Infinitum Copper Corp. (INFI:TSX) delivered on the promises it made before this summer. The Phase 1 drill program at the La Adelita copper project was completed, and assay results are slowly trickling in.

Three of the first four holes encountered high-grade copper mineralization, and the main reason why Infinitum didn’t report 4/4 was that the one hole with lower-grade mineralization didn’t reach the required depth to hit the mineralized zone.

Infinitum has slowly started to release the assay results from the drill program it completed earlier this year and kicked off the news flow with results from holes 17 and 18.

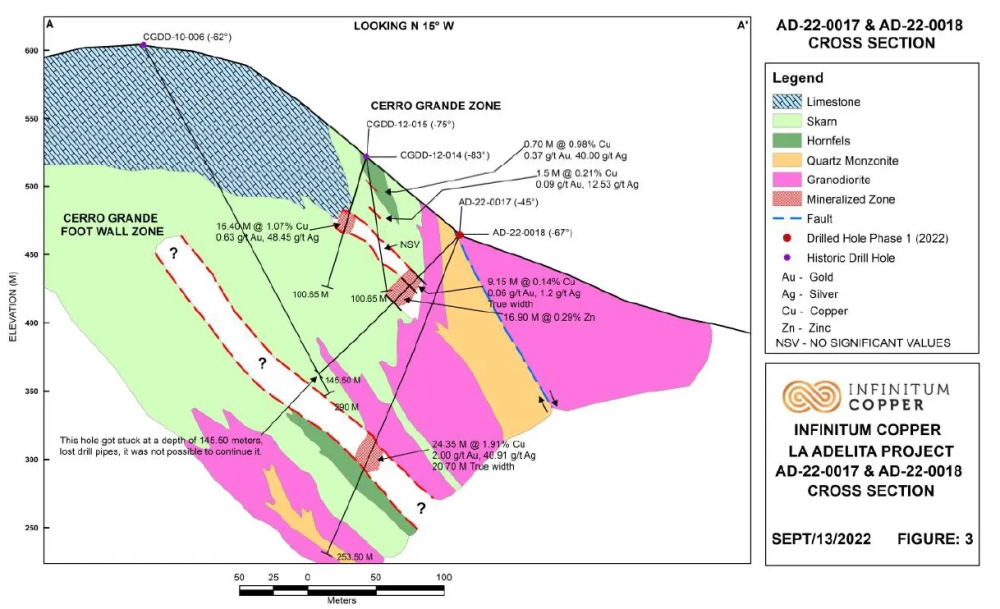

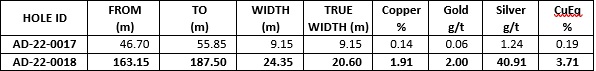

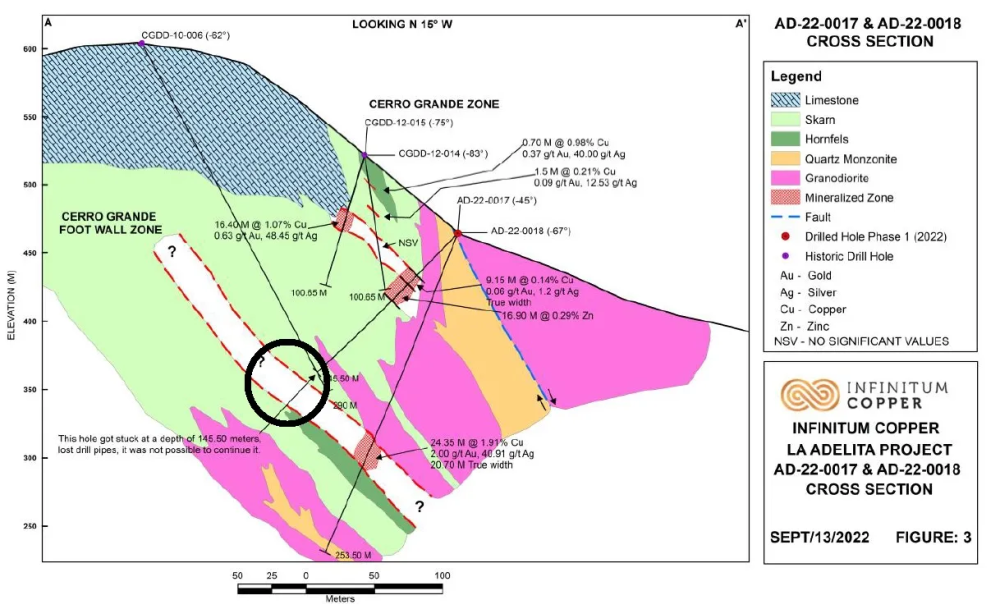

