My last update on gold was March 13 when I said a correction and consolidation was a healthy market action.

I expected more of a correction, but my bullish case was that mild support would hold around $2160, and then gold would go higher. That is what happened with gold's break out to new highs. Gold started to move around 1 pm and peaked at $2192 for the day and is moving to new highs again today.

This move in gold should be no surprise to readers of this newsletter. I have been predicting that a new bull market in gold would start in 2024, back in mid to late 2023. The talking heads dragged out the same old story that anticipation of a Fed pivot is driving gold. It is much more than this, and I am not going to repeat myself here. I gave seven reasons back in my early March newsletter, which you can review if you wish.

Some are asking how high this bull move will go. The bull move off the 2008 crisis, and Fed easing was about 140%, and the more recent from 2018 to 2020 was about 70%, so a 100% move is quite reasonable, putting gold between $4,000 and $5,000.

I am not saying this year, but $3,000 is quite obtainable this year. I have been comparing this period to the 1970s/80s, so in this regard, this could be the start of a super bull market in gold. Back then, gold ran up 800% or more, so this would give us a target of $15,000 to $20,000. This would not surprise me at all but it would take several years to unfold.

So far, retail investors are barely participating, and most of them are bamboozled by cryptocurrencies. Money has been flowing out of gold ETFs, and the gold miners have barely moved. However, here lies our opportunity. The Gold Bugs HUI index has barely moved, and first positive step will be a higher high above 260, and that is coming soon.

The TSX Venture index had a small bump on gold's first move and gave it all back.

These juniors won't get much steam until the HUI goes over 300. Long term, they will have the highest percent gain.

There are strong odds that Bitcoin has put in a double top.

I know it has broken above the 2021 high, but this only lasted about four days, and in my experience, that is not a convincing breakout.

There is a lot of hype around all these new Bitcoin ETFs, but as we older gold investors know, this is a method used by the Banksters and agents of the Government to control the market. The first gold futures contracts came out in the 1970s and 80s, while Bitcoin futures contracts have been around for about five years. A whack of gold-related ETFs came out in the big gold bull run of 2003 to 2011. Most of the gold ETFs hold gold-related investments, and no good evidence they hold physical gold, and if they do, it is probably lent out.

I am anxious to start diving into the financial statements of these Bitcoin ETFs, and I am willing to bet they hold more Bitcoin financial instruments than actual Bitcoin. Perhaps they just have access to Bitcoin or all using the same pool. Time will tell, and I will share my findings. These ETFs have only been out a couple of months, so probably two or three months before we get the first financial statements.

Like the gold ETFs, the prospectus I read talked about Bitcoin custodian, so will the ETF have any actual Bitcoin?

I know that many harp about Crypto as an alternative to fiat currencies and compare it to gold. The reality is that the three are very different. It is sort of like apples, oranges, and cherries, which are all fruit, and that is where the likeness ends. With Fiat, Crypto, and Gold, they are all financial instruments and that is where the likeness ends. I will get into some more detail in the future, but for now, I want to take advantage of the cheap gold stocks and add a new one to our list.

Calibre Mining

Recent Price - $1.66

52-week trading range - $1.15 to $1.89

Shares outstanding - 717.4 million (B2Gold owns 15%)

Cash Balance - US$86 million plus announced

I have followed Calibre Mining Corp. (CXB:TSX; CXBMF:OTCQX) for a long time. They got going in a big way in 2019 when they acquired B2Gold's producing mines in Nicaragua.

I have been to Nicaragua and visited mining properties there. The country is very pro-mining, but nonetheless, it is a jurisdiction that is not popular with investors.

Calibre had been exploring for ten years in Nicaragua before they acquired B2Gold's assets there so they are very familiar and experienced working there, and they have done so without a hitch.

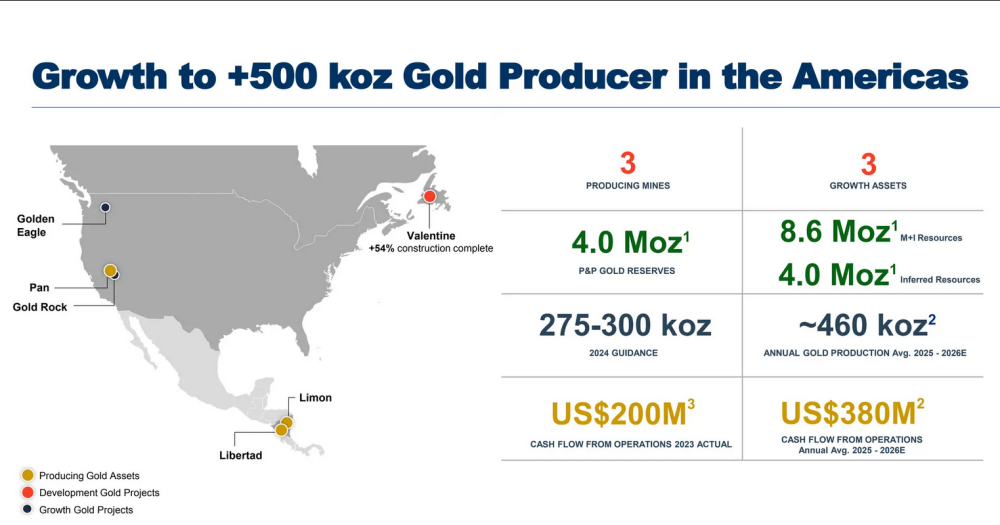

Since then, Calibre acquired the Pan Gold Mine in Nevada, a 200-plus-sq. km land package in the multimillion-ounce Battle Mountain Eureka Trend. More recently, they acquired the Valentine project in NFLD, acquisition closed in January this year.

