I have found what I see as the best risk/reward play for a junior oil and gas company that I can ever remember. It is seldom to find an oil and gas play with huge potential for a 10 to 20-bagger, yet there is practically no downside risk. This is a very unique company! Trillion Energy International Inc. (TCF:CSE; TRLEF:OTC; 3P2N:FSE)

Trillion Energy International Inc. (TCF:CSE;TRLEF:OTC;3P2N:FSE)

Recent Price - $0.23

Shares outstanding - 114 million

Warrants and Options - Way out of the money

The stock has been hammered to a way over-sold condition. What caused it was a major shareholder who passed away, and his entire position had to be dumped by his estate. This pushed the stock down and put a negative bias on it. Then, the company failed to meet its production expansion on target because it found it needed some more engineering and parts to remedy a water load issue.

It was causing the daily production volumes to fluctuate considerably. This will soon be fixed. In the recent weak market for oil and gas and jittery shareholders, more bailed on this news and drove the stock to recent lows around $0.20.

This brings us the opportunity. TCF operates in Turkiye (pronounced and often called Turkey), and many call it the Texas of Europe because of favorable fiscal terms and strong exploration potential. There is a 12.5% royalty and a 22% corporate tax, that has remained the same forever. Permits are for the life of the project. Turkey is one of the G20 and a NATO member.

Why Turkey?

They are the seventh largest consumer of Natural Gas in the world but have to import 98% of it and import 93% of their oil. They are very keen to produce more in their country and offshore in the Black Sea. Natural Gas prices are very high, like most of Europe, around US$11 to US$12/MCF compared to recent prices in the U.S. in the $2 to $3/MCF range. Natural Gas production there provides very strong cash flow and profits.

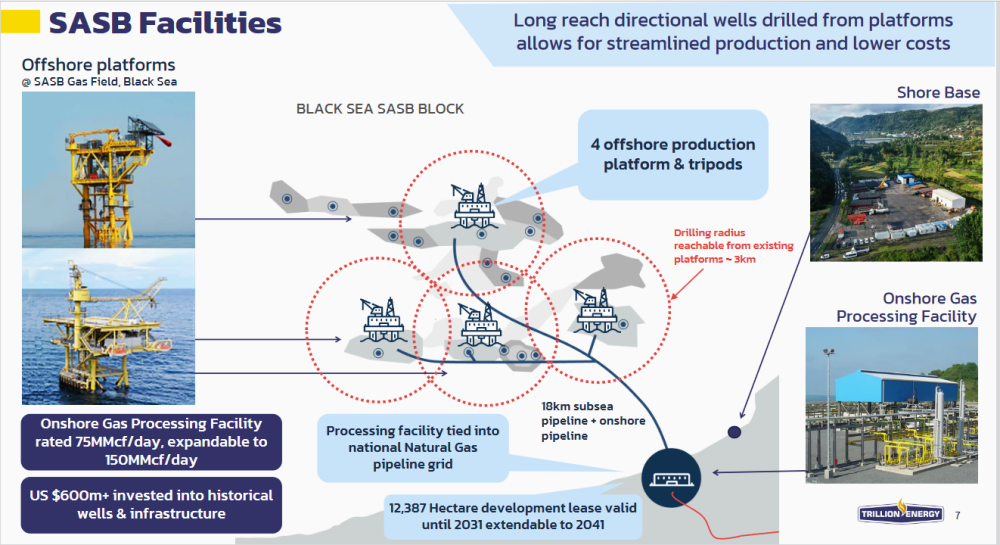

I will just put it that Trillion was extremely fortunate to get a 49% interest in their SASB Gas Field, Black Sea, Turkey. The company that was operating it went bankrupt, not because of this asset but others, and Trillion ended up picking up their 49% interest for about US$2 million or just pennies on the dollar. About US$600 million was spent building the offshore platforms and gathering systems. Trillion is the operator now, but previously, back in 2011, only vertical wells were drilled.

