innovators, but Bloom Burton & Co. cofounder and President Brian Bloom can show you some truly hot Canadian companies with compelling skill sets and pipelines. In this interview with The Life Sciences Report, Bloom talks about his firm's upcoming conference and presents a detailed picture of four very interesting companies that could return doubles, triples or more.

More >

The Next Billion (Barrels of Oil): T. Boone Pickens Calls for Energy Plan at Stansberry Society Event

Source: JT Long of The Energy Report (6/12/14)

Known for his saying that "the first billion is the hardest," oil billionaire T. Boone Pickens addressed the Stansberry Society Conference in Dallas at the end of May with a plea for a national energy plan that takes advantage of the millions of barrels of oil being produced each day in the U.S. for domestic use. First addressing the audience, and then in conversation with event host Porter Stansberry, followed by an all-star energy investing panel, the Pickens Plan advocate was optimistic about the prospects for growing the country and individual investment portfolios through smart use of natural resources.

More >

Bill Bonner's Ten Undervalued Plays in Western Canada

Source: Peter Byrne of The Energy Report (6/12/14)

Bill Bonner's Brickburn Asset Management is located in Calgary, the financial brain of booming oil and gas plays in Western Canada. Bonner knows the reputations of the local managers, the geological promise of oil and gas field rigs, and how production for export is being pumped up as Asian companies with deep pockets throw tons of money at small producers. In this interview with The Energy Report, Bonner shares 10 names where these stars align.

More >

Immunopalooza! Time to Profit (Again) from the 'ASCO Effect'

Source: William Patalon, Money Morning (6/12/14)

"Investors like us love ASCO because of the so-called 'ASCO Effect'—a hefty surge in cancer-focused biotech stocks that always accompanies the start of this meeting."

More >

Follow the Shovels in the Ground forGlobal Energy Demand Growth

Source: Jared Anderson, Energy Collective (6/12/14)

"When following major energy development projects like pipelines or LNG plants, it's important to watch for sales and purchase agreements (legally binding contracts) and final investment decisions."

More >

Silver: The Undercover Super Metal Does Medicine, Too

Source: Visual Capitalist (6/12/14)

"Silver plays a major roll in technology today. From everyday gadgets to healing wounds, this precious is an important part of modern life."

More >

Van Eck Fund Manager Joe Foster Is Building for the Upswing

Source: JT Long of The Gold Report (6/11/14)

Lackluster gold should find some of its sparkle in the second half of 2014, according to Joe Foster, fund manager at Van Eck Associates. The prospect of loosened import and tax restrictions in India is one potential catalyst, and stabilization in the exchange-traded funds is another positive. He shares with The Gold Report his perspective on the likely state of merger and acquisition activity in the gold equity space this year, and discusses companies positioned to ride the upswing.

More >

Will Import Taxes on Solar Panels Hamper Silver's Ability to Rally?

Source: Bob Kirtley, SK Options Trading (6/11/14)

"We are aware that this downtrend has existed for almost four years and has tested the patience of the most ardent bulls, however, that's not a reason to hit the acquisition trail with gusto."

More >

Mark Seddon's Catch-22: We Need More Tungsten, But Projects Can't Find Funding

Source: Kevin Michael Grace of The Mining Report (6/10/14)

Even as demand rises steadily, the world's largest non-Chinese tungsten mine will be exhausted by next year. So investors should be lining up to fund new mines, right? Not a bit of it, says analyst Mark Seddon of Tungsten Market Research. In this interview with The Mining Report, Seddon argues that a supply shortage could mean much higher prices, leading to handsome profits for those companies that get to market soonest.

More >

Leave No Rock Unturned to Find Natural Resource Stocks with Game-Changing Catalysts

Source: Jason Mallin of The Gold Report (6/9/14)

Renowned investor Peter Lynch once said, "The person who turns over the most rocks wins the game." All resource investors should be turning over rocks, but who has time to track hundreds of companies, to visit projects, to meet with management? The Gold Report has asked Sprott's Rick Rule, Canaccord Genuity's Joe Mazumdar and Oil & Gas Investments Bulletin's Keith Schaefer to identify a select group of natural resource companies they feel are poised to make a move before the end of the year. We will be tracking these precious metals and oil & gas companies with game-changing catalysts on the newly launched Natural Resources Watchlist.

