A 1-month favorable report on inflation does not make a trend, but energy prices are a bit weaker so far in November, so we could get another low CPI reading for November.

Regardless, I am expecting good markets until year-end with a typical Santa Claus rally.

Gold often has some year-end weakness, but in late December and into the New Year, gold usually does well. If interest rates continue to ease, that will also be bullish for gold.

I marked the important areas on the chart, so a break above $2020 would be very bullish, and a test of $2130 highs would be next. Also, I would not want to see a break below $1920. It is likely we could go sideways for four or five weeks, and an eventual break to the upside will happen. There is one gold producer that I believe has been oversold, and a little weaker gold price will probably not be that negative for the stock.

I have followed Torex Gold Resources Inc. (TXG:TSX) for many years, but I always felt the stock was high and the valuation was high, but it was deserving. I kept watching for a day I could buy the stock on sale, and that day has arrived.

Torex was $24/$25 in May and is now around $13. In the last several months, negative factors have been way overdone with the miners.

Torex is an intermediate gold producer based in Canada, engaged in the exploration, development, and operation of its 100%-owned Morelos property, an area of 29,000 hectares in the highly prospective Guerrero gold belt located 180 kilometres southwest of Mexico City.

The company's principal asset is the Morelos complex, which includes the El Limon Guajes mine complex, the Media Luna project, a processing plant, and related infrastructure.

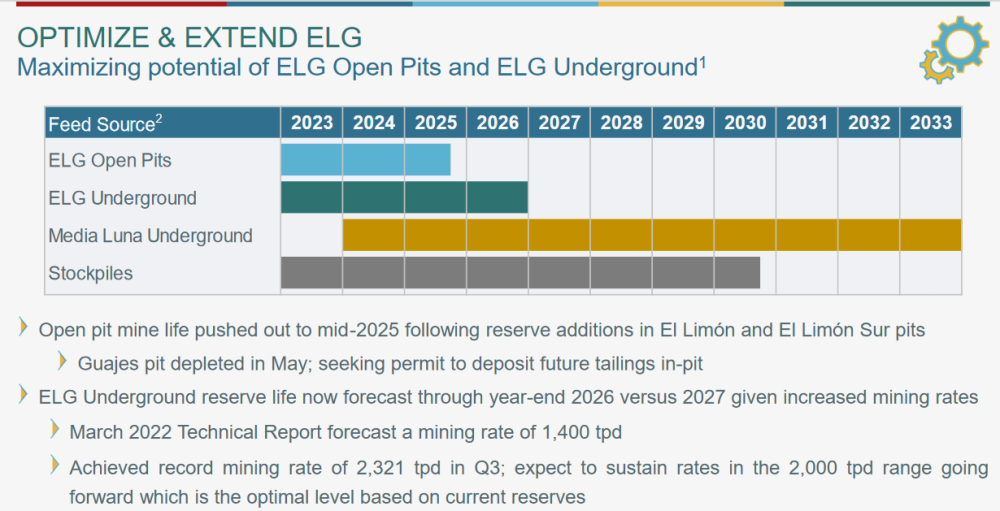

Commercial production from the Morelos complex commenced on April 1, 2016. Torex's key strategic objectives are to optimize and extend production from the ELG mine complex, derisk and advance Media Luna to commercial production, build on environmental, social, and governance excellence, and expand through continuing exploration across the entire Morelos property.