Trillion is using the same platforms to drill out on angles and horizontally into new gas pay zones. They have drilled five wells and reworked another for a total of six. To address the water load issue, they hired third-party engineering for the execution of an artificial lift plan that was delivered in December 2023. The company has now put in motion ordering pumps, wellheads, new well tubing, and the like.

Trillion is projecting production of 7.54 MCF/day for 2024, their 49% interest ( 15.4 MCF/day 100% gross). Additionally, the company plans to fit two legacy wells with pumps for a total of eight producing wells, and this is not included in the above numbers.

Cash flow will be over $2 million per month based on just 3 MCF/day. This will be a cash cow for the company, is very low risk, and proof of execution should get the stock easily into the $0.30 to $0.50 range.

Management

I spent almost an hour with the CEO, Dr. Arthur Halleran, going over all the details and asking questions. The company has a lot of international experience in Turkey.

Dr. Halleran has a Ph.D. in Geology from the University of Calgary and 40 years of petroleum exploration and development experience. His international experience includes countries such as Canada, Colombia, Egypt, India, Guinea, Sierra Leone, Sudan, Suriname, Chile, Brazil, Bulgaria, Turkiye, Pakistan, Peru, Tunisia, Trinidad Tobago, Argentina, Ecuador, and Guyana.

Dr. Halleran has worked for Petro-Canada, Chevron, Rally Energy, Canacol Energy, and United Hydrocarbon International Corp. In 2007, Dr. Halleran founded Canacol Energy Ltd., a company with petroleum and natural gas exploration and development activities in Colombia, Brazil, and Guyana, which made a billion-dollar natural gas discovery in Colombia.

This month, Al Thorsen was brought on board as chief operating officer. As part of his duties, Mr. Al Thorsen will be responsible for the production operations of SASB gas field as well as future drilling activities in Turkey and abroad.

With a proven track record in expanding and leading domestic and international operations, Mr. Thorsen brings a wealth of experience developing and leading large cross-functional teams, consistently achieving robust strategic objectives for high-profile organizations within the energy industry, including implementing comprehensive technical solutions. Highlights of his career include: Valeura Energy Inc. as operations manager in Turkey, where he managed 55 employees, 300 natural gas wells, and 500 km gas gathering system; Journey Energy, leading a production team where he directed joint ventures and production engineering to 10,000 BOE/d. He has also held positions with Rio Alto Exploration, a 100,000 BOE/d international company, as country manager and production manager, Zargon Oil and Gas as VP of Operations, Orleans Energy as VP of Operations, and Central Petroleum as COO.

Mr. Thorsen has substantial experience in Turkey with artificial lifts in an international production environment. He holds a Bachelor of Science in Petroleum Engineering and graduated in 1986 from Montana College of Mineral Science & Technology, Butte, Montana. Along with the rest of the team, I am very confident that Trillion has the expertise to get the job done.