These were drilled from the same drill pad, and as you can see below, hole 17 used a 45-degree dip while hole 18 went in steeper at a 67-degree angle in an attempt to intersect the mineralization a little bit further away.

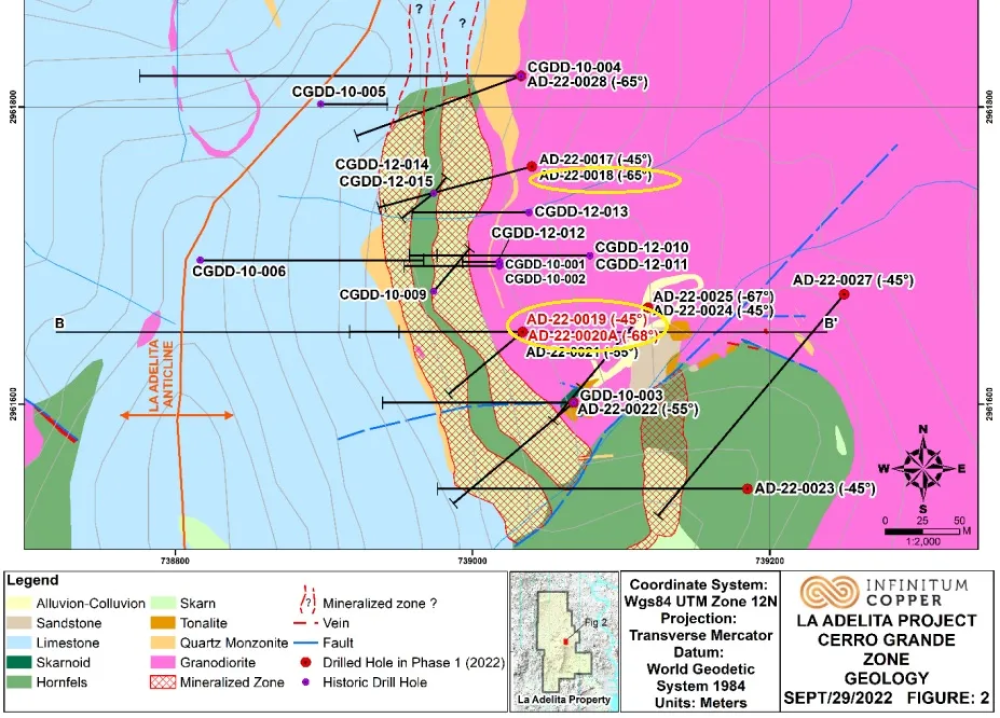

Both holes did encounter copper mineralization, but while hole 17 was nothing to write home about, with 9.15 meters of 0.14% copper and 0.06 g/t gold, hole 18 was good.

It was even exceptional. The drill bit encountered 24.35 meters (20.60 meters true width) of 1.91% copper, 2 g/t gold, and just under 41 g/t silver, as you can see in the table below. This represents an official copper-equivalent grade of 3.71%.

Needless to say, encountering that type of grade over an interval of in excess of 20 meters on a true width basis is excellent.