This is going to propel significant production growth, with the first gold pour expected in the first half of 2025. This will propel Calibre to 500,000 ounces per year, from the current 275,000 to 300,000 per year. This also results in the majority of their assets being in North America, which now makes them a different and well-diversified gold producer.

This graphic is a snapshot of their mines/assets.

The company is also expanding production in Nicaragua. They have excess capacity at one of their mills that could be filled with recent new discoveries. This should come on stream in 2026.

Currently, Calibre is advancing a +80,000-meter multi-rig drill program at Limon, Libertad, Pavon, and Eastern Borosi with +15 active drill rigs. Additionally, regional field crews continue to unearth new targets and build a robust pipeline of priory exploration targets, all within haulage distance to the Libertad mill with surplus processing capacity.

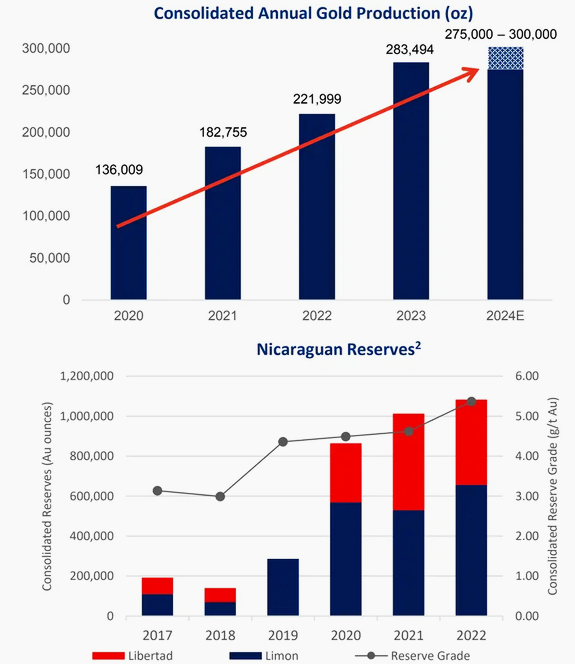

The company has a very solid track record of growth, as 2024 will be its fifth year in a row with production growth.

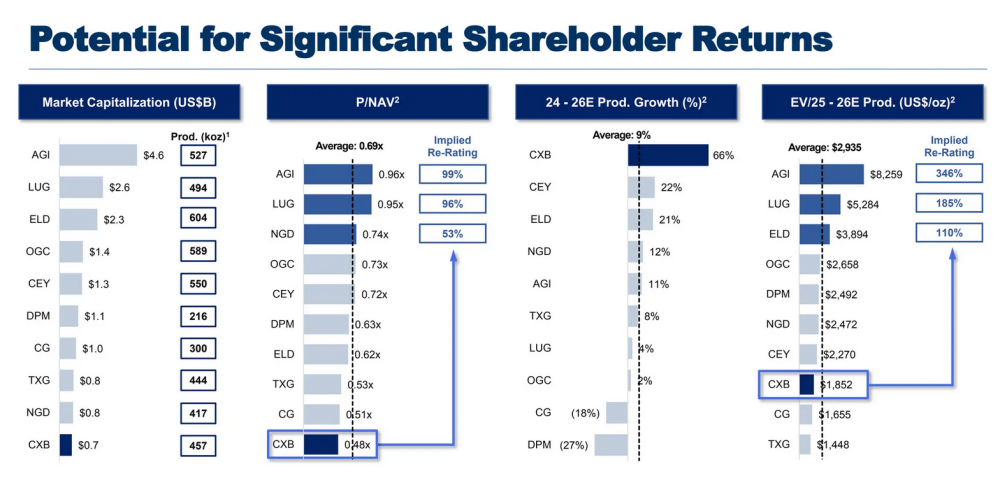

The stock should also get a higher valuation as it moves from a junior producer to a mid-tier producer.

This graphic from their presentation shows the low valuation of peers.

Currently, the stock is down in price like all the gold miners, but they also announced a $100 million bought deal financing yesterday at $1.68 per share that has put temporary pressure on the stock.

Before this financing, CXB had a market cap of about US $935 million, less $86 million cash for a $849 million valuation or about $99 per ounce of measured and indicated gold ounces in the ground.

I see this as a low valuation, especially considering the company's strong track record and high growth profile. In this recent bear market, gold mining growth companies were not getting much respect. I think that is going to change.

The stock has put in a triple bottom and is in a nice up trend, as well as breaking above resistance. The financing news has most likely temporarily knocked the stock down.

That provides a nice buying level for us.

| Want to be the first to know about interesting Gold and Cryptocurrency / Blockchain investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Ron Struthers: I, or members of my immediate household or family, own securities of: Calibre Mining. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.