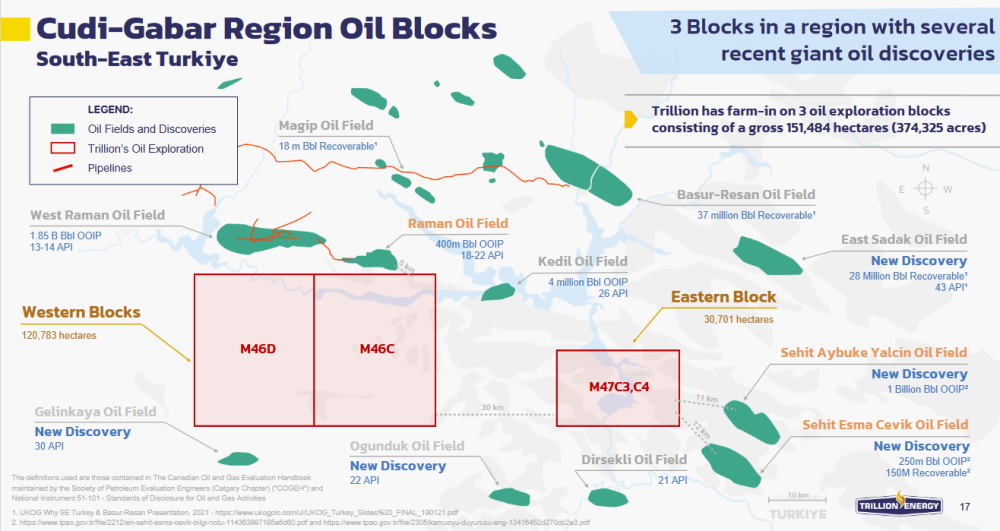

Trillion plans to drill more horizontal wells at SASB in 2024 so production will continue to grow, and more importantly, later in 2024, this will fund the development of huge potential on their 3 Cudi-Gabar oil blocks in SE Turkey. There have been two recent large discoveries: Sehit Aybuke, 1 billion barrels, and Sehit Esma, 250 million barrels, just 11 kms from Trillion's Eastern Block. The same geological features in these discoveries trend through Trillion's Eastern Block.

Trillion can earn a 50% interest in these blocks by completing Seismic and drilling 4 wells. They did a fair bit of seismic last year and should have the rest completed by April. Drilling is not expensive here, and these will be straight vertical wells.

Costs are estimated between $3 to $3.5 million per well. Trillion has to fund 100% in the first four wells to earn their 50% interest then costs would be 50/50 with their partner TPAO, the Turkey State Oil company. TPAO is also their partner on the SASB gas play.

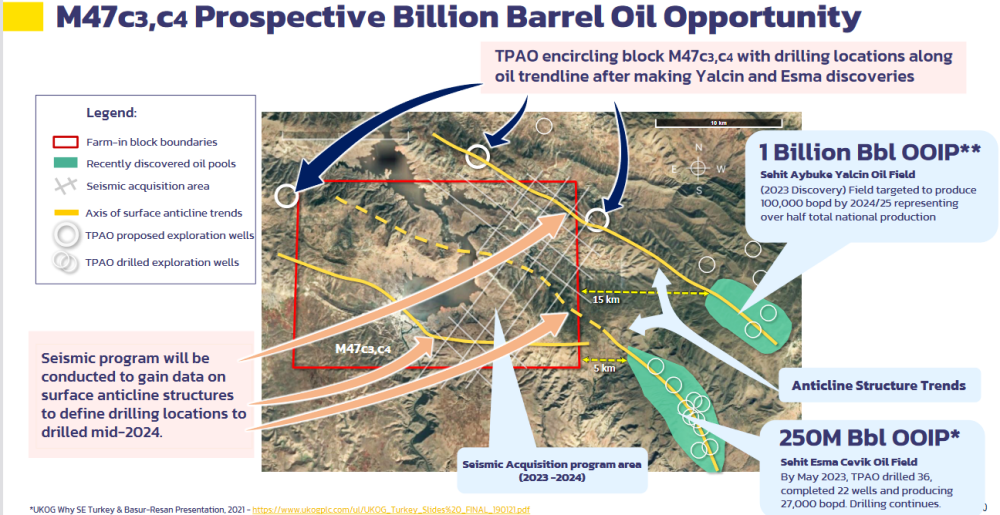

This next graphic is very important. The white lines to the right on their M47 prospect show the completed seismic so they have about half to finish the block. Most important is TPAO made those huge 1 billion and 250 million barrel oil discoveries in 2023 and then went on to acquire ground encircling Trillion's M47 block, shown by 3 blue arrows. The potential is huge. Note that by 2025, that 1 billion barrel discovery will be producing over half of Turkey's domestic oil production.

Exploration is never 100% risk-free, but this oil play is pretty close to it. I asked CEO Halleran about what he thought of the seismic so far. He would not say because there is no public disclosure yet, but he seemed very happy about it.

Financial

The last financials show little cash, about $750,00, and since then, Trillion closed a CA$10.8 million financing at CA$0.30 per share on November 28, 2023. There were no warrants with the financing other than Broker warrants.