These two holes were drilled just a few dozen meters away from the old Adelita adit in an attempt to identify the extension of the high-grade copper-gold-silver mineralization at the Cerro Grande and Cerro Grande Footwall zone. And if we pull up the same cross-section again, you see hole 17 had to be abandoned before reaching the desired depth.

And that’s a pity, as the current interpretation of the mineralization encountered in hole 18 seems to focus on an upward trajectory, and hole 17 appeared to have been lost just meters from the anticipated mineralization. An additional bonus for the project is the high magnetite content encountered in hole 18 (with iron values averaging 24% Fe).

The combination of semi-massive magnetite with high-grade copper-gold-silver mineralization should be detectable with detailed magnetometry, and Infinitum Copper is planning to complete a detailed magnetometer survey after the vegetation in the area dies again.

A few weeks after the results of the first two holes were published, Infinitum released the assay results from two additional drill holes. We were hoping to see Infinitum being able to replicate the high-grade mineralization from hole 18 in the subsequent two holes. Holes 19 and 20 were designed as step-out holes to drill-test the structure about 110 meters to the south.

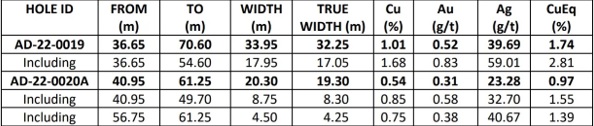

The results of hole 19 were excellent as the drill bit intersected 33.95 meters (with an estimated true width of 32.25 meters) containing 1.74% copper-equivalent consisting of 1.01% copper, 0.52 g/t gold and 39.69 g/t silver, including a higher grade interval of 17.05 meters true width containing 2.81% copper-equivalent.

And while hole 20 was the ‘weakest’ of the three recently disclosed holes, encountering 19.3 meters true width of 0.97% copper-equivalent, including two distinct higher grade zones with 8.3 meters containing 1.55% copper-equivalent and 4.25 meters containing 1.39% copper-equivalent is still a good result as it confirms the continuity of the mineralization.

Seeing the results of holes 18, 19, and 20, it is a pity that hole 17 was lost before it reached the target depth, as it would have been pretty interesting to see a further extension of the (high-grade) mineralization towards the North.

As Infinitum has only reported on the assay results from just four holes, we would expect the company to release new assay results from the summer drill program at La Adelita. As a reminder, Infinitum completed twelve holes at La Adelita in its Phase 1 drill program, which means the assay results from eight more holes are yet to be released.

The assay results of the first few holes of the 2022 drill program are very positive as it further helps the company to zero in on the high-quality drill targets at La Adelita and the finetuned projection of the mineralization means it should be relatively easy to build tonnage at that specific zone.

Do we expect those holes to be as good as holes 18-20?

Maybe not, but keep in mind that this is an exploration and not infill drilling on a well-known zone.

But having eight additional data points will help the exploration team to connect the dots and provide valuable information on the structural controls of the mineralization.

Now the rainy season has ended, we expect Infinitum to restart drilling as soon as practically feasible. The Phase 2 drill program was originally anticipated to complete 6,000 meters of drilling in twenty holes, but we expect the total amount of holes and meters to be subject to the financial situation of the company and the factor of how much cash Infinitum can raise.

In fact, the experienced crew at Infinitum will probably find ways to stretch the available budget as far as possible to continue to advance the discovery process despite the difficult market conditions. This probably means a little less drilling in favor of more prospecting, mapping, boots-on-the-ground type work, and additional magnetometry work will likely be completed within the next few months.

Infinitum Is Raising CA$1M To Continue to Work on La Adelita

Infinitum announced a private placement to add some cash to the treasury. The CA$1M financing was priced at CA$0.13, and each unit will consist of one common share and half a warrant, with each warrant allowing the warrant holder to acquire an additional share of Infinitum Copper CA$0.22 for a period of two years.