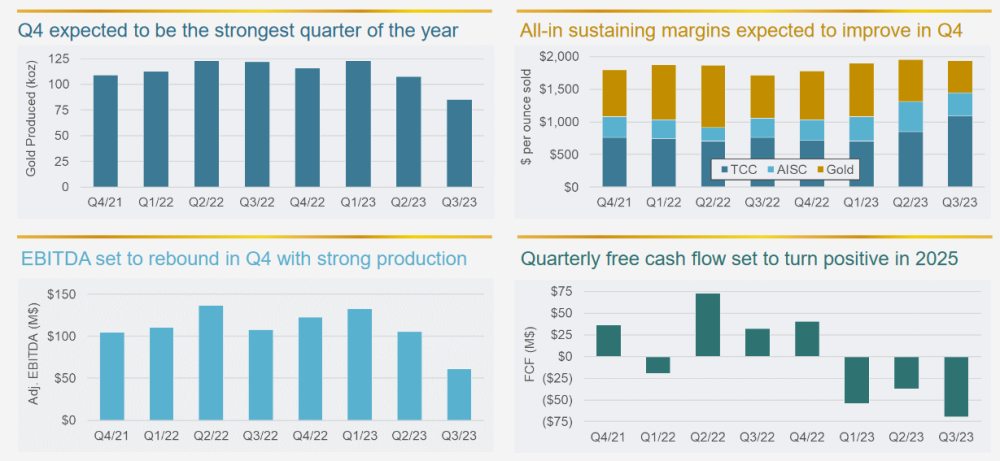

Torex has been producing about 440,000 to 470,000 ounces of gold per year. Their relatively high grade of over 4 g/t for open pit mining has provided very good cash flow and profits.

However, in Q2 and Q3, they were mining lower-grade stockpiled ore because the reserves in their Guajes pit were running out, and they were doing waste stripping on the next pit, called El Limo.

This resulted in lower average grades mined of just 2.47 g/t in Q3 and, of course, resulted in lower cash flow and profits. However, this stripping on El Limo is done, so Q4 will see a big rebound in grades along with lower costs.

These lower grades and stripping of the new pit should have been no surprise to the market as Torex broadcast their plans quite clearly. It seems markets are not so efficient anymore, and the stock overreacted to the downside on what was a normal case of mine development. The stock should rebound as normal grades and production commence in Q4.

The company commented on their October production to indicate grades were back to normal. October gold production of 41,450 oz, which included 105 hours of planned maintenance in the process plant at the start of the month.

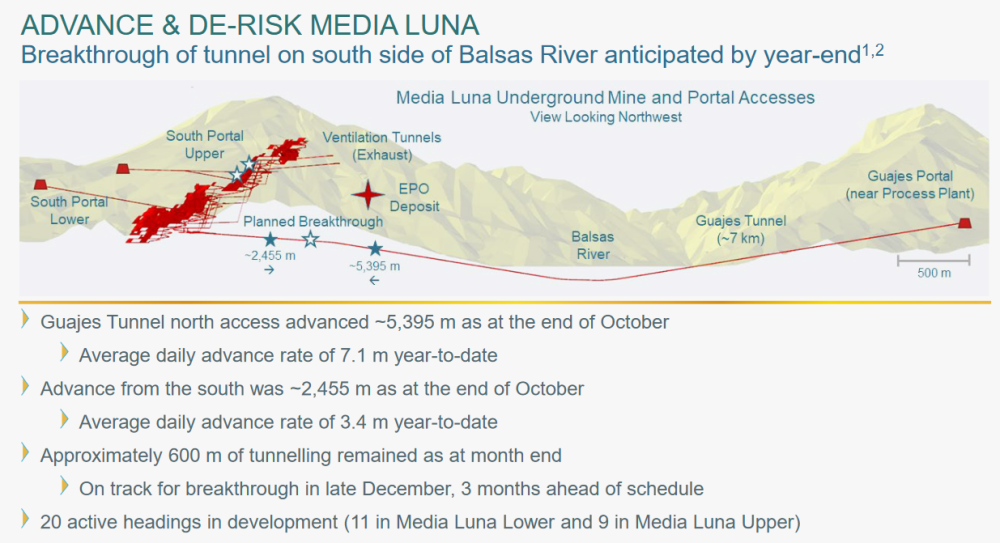

With mining now into higher-grade benches in the open pit, the average gold grade processed during October averaged 4.05 grams per tonne (gpt) compared to 2.47 gpt during Q3. A big focus on growth is their nearby Media Luna deposit that will replace production from the ELG open pits and extend mine life out to at least 2033.

This slide from their presentation shows Media Luna in detail. Ore will be shipped to the processing plant by a tunnel that should soon be completed. Torex expects to be producing ore from Media in late 2024.