More >

Tesla's Gigafactory: The Critical Minerals Impact

Source: Simon Moores, Industrial Metals (6/6/14)

"At a time when supply chain security, transparency and responsibility are becoming central concerns for both manufacturers and consumers, IM Data discusses Tesla Motors' plans to build the world's biggest lithium-ion battery plant and the impact it could have on demand for critical minerals: graphite, lithium and cobalt."

More >

What To Look For in an E&P Company: Foucaud's Secrets for International Investing

Source: Tom Armistead of The Energy Report (6/5/14)

Stephane Foucaud sees a very positive period for the international E&P sector on the horizon. Cash is flowing back into the sector in spite of the unstable politics of some producing countries. In this interview with The Energy Report, the managing director of institutional research at FirstEnergy Capital reveals what he looks for in an investment candidate and where you can find promising opportunities in oil and gas.

More >

Shortage of R&D at Big Pharma Creates Demand for Small Biotech: Joseph Pantginis

Source: George S. Mack of The Life Sciences Report (6/5/14)

The recent pullback in biotech shares has not changed the time-tested theory of investing in small-cap drug development companies. Good or bad data will continue to move shares. In this interview with The Life Sciences Report, ROTH Capital Partners' Senior Research Analyst Joseph Pantginis presents five biotech names with varying timeframes for market-moving data that could provide huge upside for investors willing to do some homework and understand the growth proposition.

More >

Focus on Catalysts to Cash In on Biotech: Jason Kolbert

Source: George S. Mack of The Life Sciences Report (6/4/14)

When progress is made in drug development, value is created. Investors recognize that progress by purchasing shares in companies when milestones—which act as catalysts—are met. The Maxim Group's Senior Managing Director and Head of Healthcare Jason Kolbert lives by catalysts, and urges his investor clientele to understand there is no other reason to buy a stock except in anticipation of new information that creates value. In this interview with The Life Sciences Report, Kolbert discusses six names that have immense regenerative power for portfolios.

More >

Secrets of the Strategic Investors

Source: Karen Roche of The Gold Report (6/4/14)

How do you calculate ROI on investment conferences? They often require travel expenses, time away from the office and some eating of rubber chicken with mysterious sauces. But the right conference can result in a whole new way of looking at your portfolio. To evaluate the recent Altegris/Mauldin Strategic Investment Conference in San Diego, The Gold Report asked attendees for their insights on the major themes from thought leaders such as Former Speaker of the House of Representatives and host of CNN's Crossfire Newt Gingrich, Gluskin Sheff + Associates Chief Economist David Rosenberg and Hoisington Investment Management Executive Vice President Lacy Hunt.

How do you calculate ROI on investment conferences? They often require travel expenses, time away from the office and some eating of rubber chicken with mysterious sauces. But the right conference can result in a whole new way of looking at your portfolio. To evaluate the recent Altegris/Mauldin Strategic Investment Conference in San Diego, The Gold Report asked attendees for their insights on the major themes from thought leaders such as Former Speaker of the House of Representatives and host of CNN's Crossfire Newt Gingrich, Gluskin Sheff + Associates Chief Economist David Rosenberg and Hoisington Investment Management Executive Vice President Lacy Hunt.

Thoughts from the Frontline writer John Mauldin captured some of the debate waged from the stage during the 2.5 days at the Altegris/Mauldin Strategic Investment Conference when he said, "Our economic future depends on a race between two accelerating curves—debt and innovation." Attendees saw much to fear and some glimmers of hope.

More >

Finally, Good News for Mining in Peru: Ricardo Carrión and Alberto Arispe

Source: Peter Byrne of The Mining Report (6/3/14)

Ricardo Carrión and Alberto Arispe of Peru-based Kallpa Securities have a boots-on-the-ground view of the politics, legal battles and investment climate for precious metals mining in the Andes. In this interview with The Mining Report, Arispe and Carrión detail the new, positive developments afoot in this region and explain why investors should get involved now, before the rest of the world catches on.

More >