This quarter Defense Metals Corp. (DEFN:TSX.V; DFMTF:OTCQB; 35D:FSE) intends to commence a prefeasibility study (PFS) on its Wicheeda rare earths project now that the company has finished successful 2022 diamond drilling there, reported Noble Capital Markets analyst Mark Reichman in an Oct. 27 research note. A completed PFS is expected in H1/23.

Reichman expects the PFS to be a "robust," he wrote.

"In addition to significant potential to expand the resource and extend the mine life beyond 19 years, we expect grade enhancement and the meaningful conversion of Inferred [resources] to Indicated and potentially Measured," Reichman added.

This will be in large part due to two sets of drill results, those from Defense Metals' 2021 and 2022 programs, supporting the study, noted Reichman.

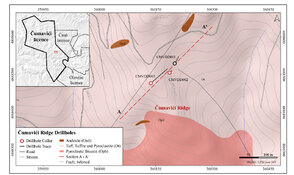

He relayed that the Canadian explorer just completed drilling 18 holes for 5,500 meters (5,500m) at Wicheeda. This 2022 work included a handful of pit slope geotechnical and hydrogeologic holes over 1,150m, results of which will help in designing the slope of the open pit for mining. Assays from the 2022 drill campaign continue to trickle in.

The most recent results are from infill hole WI22-70, which Defense Metals just announced. The hole, drilled for 383m in the deposit's northern area, "intersected a broad zone of mineralized dolomite carbonatite averaging 2.5% total rare earth oxide over 113m," reported Reichman.

WI22-70 is the sixth hole of the 2022 drill program for which Defense Metals has announced results.

"The assay results released thus far have been outstanding and are expected to contribute greatly toward upgrading resource categories in support of the preliminary feasibility study," Reichman wrote.

In the 2022 drill holes reported to date, the percentage of TREOs was as high as 6.7 (hole WI22-68) and interval lengths surpassed 100m (holes WI22-64, -67 and -68).

Noble has an Outperform rating on this exploration company.

"We think Defense Metals is well positioned to benefit from growing demand for rare earths used in electric vehicle batteries, metal alloys and advanced technology applications," wrote Reichman.

Noble's target price on the company is $0.70 per share, which compares to Defense Metals' current share price of about $0.24.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Defense Metals Corp. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Defense Metals Corp., a company mentioned in this article.

Disclosures For Noble Capital Partners, Defense Metals Corp.

Research Analyst Certification: Independence Of View - All views expressed in this report accurately reflect my personal views about the subject securities or issuers.

Receipt of Compensation - No part of my compensation was, is, or will be directly or indirectly related to any specific recommendations or views expressed in the public appearance and/or Probe report.

Ownership and Material Conflicts of Interest - Neither I nor anybody in my household has a financial interest in the securities of the subject company or any other company mentioned in this report.