By raising just CA$1M, Infinitum is keeping the dilution at the current share price limited, but we would expect the company to accept more than CA$1M in subscriptions if the demand is there (but it’s definitely not easy to raise money out there). As there are currently 45.6M shares outstanding (including the impact from the shares that will be canceled in the near future), raising CA$1M at the current terms would increase the share count to 53.3M shares and even post-financing the market capitalization is less than CA$7M.

Or, as Capital Markets Advisor Jorge Ramiro Monroy mentioned on a recent investor call, ‘you are basically buying a company with two strong copper projects for the price of a shell.’

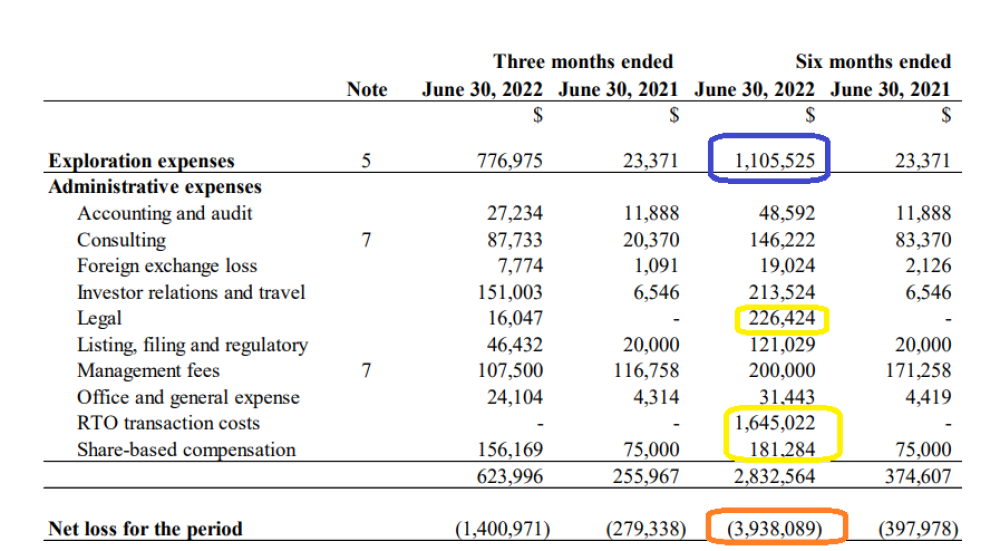

Of course, it is also very important to see what Infinitum spends the money on. And while we are still waiting for the company to report its Q3 results, the H1 results already provide some insight into how Infinitum spends its cash.

While the net loss in the first semester was almost CA$4M, in excess of 40% was related to RTO transaction costs (which are non-recurring), while the CA$226,000 in legal fees should also be non-recurring (we can already see this in the second quarter when just CA$16,000 in legal fees were incurred).

Additionally, the CA$181,000 in share-based compensation is a non-cash expense as well. This means that of the CA$3.94M in net loss, approximately CA$2.05M was either non-recurring or noncash.

And as CA$1.1M was spent on exploration, approximately 58% of the cash outflow (excluding the property payments) was spent on exploration. This a decent result, and as you can see in the image above, that ratio increased to 62% in the second quarter (the company’s first quarter as a publicly listed company).

So in excess of 50% of every dollar raised goes into the ground. And that ratio should increase as INFI is able to raise more funds, as the fixed overhead costs shouldn’t increase.

Conclusion

The assay results of the first few holes of the 2022 drill program are very positive as it further helps the company to zero in on the high-quality drill targets at La Adelita and the finetuned projection of the mineralization means it should be relatively easy to build tonnage at that specific zone.

We expect a silent period while the financing is being completed and expect Infinitum to be able to release the assay results from several La Adelita holes once the financing closes.

| Want to be the first to know about interesting Critical Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Thibaut Lepouttre I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Infinitum Copper Corp. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: Infinitum Copper Corp.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: Infinitum Copper Corp. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Infinitum Copper Corp., companies mentioned in this article.