On November 16, Torex announced excellent drill results from their 2023 drill program. As of the end of September, approximately 54,600 m across 235 holes had been drilled as part of the 2023 ELG brownfield and near-mine exploration and drilling programs, representing 96% of the planned meters for the year. Year to date, assay results have been received for 55% of the total holes drilled. Here are some examples of very high-grade results that I put in bold.

El Limon Sur trend:

- Drill hole LS-293 returned 20.74 grams per tonne gold equivalent over 4.6 meters, being the first subsequent hole of a program at El Limon Sur Deep zone following the previously reported high-grade intercept from drill hole LS-220 (88.92 g/t AuEq over 14.5 m). LS-293 confirms the continuity and extension of the high-grade gold mineralization at El Limon Sur Deep for another 100 m at depth.

- Advanced exploration drilling where El Limon Sur trend intersects La Flaca fault returned multiple economic intercepts, including 11.75 g/t AuEq over 22.9 m in LDUG-239, 11.55 g/t AuEq over 14.9 m in LDUG-290, 10.03 g/t AuEq over 14.4 m in LDUG-296, 11.71 g/t AuEq over 8.9 m in LDUG-277, 11.36 g/t AuEq over 8.7 m in LDUG-308 and 8.13 g/t AuEq over 12.4 m in LDUG-280. Given the results to date, this area represents a potential new mining front within ELG underground.

El Limon Deep trend:

- Infill and stepout drilling continues to extend mineralization at depth, with notable high-grade intercepts including 33.91 g/t AuEq over 9.1 m in LDUG-256 and 35.81 g/t AuEq over 4.8 m in LDUG-268.

Sub-Sill trend:

- Infill drilling returned high-grade intercepts within the extension of the Sub-Sill zone, including 19.45 g/t AuEq over 12.1 m and 21.32 g/t AuEq over 4.0 m in SST-312, and 23.32 g/t AuEq over 4.7 m in SST-313. Additionally, two holes drilled 250 m north of the La Flaca fault encountered mineralization, opening the exploration potential for additional mineralization to the north.

Here is a good snapshot of their development and mining plan of the various deposits.

Financial Torex has a strong financial position with no long-term debt. They extended and increased the available credit facilities with a syndicate of international banks in the quarter, now providing a total of $300.0 million in available credit maturing in 2026. The quarter closed with net cash of $188.3 million, including $209.4 million in cash and $21.1 million of lease-related obligations, no borrowings on the credit facilities of $300.0 million and letters of credit outstanding of $7.9 million, providing $501.5 million in available liquidity.

Media Luna expenditures totaled $98.7 million during the quarter (YTD -- $242.3 million), with a remaining project spend of $507.5 million. Quarterly cash flow in 2024 will also be a significant help. Summary Torex has a very solid mine plan, and the Morelos property with very good gold grades is a real cash cow. The production and profit side in Q2 and Q3 was planned, and I do not see any reason why they would have to go back and use so much lower-grade stockpile in the next several years.

The market's overreaction is a good opportunity to buy an attractive mid-tier gold producer at a great price. The current market cap is CA$1.11 billion or US$ 816 million. Torex currently has 7.5 million ounces gold equivalent at a very good grade of 4.86 gpt. Assuming their $200 million plus cash will be used to develop Media Luna, the market is putting a value on their M&I gold resources of only US$108 per ounce.

Quite low for a very profitable producer. I expect they will have cash flow of at least CA$300 million in 2024, so the stock is trading at just 3.5 times 2024 cash flow. To compare, Alamos Gold is trading at 23 times cash flow. Alamos is producing about 500,000 ounces per year, so it is a similar-sized company.

I see Torex as a very attractive takeover target as well, especially for another Mexican producer like Alamos Gold. The chart looks very good, too as the stock has come down to long-term support around $12. There is a possibility of further weakness if gold sells off some and a possibility of tax loss selling. In cases like this, I like to buy half my intended position now and the rest on a drop, as an example, 500 shares around $13. If the stock dips down to $12, I will buy the other 500 (half) at $12. This way, you get a better average price, and if the stock does not dip down, you at least have your half a position to ride the upside.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Ron Struthers: I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.