Longer Term Gas Potential

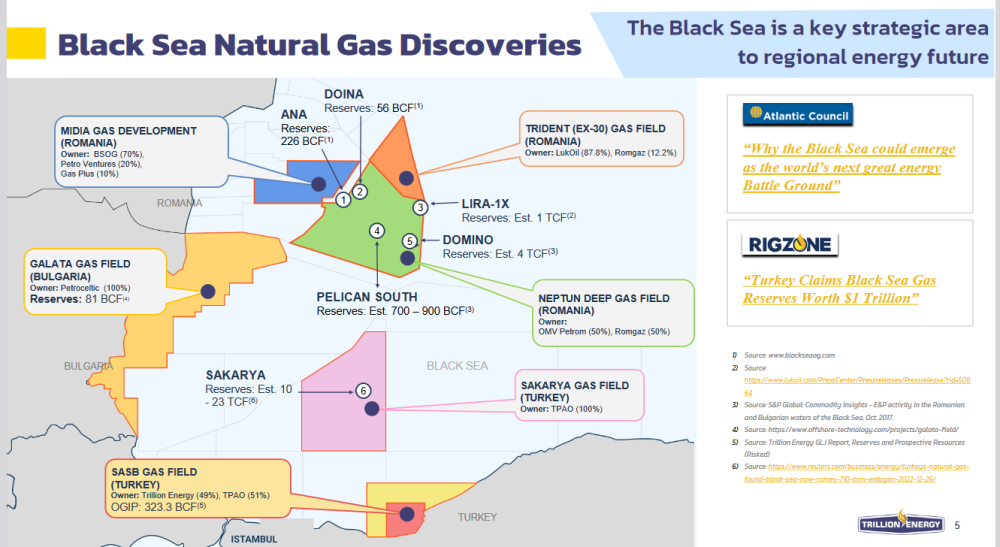

Before I wrap up, I will highlight the large gas potential in the Black Sea. It was previously thought the large gas systems in the Black Sea were not charged enough with pressure to be commercially productive. However, in recent years, that has been proven otherwise, and huge gas discoveries have been made.

The largest is Sakarya at 23 TCF, and it is the closest one to Trillion's SASB Gas Field. Trillion could drill out further from their current location with new platforms. The area is shown in yellow. This would be years down the road, though, but it is significant.

Conclusion

The 2022 to 2023 SASB development drilling program succeeded in six out of six wells, resulting in large volumes of gas reserves being tied into the pipeline for production. There is no reason why future additional wells will not have the same success. The artificial lift solutions being deployed are expected to monetize the reserves for sale at the high gas prices in the region. Trillion got a $600M plus asset here for pennies on the dollar that is going to provide strong and growing free cash flow.

Trillion is partnered with the state oil company, and that tells me there is a lot of confidence in the management of this company to execute on their gas field and upcoming oil exploration. The fact that their Eastern Block is on trend to major oil discoveries and the same company, TPAO that made these discoveries than grabbed all the land around Trillion's Eastern Block is extremely bullish. I have little doubt they will make a major discovery. Probably just a matter of whether it takes one, two, or three wells. Oil is in high demand in Turkey, and a planned pipeline from these new discoveries to Raman will run right through Trillion's Eastern Block. That will mean lower production costs.

I believe the stock is a steal at these prices. We can buy the stock below the recent CA$0.30 financing that had no warrants attached. This is a sign of strong investor demand. I believe the stock has pretty much turned over, and most, if not all, of any past disgruntled shareholders have already sold. On the chart, the downtrend has stopped and there has been a strong base built, mostly between $0.20 and $0.30. A close at $0.35 or higher would be a clear break out from that base, and the next major resistance would be around CA$0.65.

| Want to be the first to know about interesting Oil & Gas - Exploration & Production investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- [Ron Struthers]: I, or members of my immediate household or family, own securities of: [Trillium Energy]. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.